both please

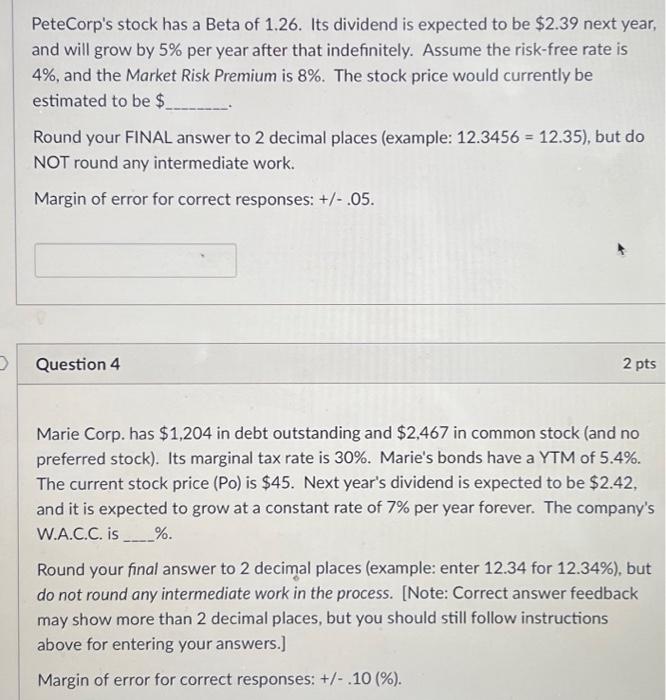

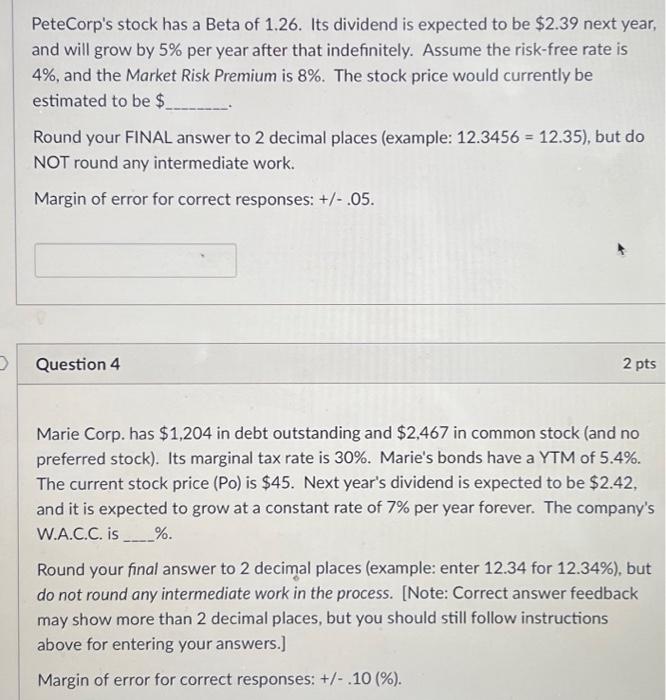

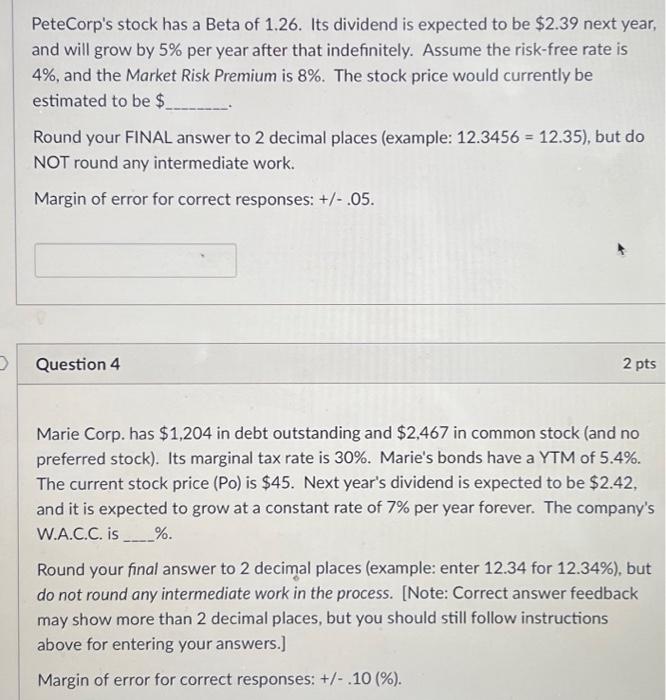

PeteCorp's stock has a Beta of 1.26. Its dividend is expected to be $2.39 next year, and will grow by 5% per year after that indefinitely. Assume the risk-free rate is 4%, and the Market Risk Premium is 8%. The stock price would currently be estimated to be $ Round your FINAL answer to 2 decimal places (example: 12.3456=12.35 ), but do NOT round any intermediate work. Margin of error for correct responses: +/.05. Question 4 2 pts Marie Corp. has $1,204 in debt outstanding and $2,467 in common stock (and no preferred stock). Its marginal tax rate is 30%. Marie's bonds have a YTM of 5.4%. The current stock price (Po) is $45. Next year's dividend is expected to be $2.42, and it is expected to grow at a constant rate of 7% per year forever. The company's W.A.C.C. is %. Round your final answer to 2 decimal places (example: enter 12.34 for 12.34% ), but do not round any intermediate work in the process. [Note: Correct answer feedback may show more than 2 decimal places, but you should still follow instructions above for entering your answers.] Margin of error for correct responses: +/.10(%). PeteCorp's stock has a Beta of 1.26. Its dividend is expected to be $2.39 next year, and will grow by 5% per year after that indefinitely. Assume the risk-free rate is 4%, and the Market Risk Premium is 8%. The stock price would currently be estimated to be $ Round your FINAL answer to 2 decimal places (example: 12.3456=12.35 ), but do NOT round any intermediate work. Margin of error for correct responses: +/.05. Question 4 2 pts Marie Corp. has $1,204 in debt outstanding and $2,467 in common stock (and no preferred stock). Its marginal tax rate is 30%. Marie's bonds have a YTM of 5.4%. The current stock price (Po) is $45. Next year's dividend is expected to be $2.42, and it is expected to grow at a constant rate of 7% per year forever. The company's W.A.C.C. is %. Round your final answer to 2 decimal places (example: enter 12.34 for 12.34% ), but do not round any intermediate work in the process. [Note: Correct answer feedback may show more than 2 decimal places, but you should still follow instructions above for entering your answers.] Margin of error for correct responses: +/.10(%)