Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Both questions are separate. Question 1 Burford Ball Company (BBC) manufactures soccer balls, which sell for $30 each and have a direct materials cost of

Both questions are separate.

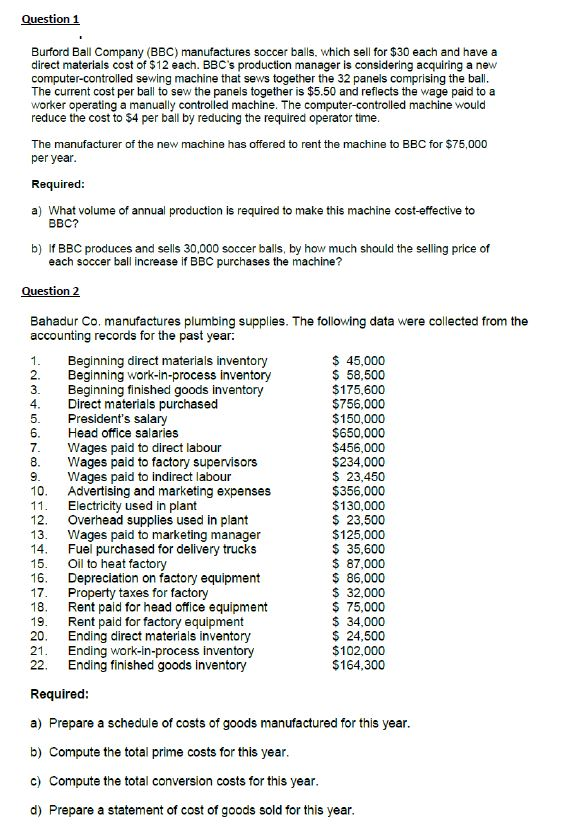

Question 1 Burford Ball Company (BBC) manufactures soccer balls, which sell for $30 each and have a direct materials cost of $12 each. BBC's production manager is considering acquiring a new computer-controlled sewing machine that sews together the 32 panels comprising the ball. The current cost per ball to sew the panels together is $5.50 and reflects the wage paid to a worker operating a manually controlled machine. The computer-controlled machine would reduce the cost to 54 per ball by reducing the required operator time. The manufacturer of the new machine has offered to rent the machine to BBC for $75,000 per year. Required: a) What volume of annual production is required to make this machine cost-effective to BBC? b) if BBC produces and sells 30,000 soccer balls, by how much should the selling price of each soccer ball increase if BBC purchases the machine? Question 2 1. 2. 3. 6. 8 Bahadur Co manufactures plumbing supplies. The following data were collected from the accounting records for the past year: Beginning direct materials inventory $ 45,000 Beginning work-in-process inventory $ 58,500 Beginning finished goods inventory $175,600 4. Direct materials purchased $756,000 5. President's salary $150,000 Head office salaries $650,000 7. Wages paid to direct labour $456,000 Wages paid to factory supervisors $234,000 9. Wages paid to indirect labour $ 23,450 10. Advertising and marketing expenses $356,000 11. Electricity used in plant $130,000 12. Overhead supplies used in plant $ 23,500 13. Wages paid to marketing manager $125,000 14. Fuel purchased for delivery trucks $ 35,600 15. Oil to heat factory $ 87,000 16. Depreciation on factory equipment $ 86,000 17. Property taxes for factory $ 32,000 18 Rent paid for head office equipment $ 75,000 19. Rent paid for factory equipment $ 34,000 20. Ending direct materials inventory $ 24,500 21. Ending work-in-process inventory $102,000 22. Ending finished goods inventory $164,300 Required: a) Prepare a schedule of costs of goods manufactured for this year. b) Compute the total prime costs for this year. c) Compute the total conversion costs for this year. d) Prepare a statement of cost of goods sold for this yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started