Answered step by step

Verified Expert Solution

Question

1 Approved Answer

both questions 7. ABC Company purchased a mine in 2017 for $3,400,000. It was estimated that the mine contained 200,000 tons of ore and that

both questions

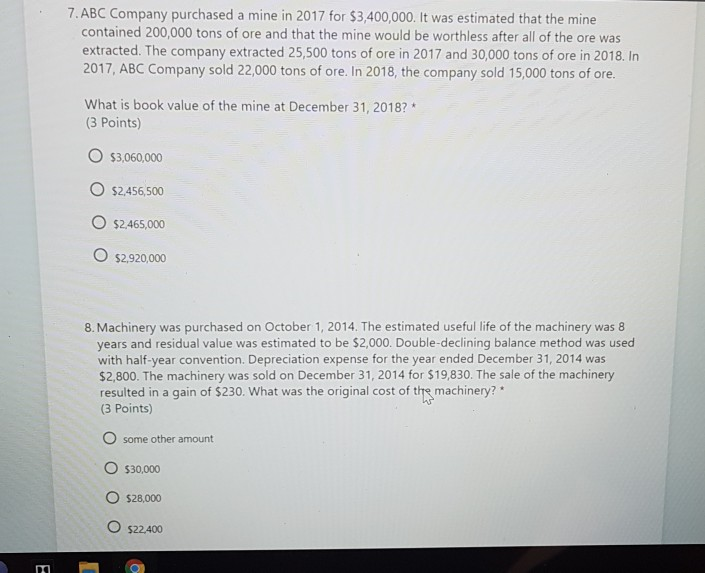

7. ABC Company purchased a mine in 2017 for $3,400,000. It was estimated that the mine contained 200,000 tons of ore and that the mine would be worthless after all of the ore was extracted. The company extracted 25,500 tons of ore in 2017 and 30,000 tons of ore in 2018. In 2017, ABC Company sold 22,000 tons of ore. In 2018, the company sold 15,000 tons of ore. What is book value of the mine at December 31, 2018? (3 Points) $3,060,000 $2,456,500 O $2,465,000 $2,920,000 8. Machinery was purchased on October 1, 2014. The estimated useful life of the machinery was 8 years and residual value was estimated to be $2,000. Double-declining balance method was used with half-year convention. Depreciation expense for the year ended December 31, 2014 was $2,800. The machinery was sold on December 31, 2014 for $19,830. The sale of the machinery resulted in a gain of $230. What was the original cost of the machinery? (3 Points) O some other amount $30,000 $28,000 O $22.400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started