Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Both charts at the bottom are the answers from a study guide for Managerial Accounting. My question is how they found the Factory Overhead? (highlighted

Both charts at the bottom are the answers from a study guide for Managerial Accounting. My question is how they found the Factory Overhead? (highlighted in yellow).

Here are questions 4-7 with the solutions.

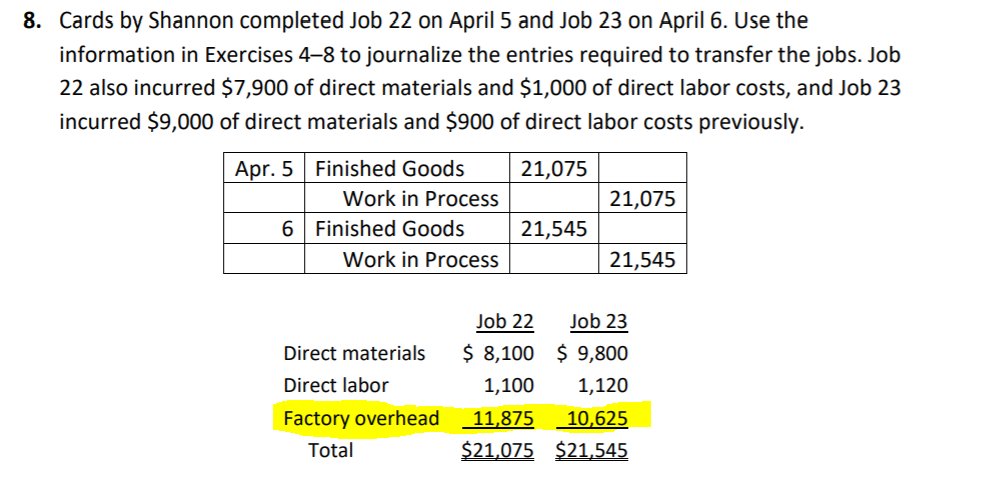

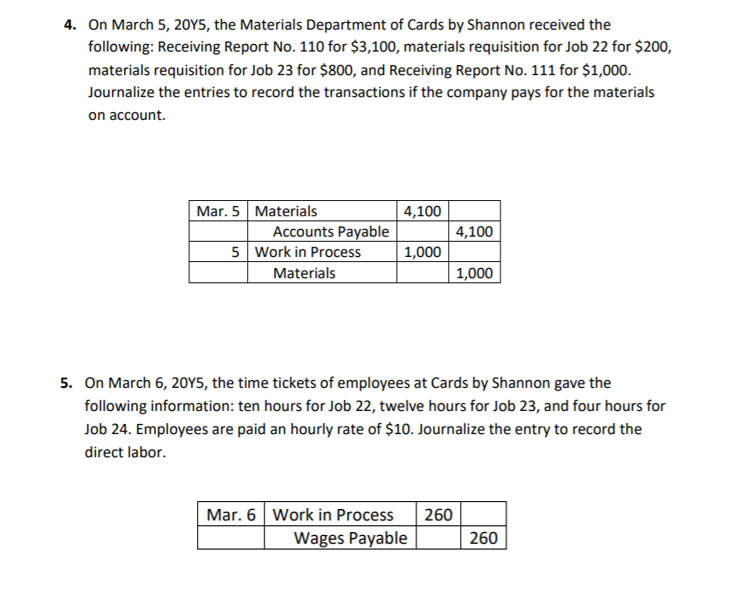

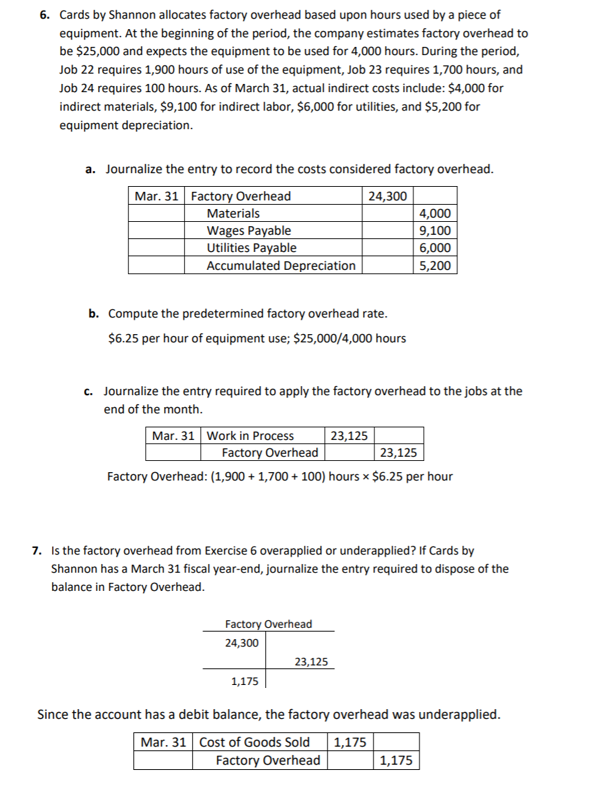

8. Cards by Shannon completed Job 22 on April 5 and Job 23 on April 6. Use the information in Exercises 48 to journalize the entries required to transfer the jobs. Job 22 also incurred $7,900 of direct materials and $1,000 of direct labor costs, and Job 23 incurred $9,000 of direct materials and $900 of direct labor costs previously. 21,075 21,075 Apr. 5 Finished Goods Work in Process 6 Finished Goods Work in Process 21,545 21,545 Direct materials Direct labor Factory overhead Total Job 22 Job 23 $ 8,100 $ 9,800 1,100 1,120 11,875 10,625 $21,075 $21,545 4. On March 5, 2045, the Materials Department of Cards by Shannon received the following: Receiving Report No. 110 for $3,100, materials requisition for Job 22 for $200, materials requisition for Job 23 for $800, and Receiving Report No. 111 for $1,000. Journalize the entries to record the transactions if the company pays for the materials on account. 4,100 Mar. 5 Materials 4,100 Accounts Payable 5 Work in Process 1,000 Materials 1,000 5. On March 6, 2045, the time tickets of employees at Cards by Shannon gave the following information: ten hours for Job 22, twelve hours for Job 23, and four hours for Job 24. Employees are paid an hourly rate of $10. Journalize the entry to record the direct labor. 260 Mar. 6 Work in Process Wages Payable 260 6. Cards by Shannon allocates factory overhead based upon hours used by a piece of equipment. At the beginning of the period, the company estimates factory overhead to be $25,000 and expects the equipment to be used for 4,000 hours. During the period, Job 22 requires 1,900 hours of use of the equipment, Job 23 requires 1,700 hours, and Job 24 requires 100 hours. As of March 31, actual indirect costs include: $4,000 for indirect materials, $9,100 for indirect labor, $6,000 for utilities, and $5,200 for equipment depreciation. a. Journalize the entry to record the costs considered factory overhead. Mar. 31 Factory Overhead 24,300 Materials 4,000 Wages Payable 9,100 Utilities Payable 6,000 Accumulated Depreciation 5,200 b. Compute the predetermined factory overhead rate. $6.25 per hour of equipment use; $25,000/4,000 hours C. Journalize the entry required to apply the factory overhead to the jobs at the end of the month. Mar. 31 Work in Process 23,125 Factory Overhead 23,125 Factory Overhead: (1,900 + 1,700 + 100) hours x $6.25 per hour 7. Is the factory overhead from Exercise 6 overapplied or underapplied? If Cards by Shannon has a March 31 fiscal year-end, journalize the entry required to dispose of the balance in Factory Overhead. Factory Overhead 24,300 23,125 1,175 Since the account has a debit balance, the factory overhead was underapplied. Mar. 31 Cost of Goods Sold 1,175 Factory Overhead 1,175

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started