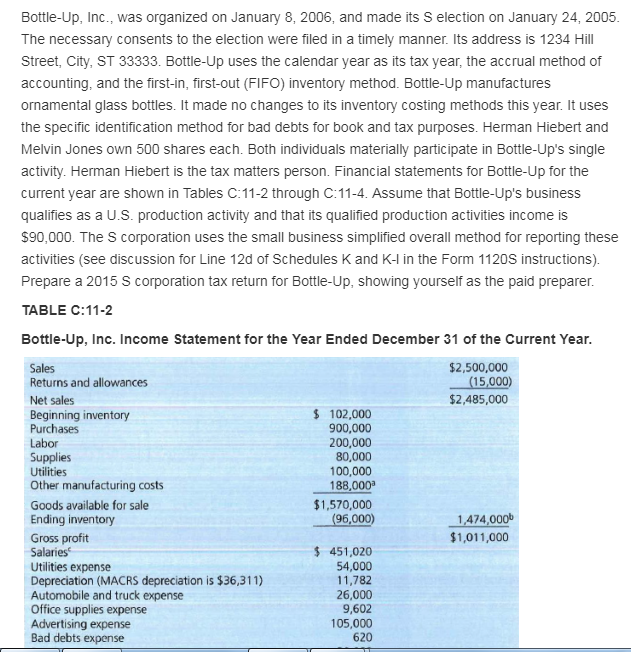

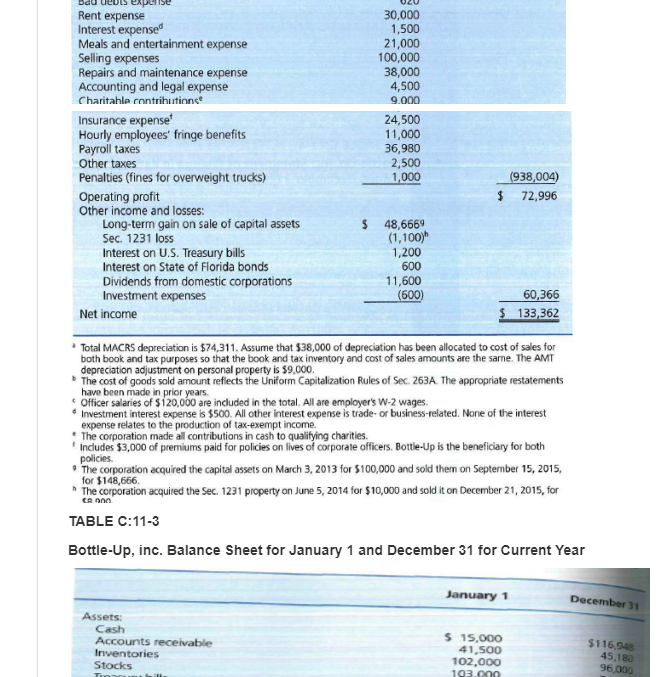

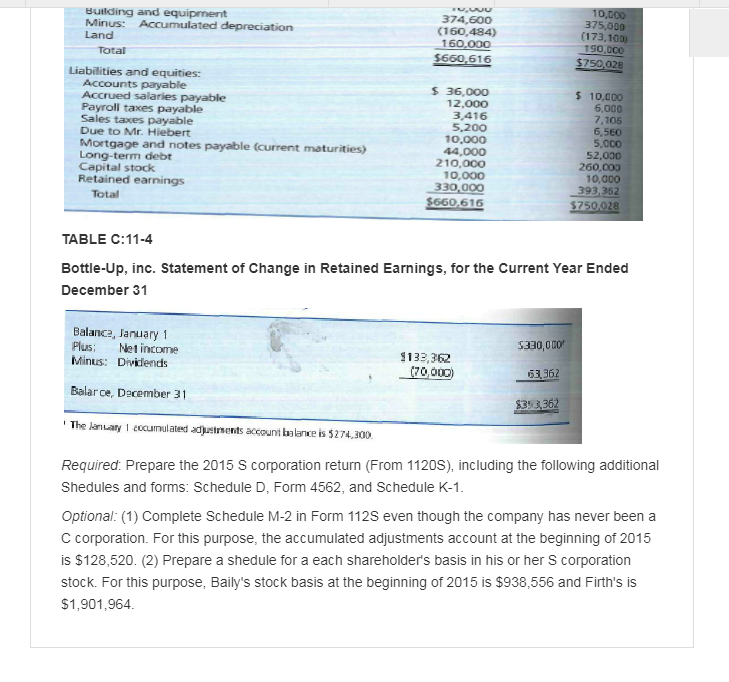

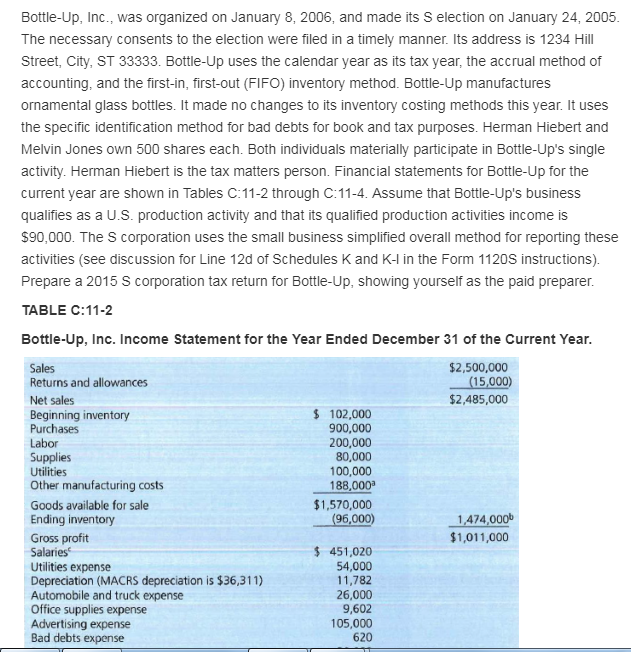

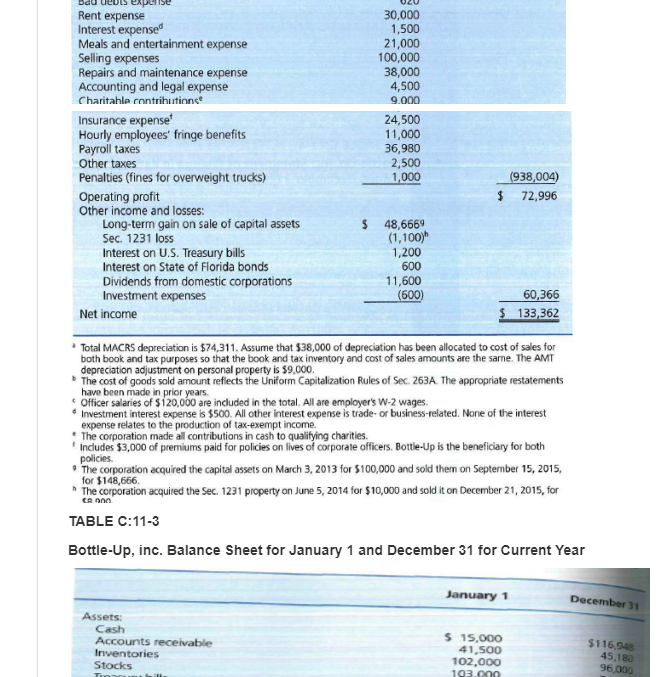

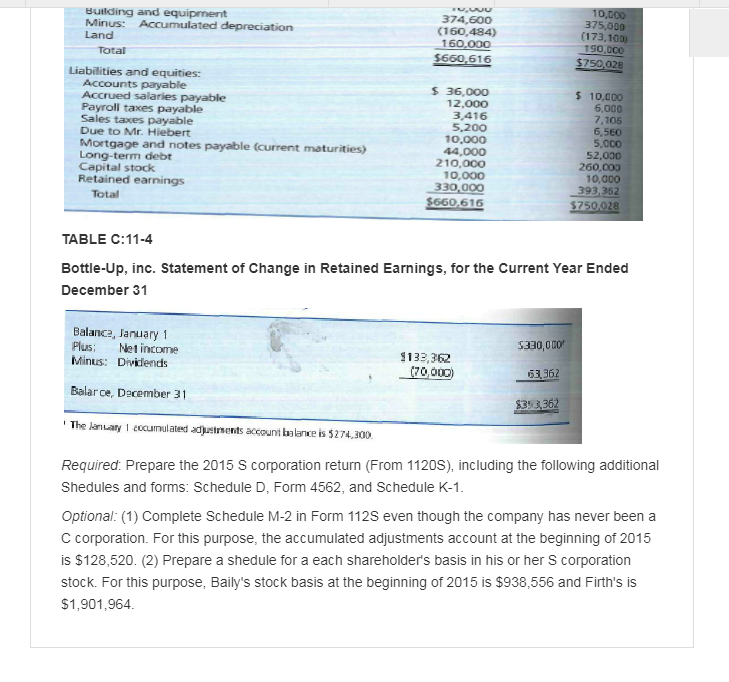

Bottle-Up, Inc., was organized on January 8, 2006, and made its S election on January 24, 2005 The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Assume that Bottle-Up's business qualifies as a U.S. production activity and that its qualified production activities income is $90,000. The S corporation uses the small business simplified overall method for reporting these activities (see discussion for Line 12d of Schedules K and K-l in the Form 1120S instructions). Prepare a 2015 S corporation tax return for Bottle-Up, showing yourself as the paid preparer TABLE C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year. Sales Returns and allowances Net sales Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salaries Utilities expense Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense $2,500,000 (15,000 $2,485,000 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 96,000) 1.474,000b $1,011,000 451,020 54,000 11,782 26,000 9,602 105,000 620 Bottle-Up, Inc., was organized on January 8, 2006, and made its S election on January 24, 2005 The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as its tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debts for book and tax purposes. Herman Hiebert and Melvin Jones own 500 shares each. Both individuals materially participate in Bottle-Up's single activity. Herman Hiebert is the tax matters person. Financial statements for Bottle-Up for the current year are shown in Tables C:11-2 through C:11-4. Assume that Bottle-Up's business qualifies as a U.S. production activity and that its qualified production activities income is $90,000. The S corporation uses the small business simplified overall method for reporting these activities (see discussion for Line 12d of Schedules K and K-l in the Form 1120S instructions). Prepare a 2015 S corporation tax return for Bottle-Up, showing yourself as the paid preparer TABLE C:11-2 Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current Year. Sales Returns and allowances Net sales Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs Goods available for sale Ending inventory Gross profit Salaries Utilities expense Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense $2,500,000 (15,000 $2,485,000 102,000 900,000 200,000 80,000 100,000 188,000 $1,570,000 96,000) 1.474,000b $1,011,000 451,020 54,000 11,782 26,000 9,602 105,000 620