Answered step by step

Verified Expert Solution

Question

1 Approved Answer

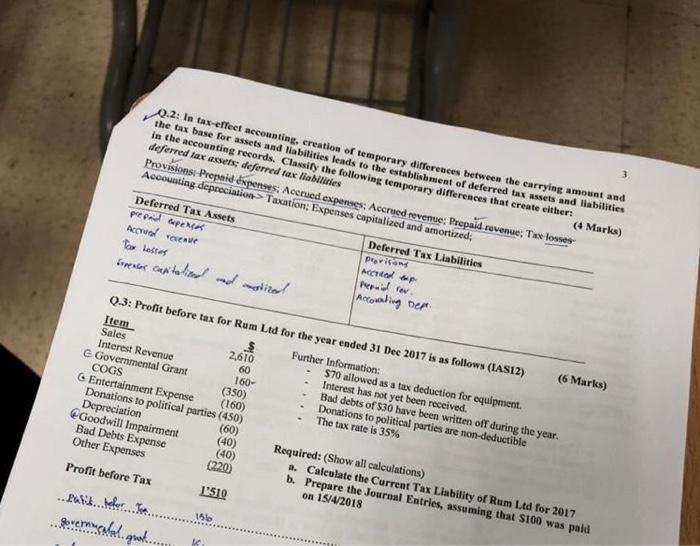

both questions please Q.2: In tax-effect accounting, creation of temporary differences between the carrying amount and the tax base for assets and liabilities leads to

both questions please Q.2: In tax-effect accounting, creation of temporary differences between the carrying amount and the tax base for assets and liabilities leads to the establishment of deferred tax assets and liabilities in the accounting records. Classify the following temporary differences that create either: deferred tax assets; deferred tax liabilities Provisions: Prepaid expenses; Accrued expenses; Accrued revenue; Prepaid revenue; Tax losses Accounting depreciation Taxation; Expenses capitalized and amortized; (4 Marks) Deferred Tax Assets prepaid expenses Accrued revenue Tax Losses Expenses capitalized and anotized Q.3: Profit before tax for Rum Ltd for the year ended 31 Dec 2017 is as follows (IAS12) Item Sales Interest Revenue G Governmental Grant COGS (350) & Entertainment Expense (160) Donations to political parties (450) Depreciation (60) @Goodwill Impairment Bad Debts Expense Other Expenses Profit before Tax Patit befor Tea K $ 2,610 60 1510 156 (40) (40) (220) 160- Deferred Tax Liabilities Provisions ACCTRed p Prepaid cev. Accounting Dep Further Information: $70 allowed as a tax deduction for equipment. Interest has not yet been received. Bad debts of $30 have been written off during the year. Donations to political parties are non-deductible The tax rate is 35% (6 Marks) Required: (Show all calculations) a. Calculate the Current Tax Liability of Rum Ltd for 2017 b. Prepare the Journal Entries, assuming that $100 was paid on 15/4/2018 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started