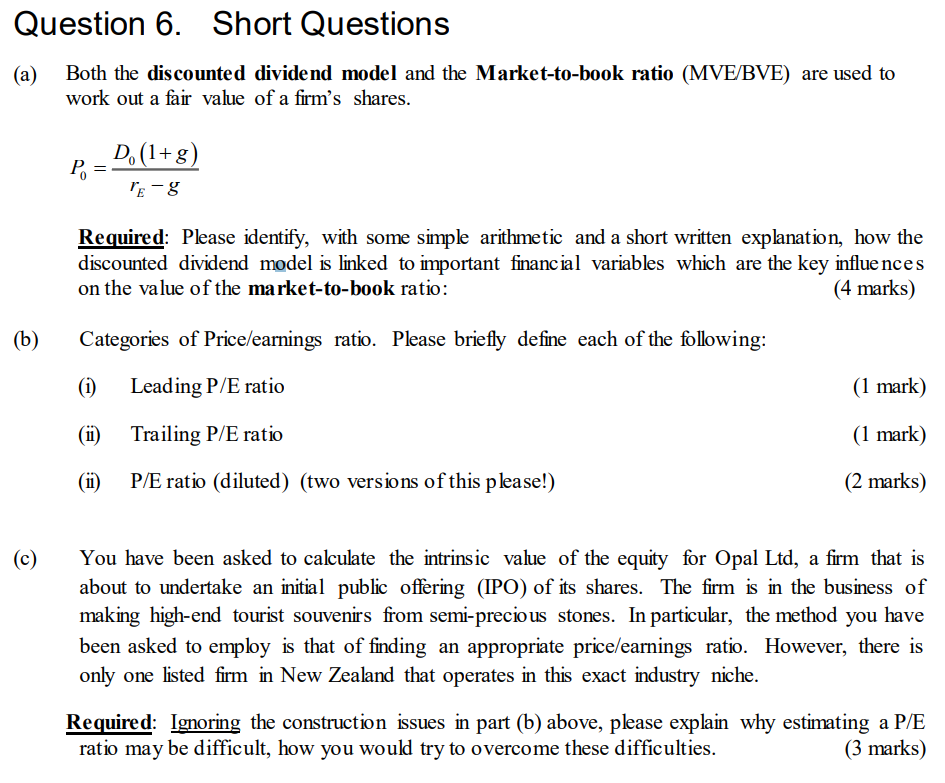

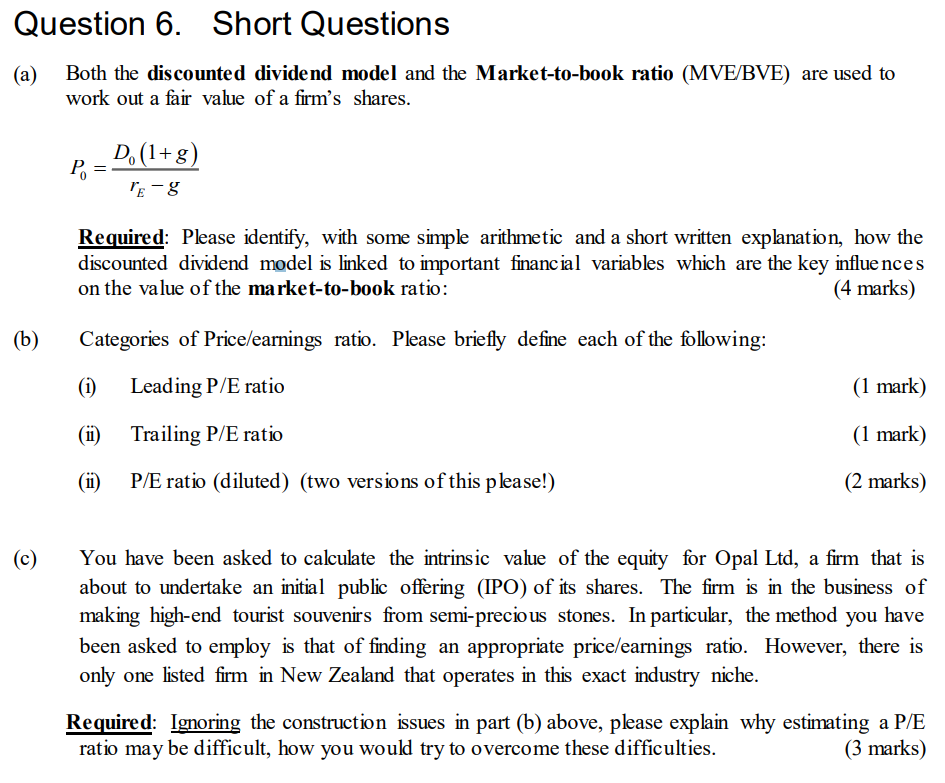

Both the discounted dividend model and the Market-to-book ratio (MVE/BVE) are used to work out a fair value of a firm's shares. P0=rEgD0(1+g) Required: Please identify, with some simple arithmetic and a short written explanation, how the discounted dividend model is linked to important financial variables which are the key influe nces on the value of the market-to-book ratio: (4 marks) Categories of Price/earnings ratio. Please briefly define each of the following: (i) Leading P/ E ratio (1 mark) (ii) Trailing P/E ratio (1 mark) (ii) P/E ratio (diluted) (two versions of this please!) (2 marks) You have been asked to calculate the intrinsic value of the equity for Opal Ltd, a firm that is about to undertake an initial public offering (IPO) of its shares. The firm is in the business of making high-end tourist souvenirs from semi-precious stones. In particular, the method you have been asked to employ is that of finding an appropriate price/earnings ratio. However, there is only one listed firm in New Zealand that operates in this exact industry niche. Required: Ignoring the construction issues in part (b) above, please explain why estimating a P/E ratio may be difficult, how you would try to overcome these difficulties. (3 marks) Both the discounted dividend model and the Market-to-book ratio (MVE/BVE) are used to work out a fair value of a firm's shares. P0=rEgD0(1+g) Required: Please identify, with some simple arithmetic and a short written explanation, how the discounted dividend model is linked to important financial variables which are the key influe nces on the value of the market-to-book ratio: (4 marks) Categories of Price/earnings ratio. Please briefly define each of the following: (i) Leading P/ E ratio (1 mark) (ii) Trailing P/E ratio (1 mark) (ii) P/E ratio (diluted) (two versions of this please!) (2 marks) You have been asked to calculate the intrinsic value of the equity for Opal Ltd, a firm that is about to undertake an initial public offering (IPO) of its shares. The firm is in the business of making high-end tourist souvenirs from semi-precious stones. In particular, the method you have been asked to employ is that of finding an appropriate price/earnings ratio. However, there is only one listed firm in New Zealand that operates in this exact industry niche. Required: Ignoring the construction issues in part (b) above, please explain why estimating a P/E ratio may be difficult, how you would try to overcome these difficulties