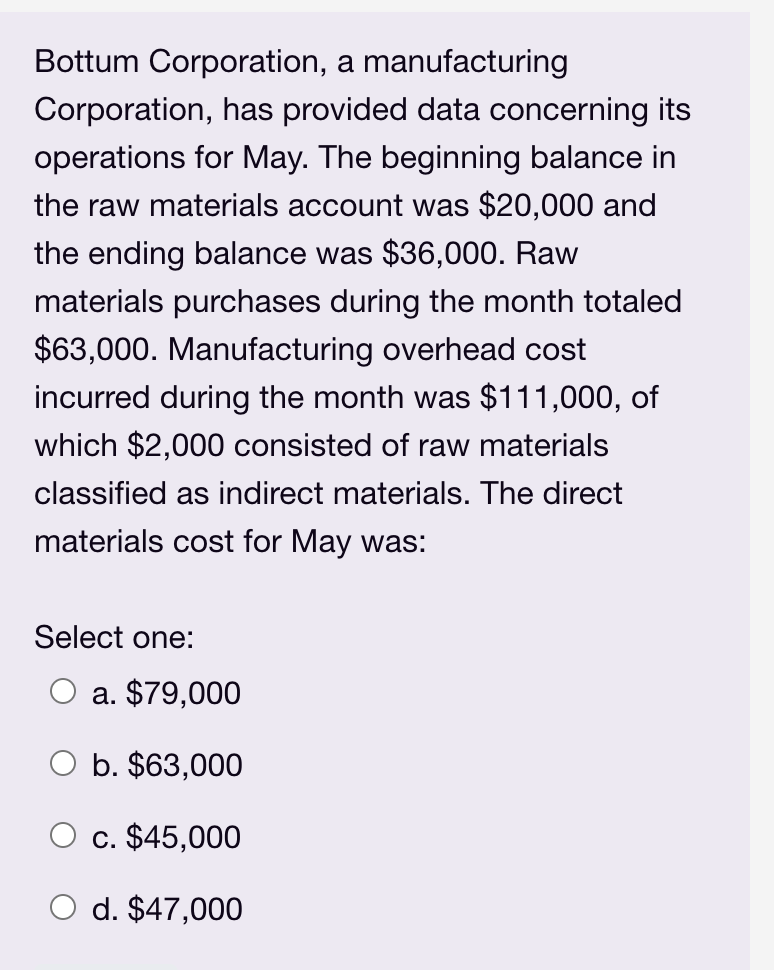

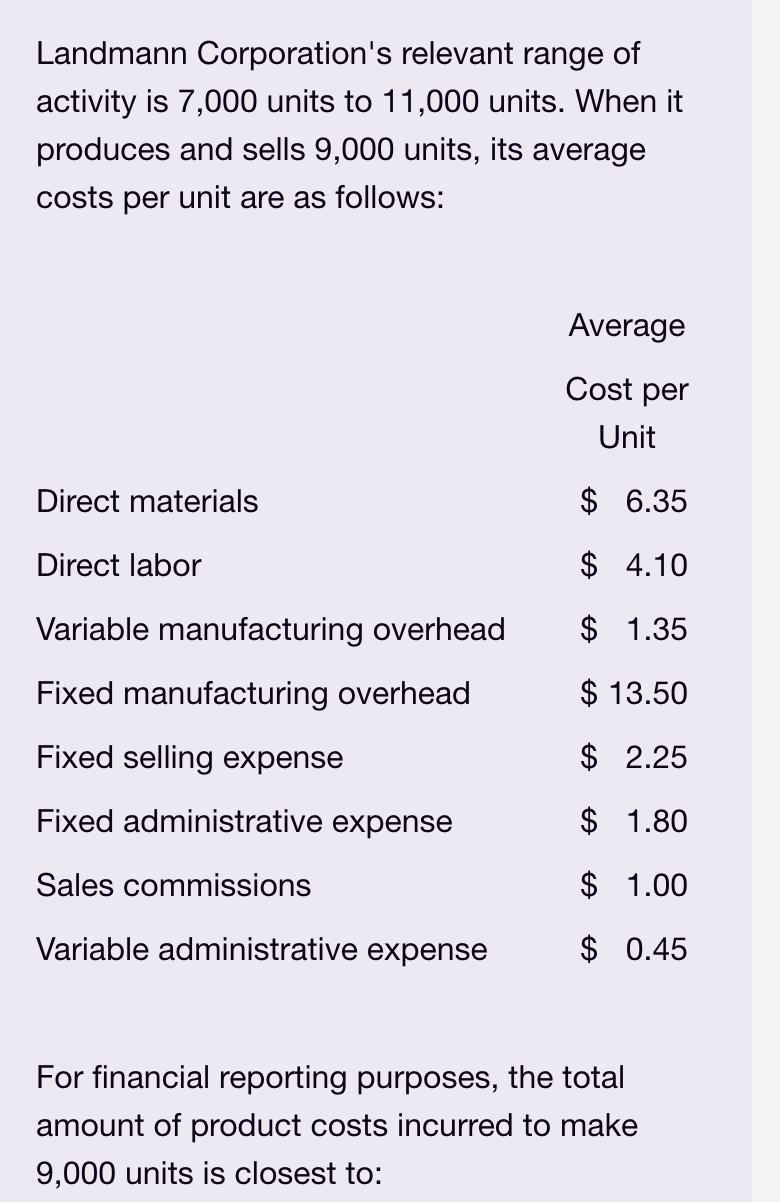

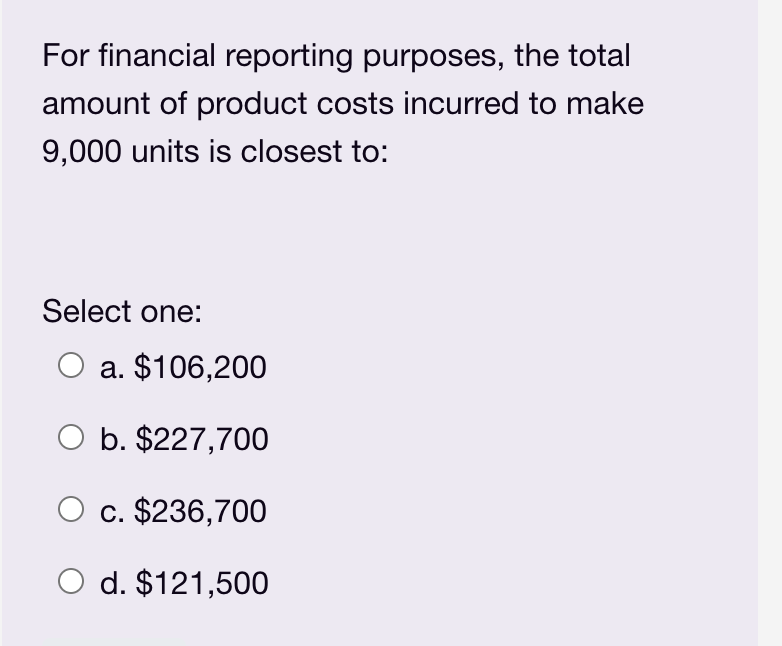

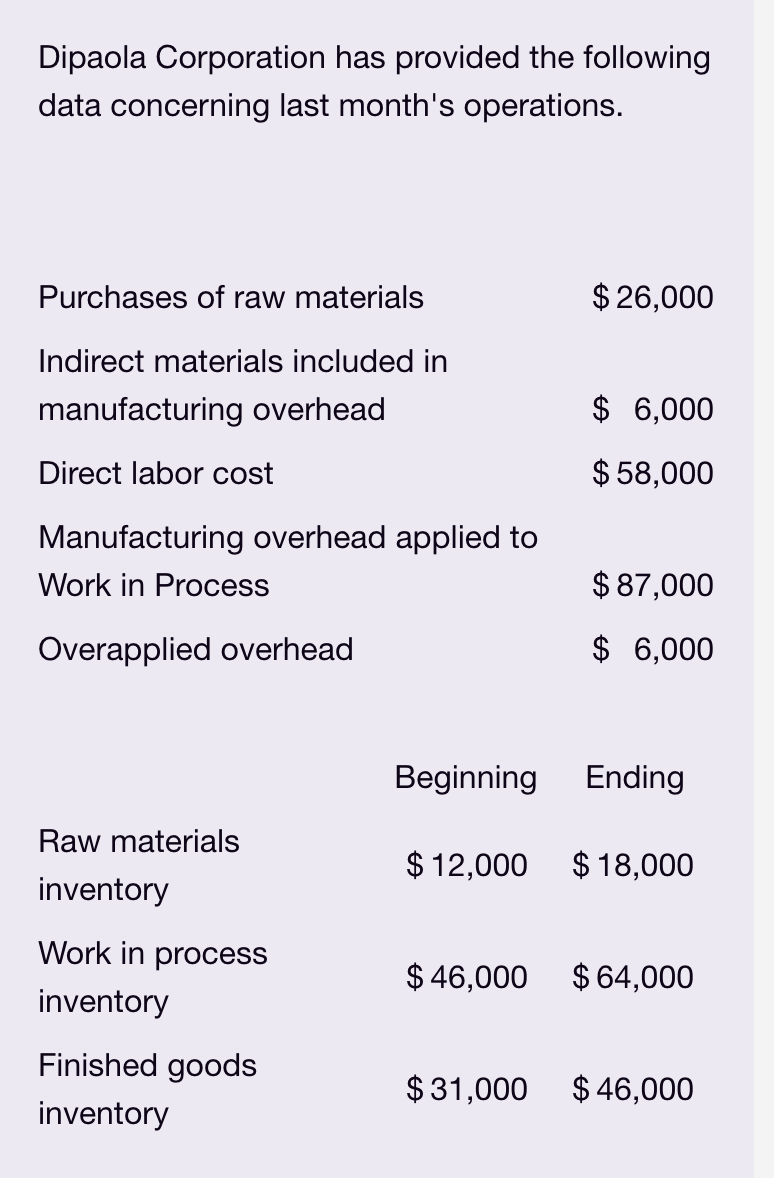

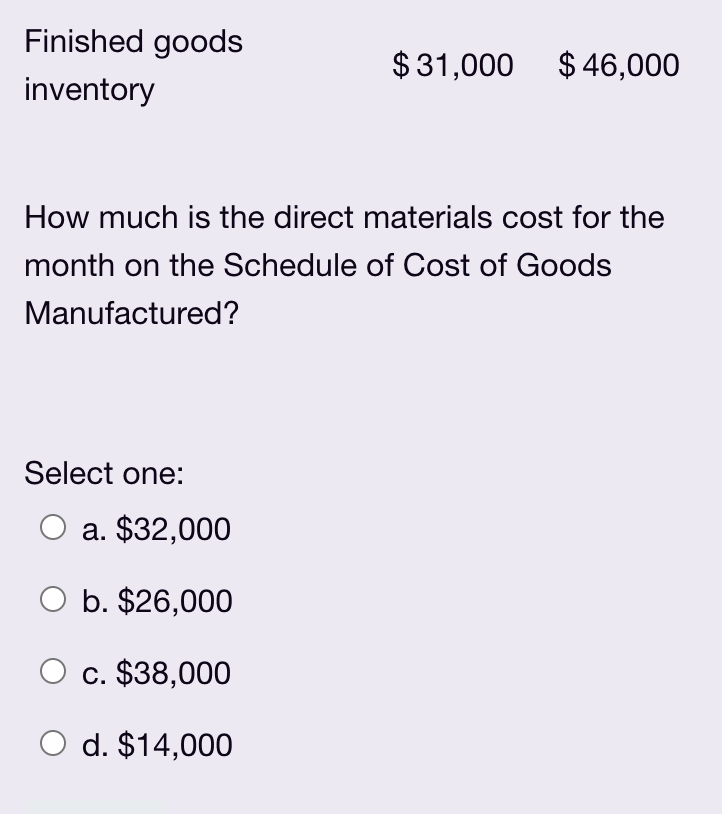

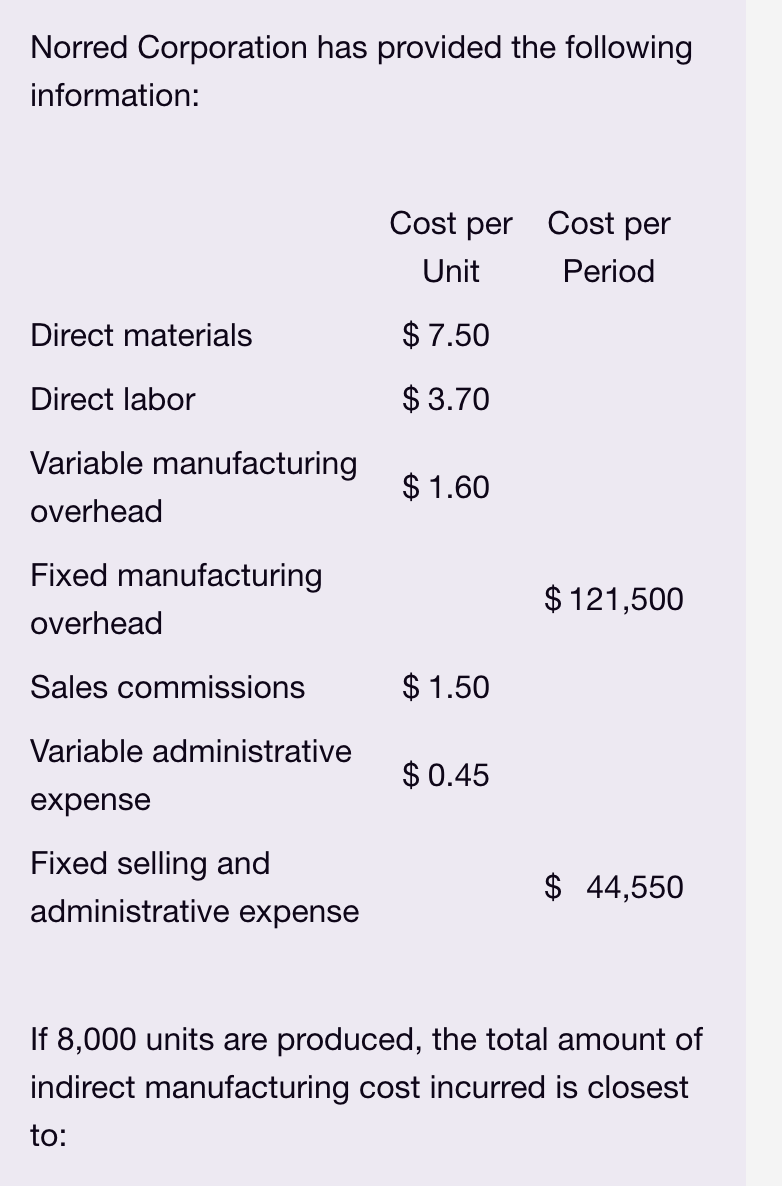

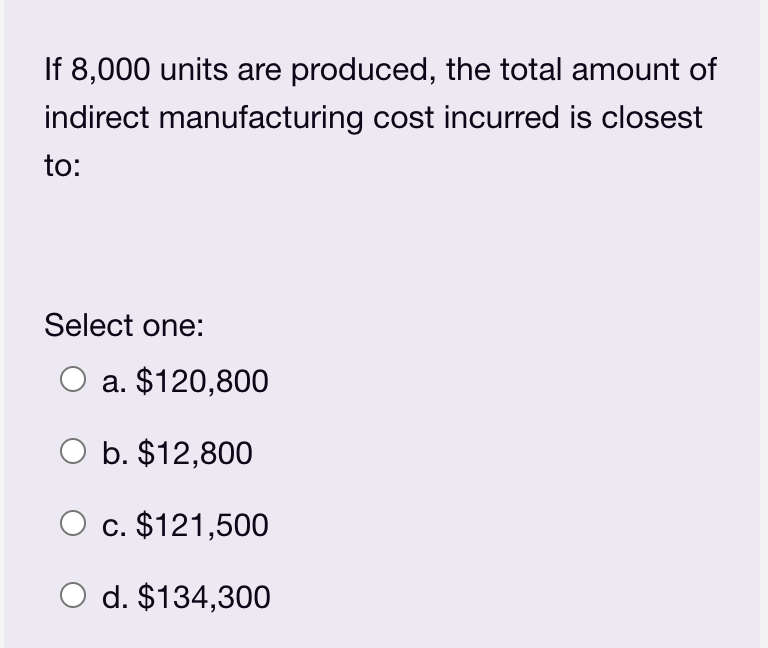

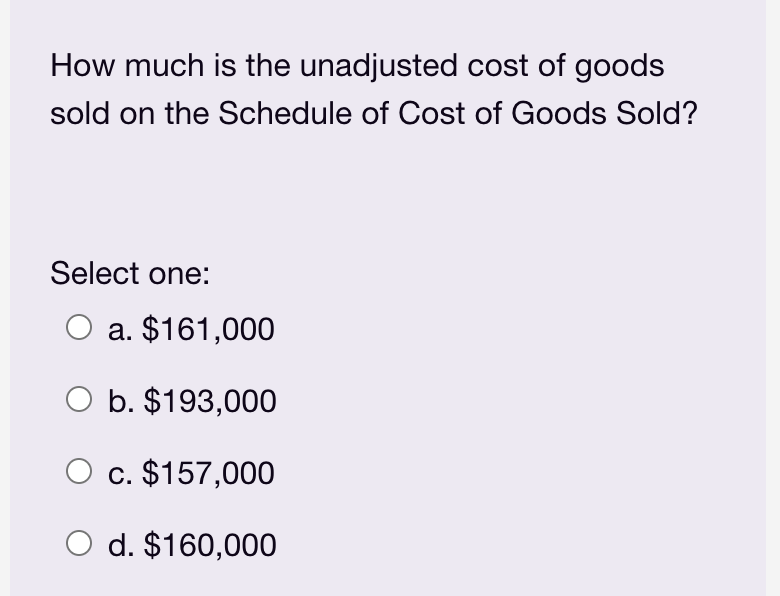

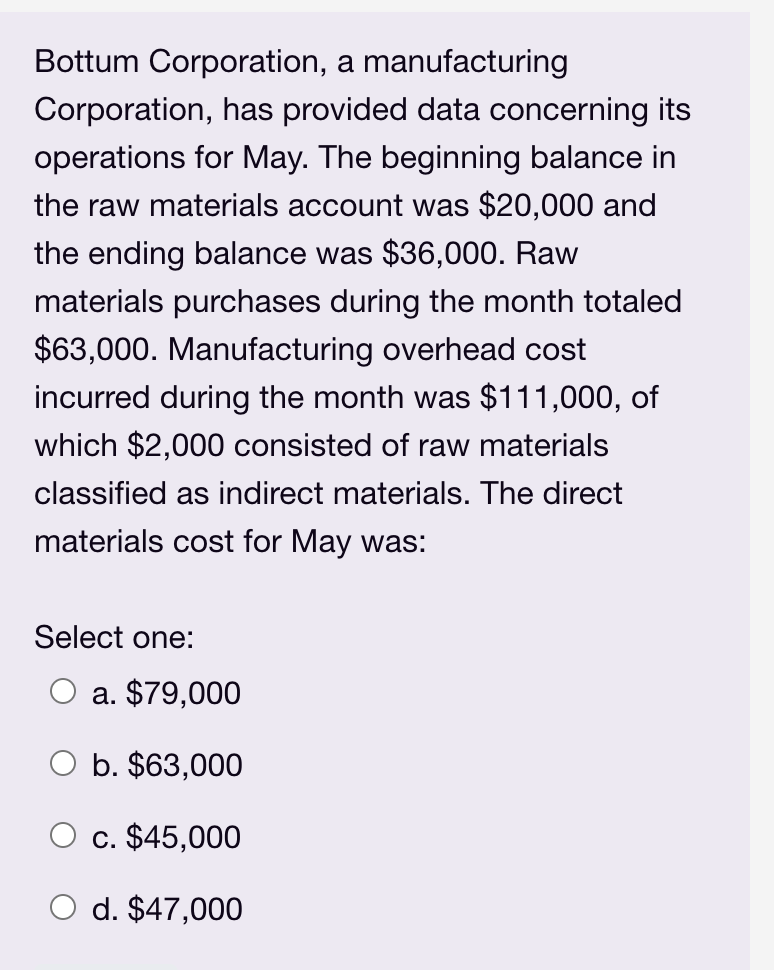

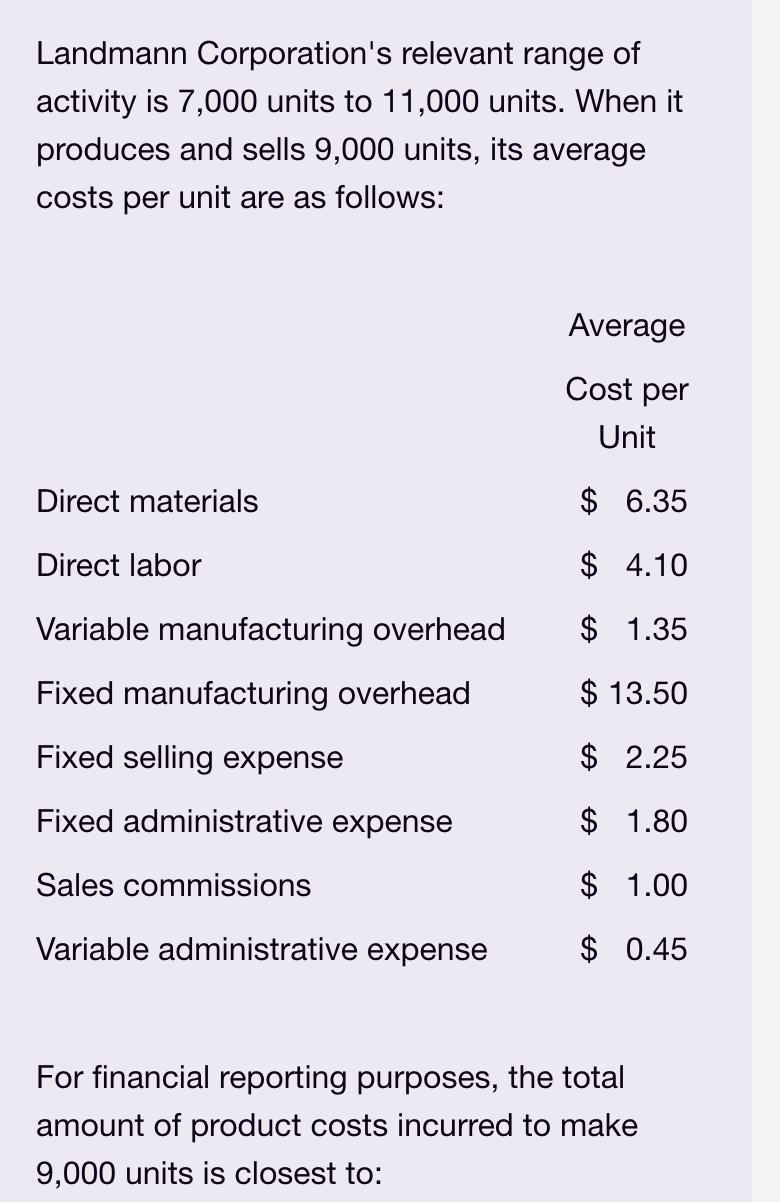

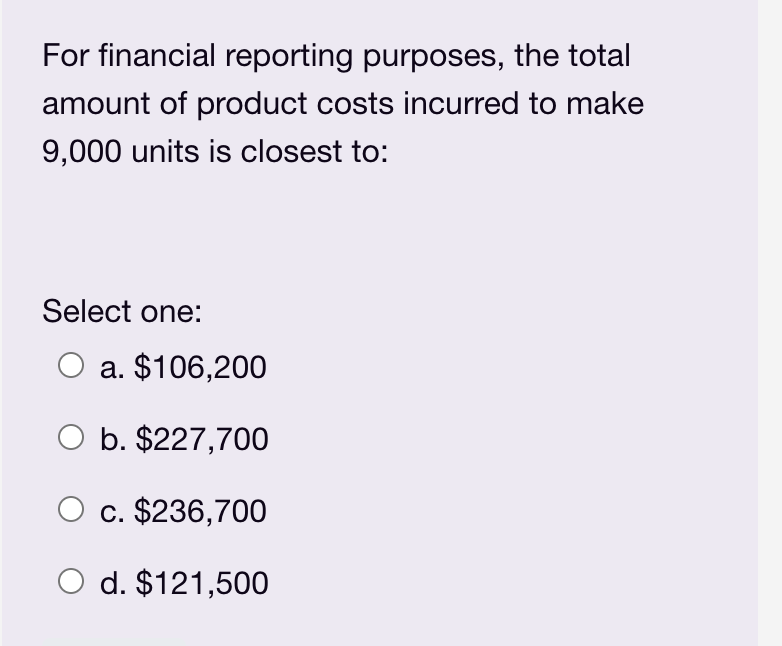

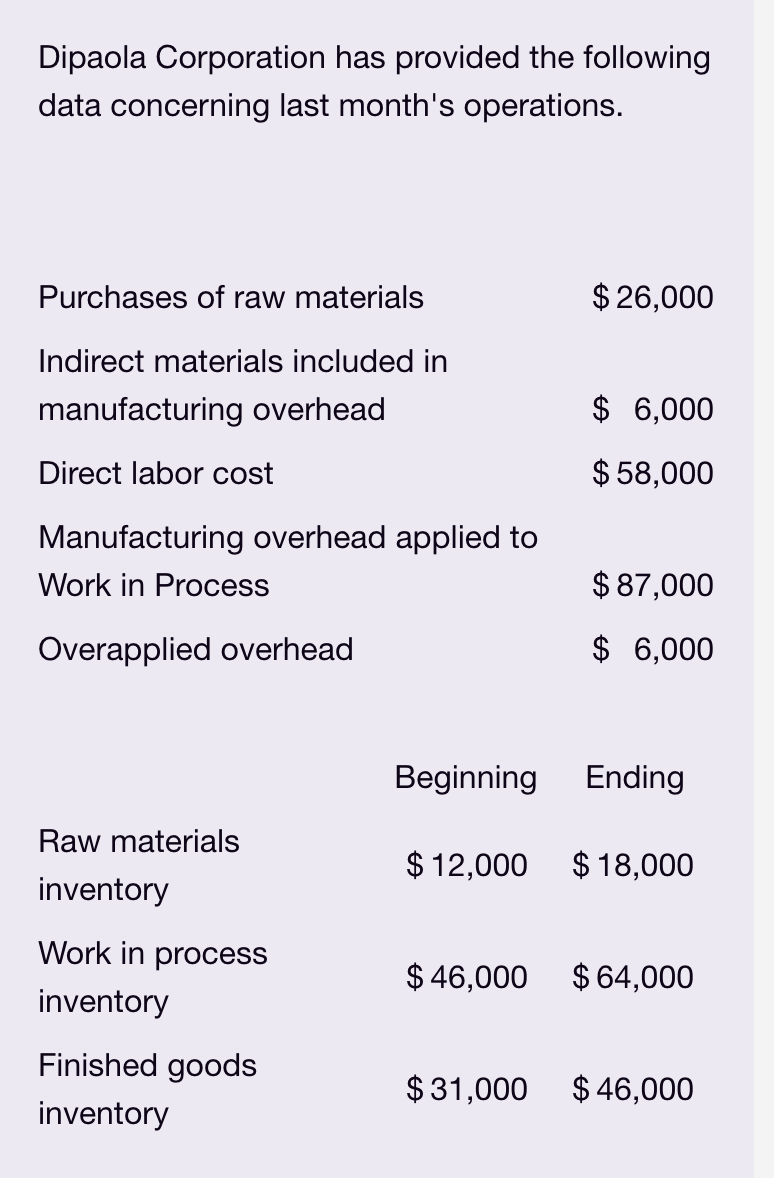

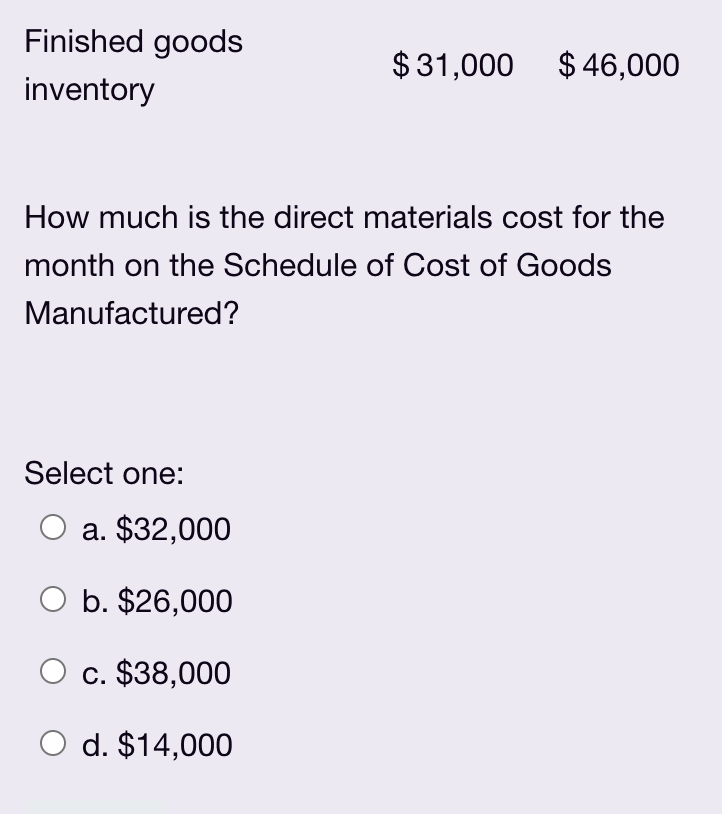

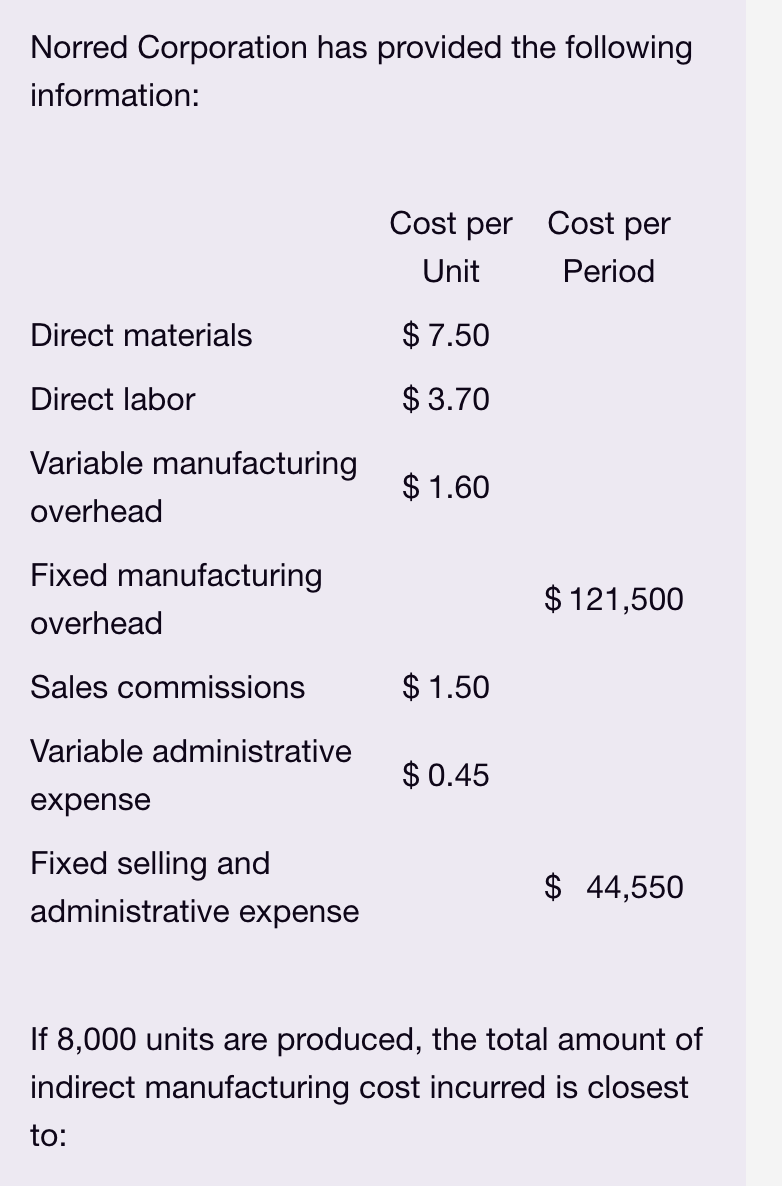

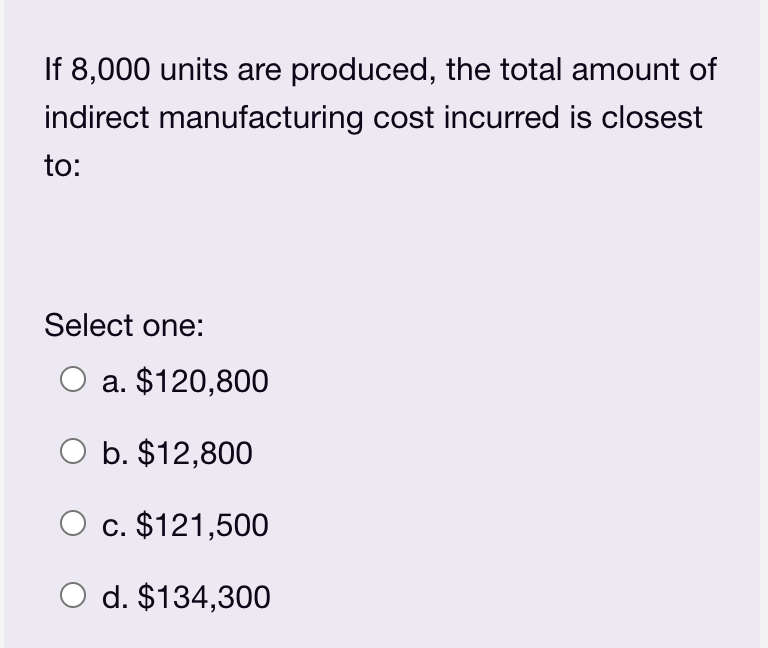

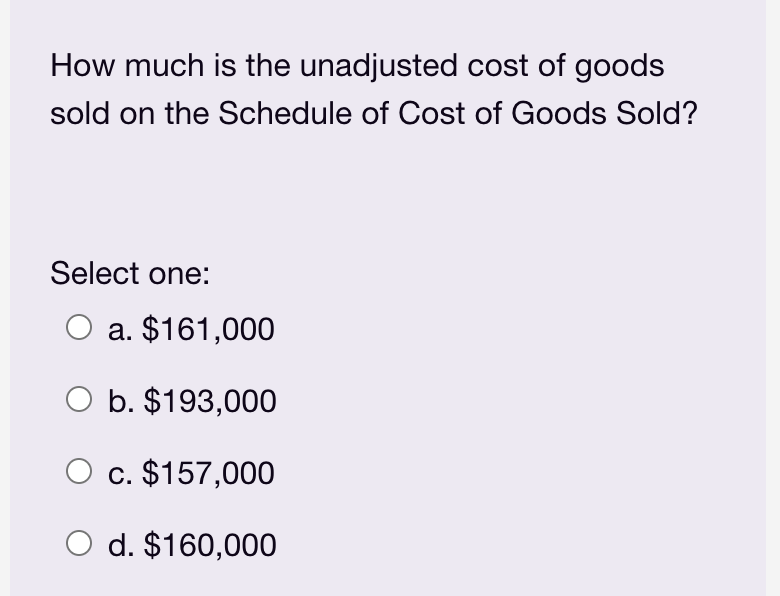

Bottum Corporation, a manufacturing Corporation, has provided data concerning its operations for May. The beginning balance in the raw materials account was $20,000 and the ending balance was $36,000. Raw materials purchases during the month totaled $63,000. Manufacturing overhead cost incurred during the month was $111,000, of which $2,000 consisted of raw materials classified as indirect materials. The direct materials cost for May was: Select one: a. $79,000 O b. $63,000 c. $45,000 O d. $47,000 Landmann Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 6.35 Direct labor $ 4.10 Variable manufacturing overhead $ 1.35 Fixed manufacturing overhead $ 13.50 Fixed selling expense $ 2.25 Fixed administrative expense $ 1.80 Sales commissions $ 1.00 Variable administrative expense $ 0.45 For financial reporting purposes, the total amount of product costs incurred to make 9,000 units is closest to: For financial reporting purposes, the total amount of product costs incurred to make 9,000 units is closest to: Select one: a. $106,200 O b. $227,700 c. $236,700 d. $121,500 Dipaola Corporation has provided the following data concerning last month's operations. Purchases of raw materials $ 26,000 Indirect materials included in manufacturing overhead $ 6,000 Direct labor cost $ 58,000 Manufacturing overhead applied to Work in Process $ 87,000 Overapplied overhead $ 6,000 Beginning Ending Raw materials inventory $ 12,000 $18,000 Work in process inventory $ 46,000 $ 64,000 Finished goods inventory $ 31,000 $ 46,000 Finished goods inventory $31,000 $ 46,000 How much is the direct materials cost for the month on the Schedule of Cost of Goods Manufactured? Select one: a. $32,000 O b. $26,000 O c. $38,000 O d. $14,000 Norred Corporation has provided the following information: Cost per Cost per Unit Period Direct materials $ 7.50 Direct labor $ 3.70 Variable manufacturing overhead $ 1.60 Fixed manufacturing overhead $ 121,500 Sales commissions $ 1.50 Variable administrative $ 0.45 expense Fixed selling and administrative expense $ 44,550 If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to: If 8,000 units are produced, the total amount of indirect manufacturing cost incurred is closest to: Select one: a. $120,800 O b. $12,800 c. $121,500 d. $134,300 How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold? Select one: O a. $161,000 O b. $193,000 c. $157,000 O d. $160,000