Answered step by step

Verified Expert Solution

Question

1 Approved Answer

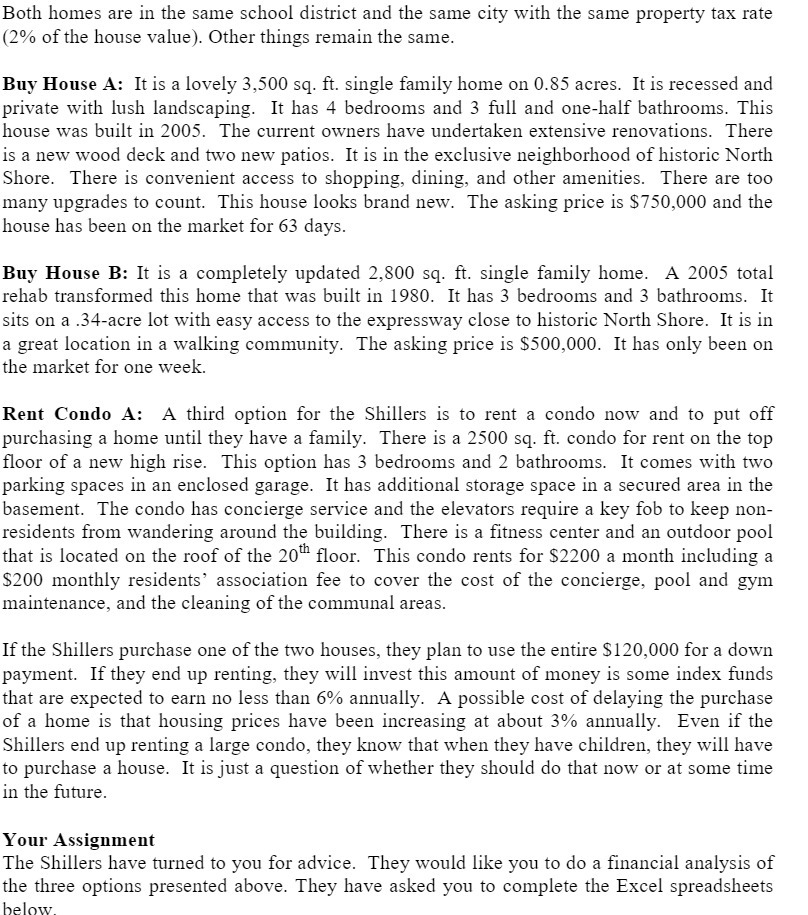

Both homes are in the same school district and the same city with the same property tax rate (2% of the house value). Other

Both homes are in the same school district and the same city with the same property tax rate (2% of the house value). Other things remain the same. Buy House A: It is a lovely 3,500 sq. ft. single family home on 0.85 acres. It is recessed and private with lush landscaping. It has 4 bedrooms and 3 full and one-half bathrooms. This house was built in 2005. The current owners have undertaken extensive renovations. There is a new wood deck and two new patios. It is in the exclusive neighborhood of historic North Shore. There is convenient access to shopping, dining, and other amenities. There are too many upgrades to count. This house looks brand new. The asking price is $750,000 and the house has been on the market for 63 days. Buy House B: It is a completely updated 2,800 sq. ft. single family home. A 2005 total rehab transformed this home that was built in 1980. It has 3 bedrooms and 3 bathrooms. It sits on a .34-acre lot with easy access to the expressway close to historic North Shore. It is in a great location in a walking community. The asking price is $500,000. It has only been on the market for one week. Rent Condo A: A third option for the Shillers is to rent a condo now and to put off purchasing a home until they have a family. There is a 2500 sq. ft. condo for rent on the top floor of a new high rise. This option has 3 bedrooms and 2 bathrooms. It comes with two parking spaces in an enclosed garage. It has additional storage space in a secured area in the basement. The condo has concierge service and the elevators require a key fob to keep non- residents from wandering around the building. There is a fitness center and an outdoor pool that is located on the roof of the 20th floor. This condo rents for $2200 a month including a $200 monthly residents' association fee to cover the cost of the concierge, pool and gym maintenance, and the cleaning of the communal areas. If the Shillers purchase one of the two houses, they plan to use the entire $120,000 for a down payment. If they end up renting, they will invest this amount of money is some index funds that are expected to earn no less than 6% annually. A possible cost of delaying the purchase of a home is that housing prices have been increasing at about 3% annually. Even if the Shillers end up renting a large condo, they know that when they have children, they will have to purchase a house. It is just a question of whether they should do that now or at some time in the future. Your Assignment The Shillers have turned to you for advice. They would like you to do a financial analysis of the three options presented above. They have asked you to complete the Excel spreadsheets below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Financial Analysis for the Shillers Heres a breakdown of how to analyze the three options for the Shillers 1 Assumptions Down payment120000 for houses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started