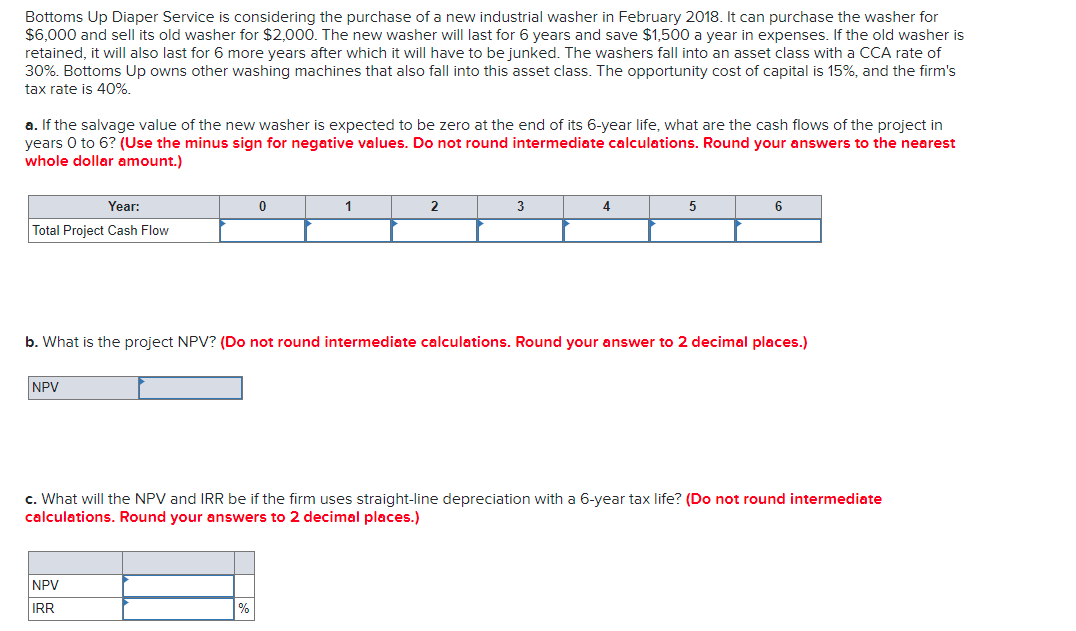

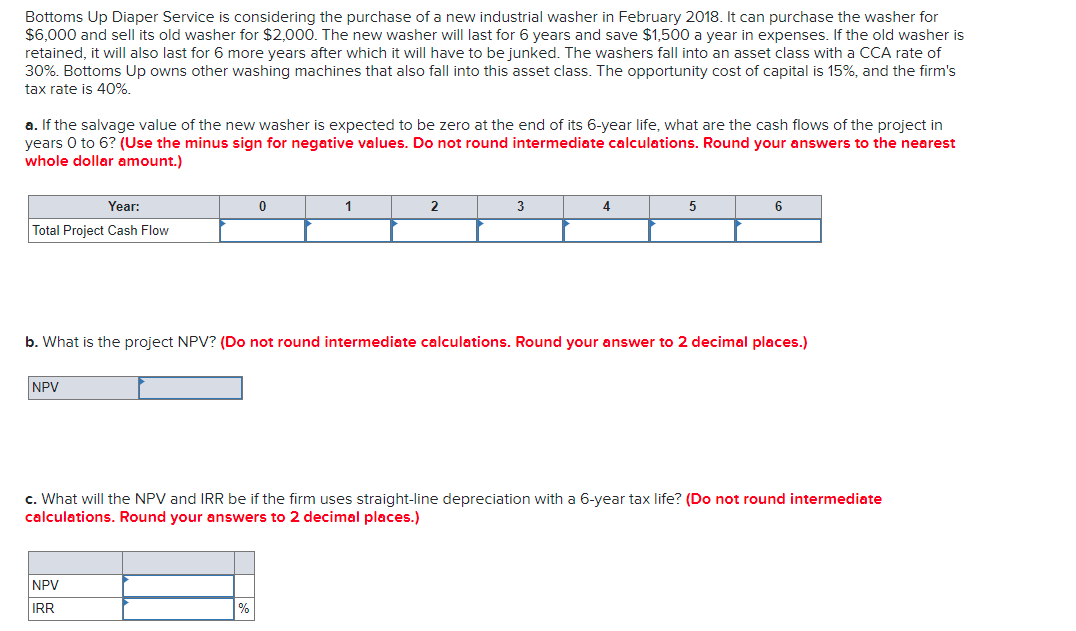

Bottoms Up Diaper Service is considering the purchase of a new industrial washer in February 2018. It can purchase the washer for $6,000 and sell its old washer for $2,000. The new washer will last for 6 years and save $1,500 a year in expenses. If the old washer is retained, it will also last for 6 more years after which it will have to be junked. The washers fall into an asset class with a CCA rate of 30%. Bottoms Up owns other washing machines that also fall into this asset class. The opportunity cost of capital is 15%, and the firm's tax rate is 40% a. If the salvage value of the new washer is expected to be zero at the end of its 6-year life, what are the cash flows of the project in years 0 to 6? (Use the minus sign for negative values. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Year: 0 1 2 3 4 5 6 Total Project Cash Flow b. What is the project NPV? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV c. What will the NPV and IRR be if the firm uses straight-line depreciation with a 6-year tax life? (Do not round intermediate calculations. Round your answers to 2 decimal places.) NPV IRR % Bottoms Up Diaper Service is considering the purchase of a new industrial washer in February 2018. It can purchase the washer for $6,000 and sell its old washer for $2,000. The new washer will last for 6 years and save $1,500 a year in expenses. If the old washer is retained, it will also last for 6 more years after which it will have to be junked. The washers fall into an asset class with a CCA rate of 30%. Bottoms Up owns other washing machines that also fall into this asset class. The opportunity cost of capital is 15%, and the firm's tax rate is 40% a. If the salvage value of the new washer is expected to be zero at the end of its 6-year life, what are the cash flows of the project in years 0 to 6? (Use the minus sign for negative values. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Year: 0 1 2 3 4 5 6 Total Project Cash Flow b. What is the project NPV? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV c. What will the NPV and IRR be if the firm uses straight-line depreciation with a 6-year tax life? (Do not round intermediate calculations. Round your answers to 2 decimal places.) NPV IRR %