Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bought $470 of supplies on account. Note: Enter debits before credits. Journal entry worksheet Received $9,500 cash for consulting services rendered. Note: Enter debits before

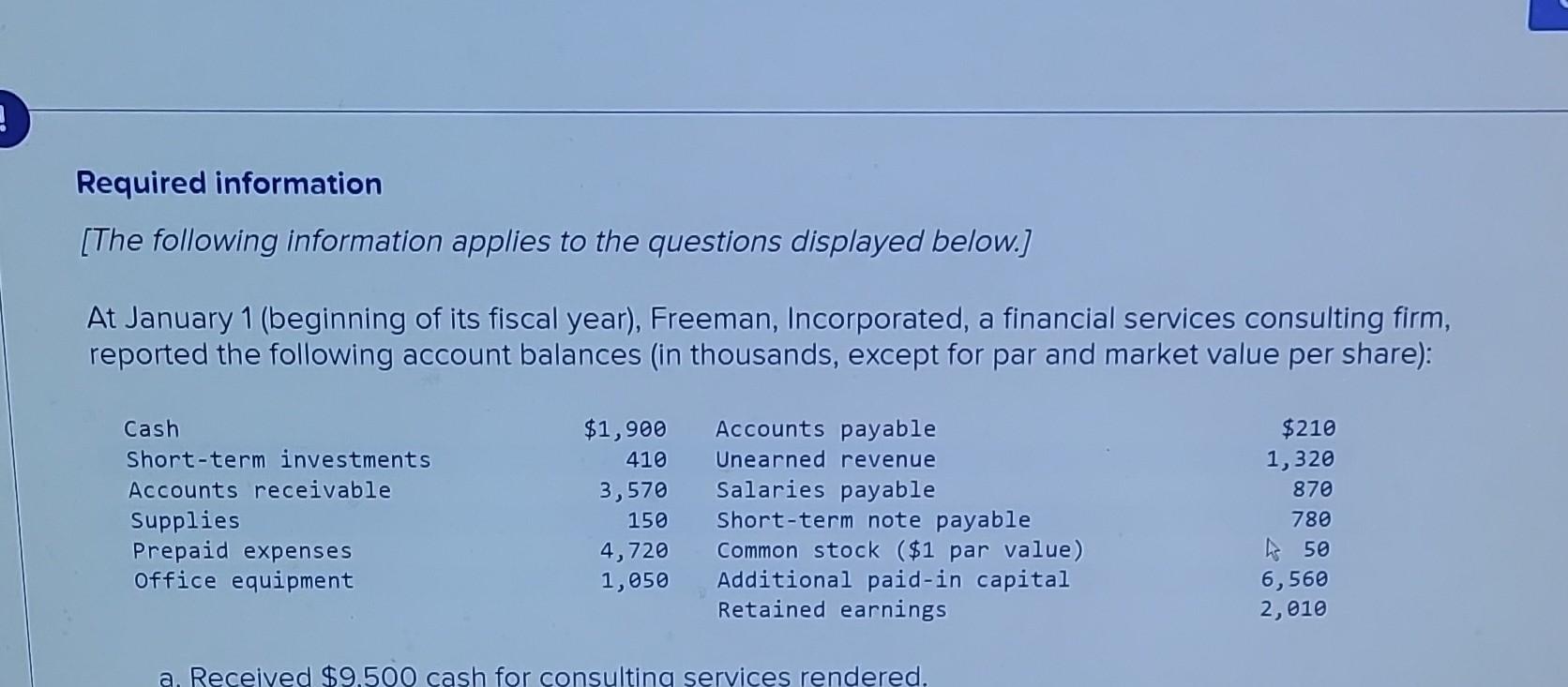

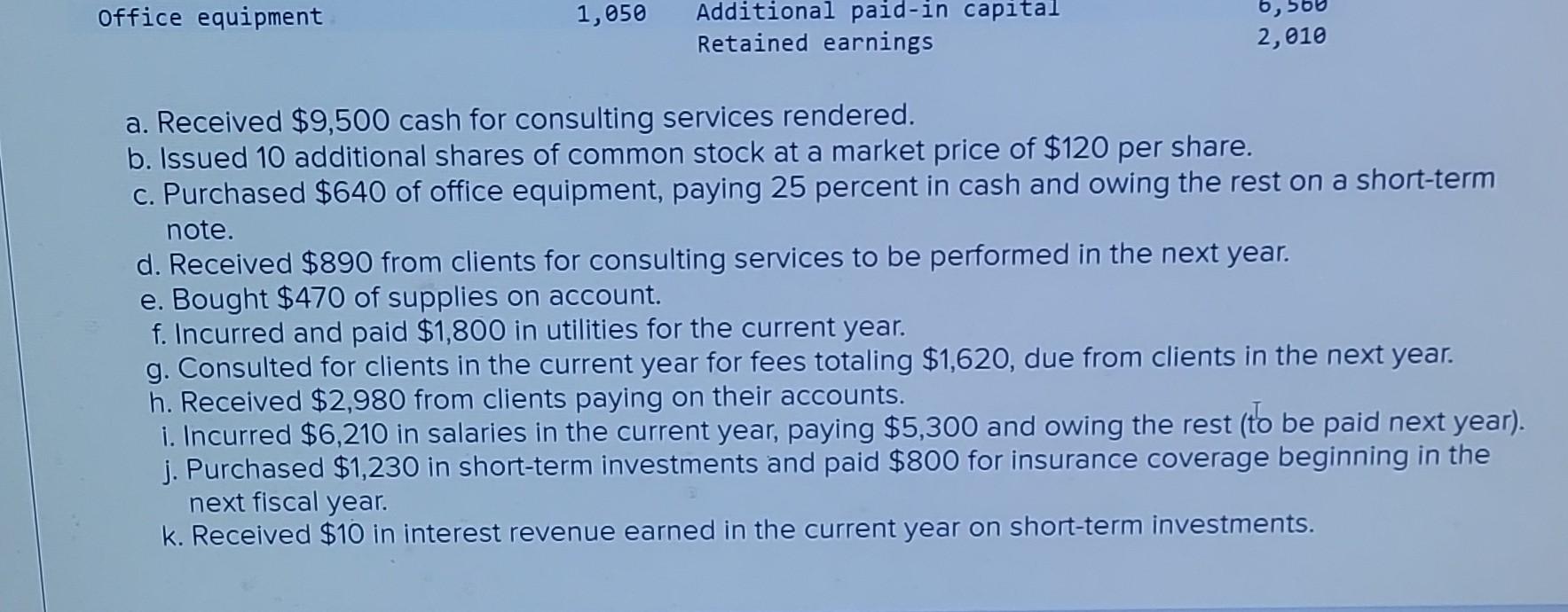

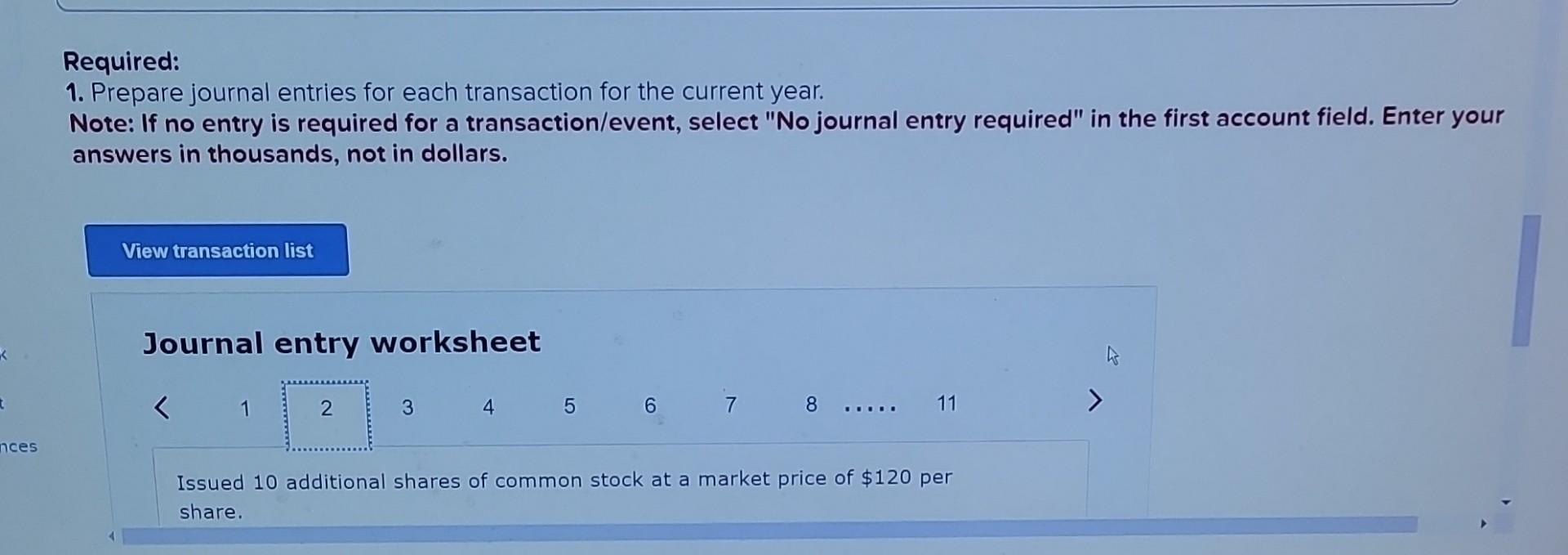

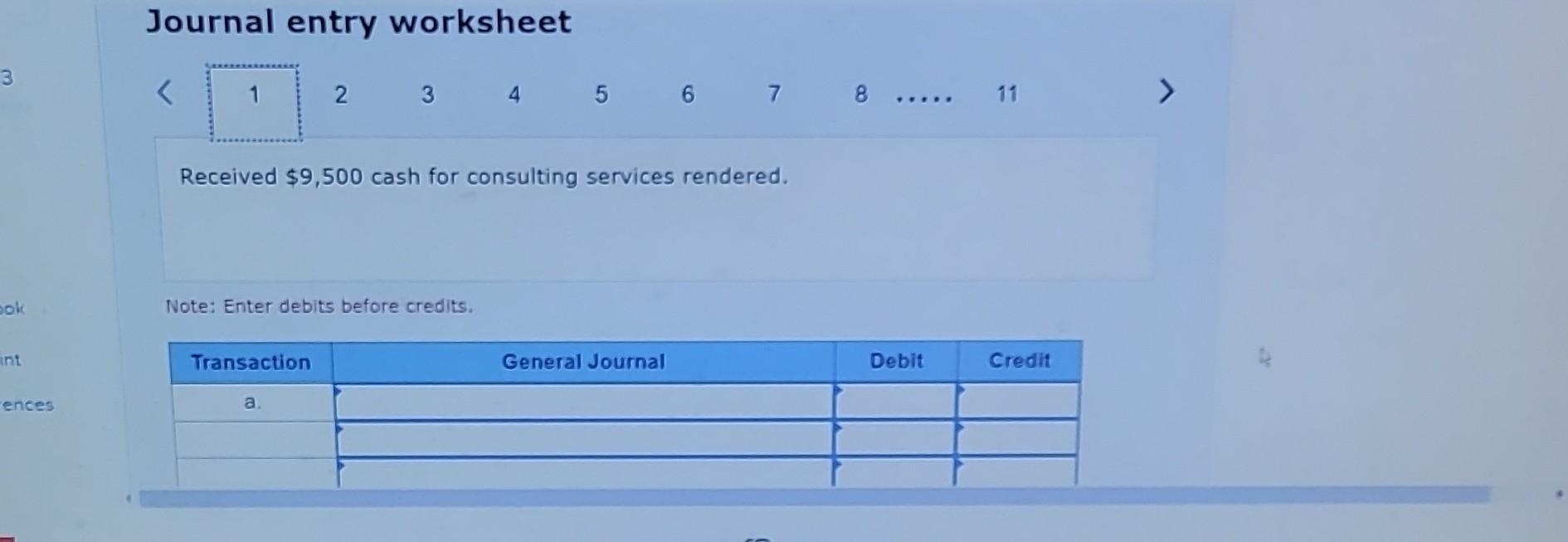

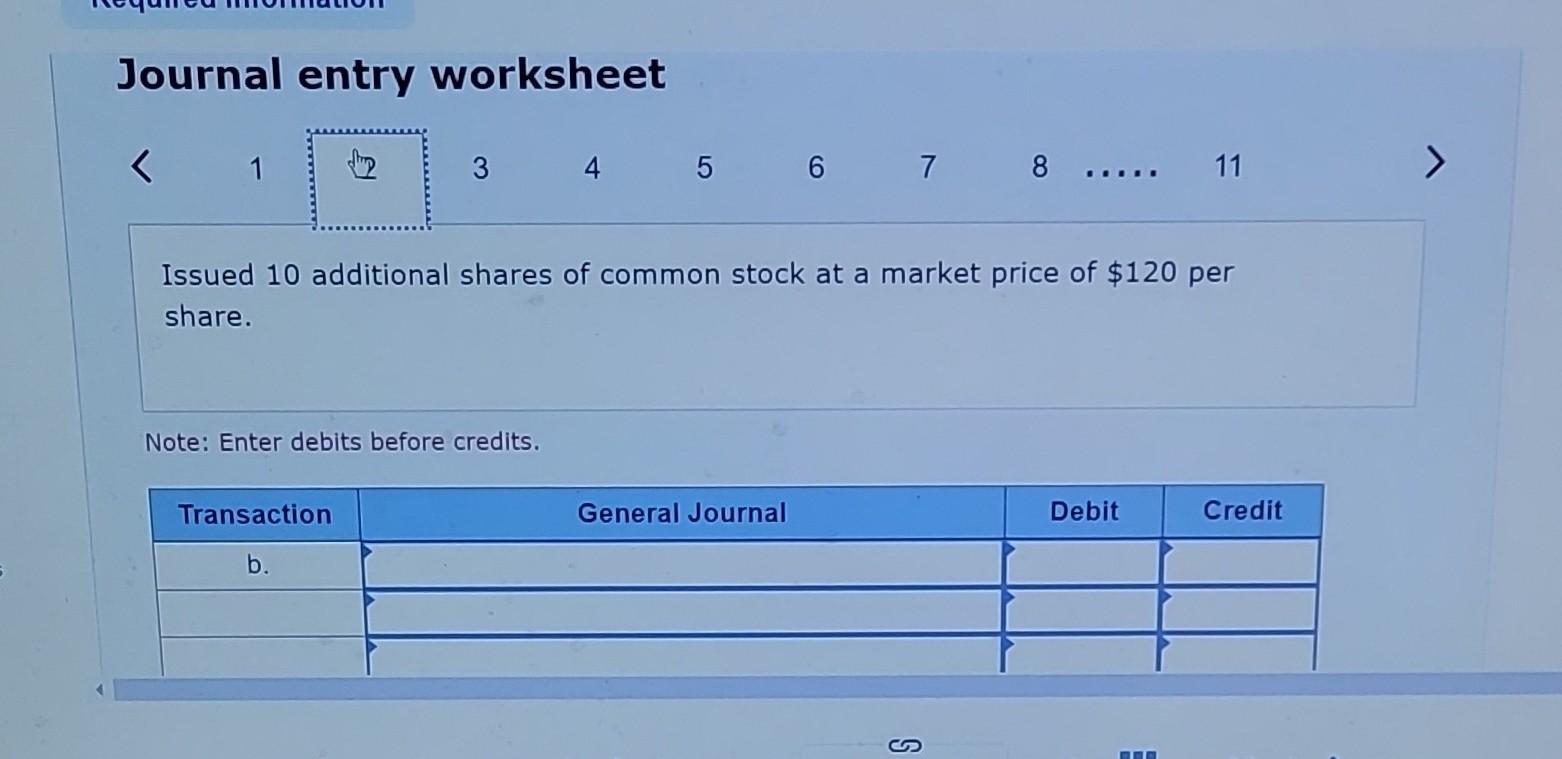

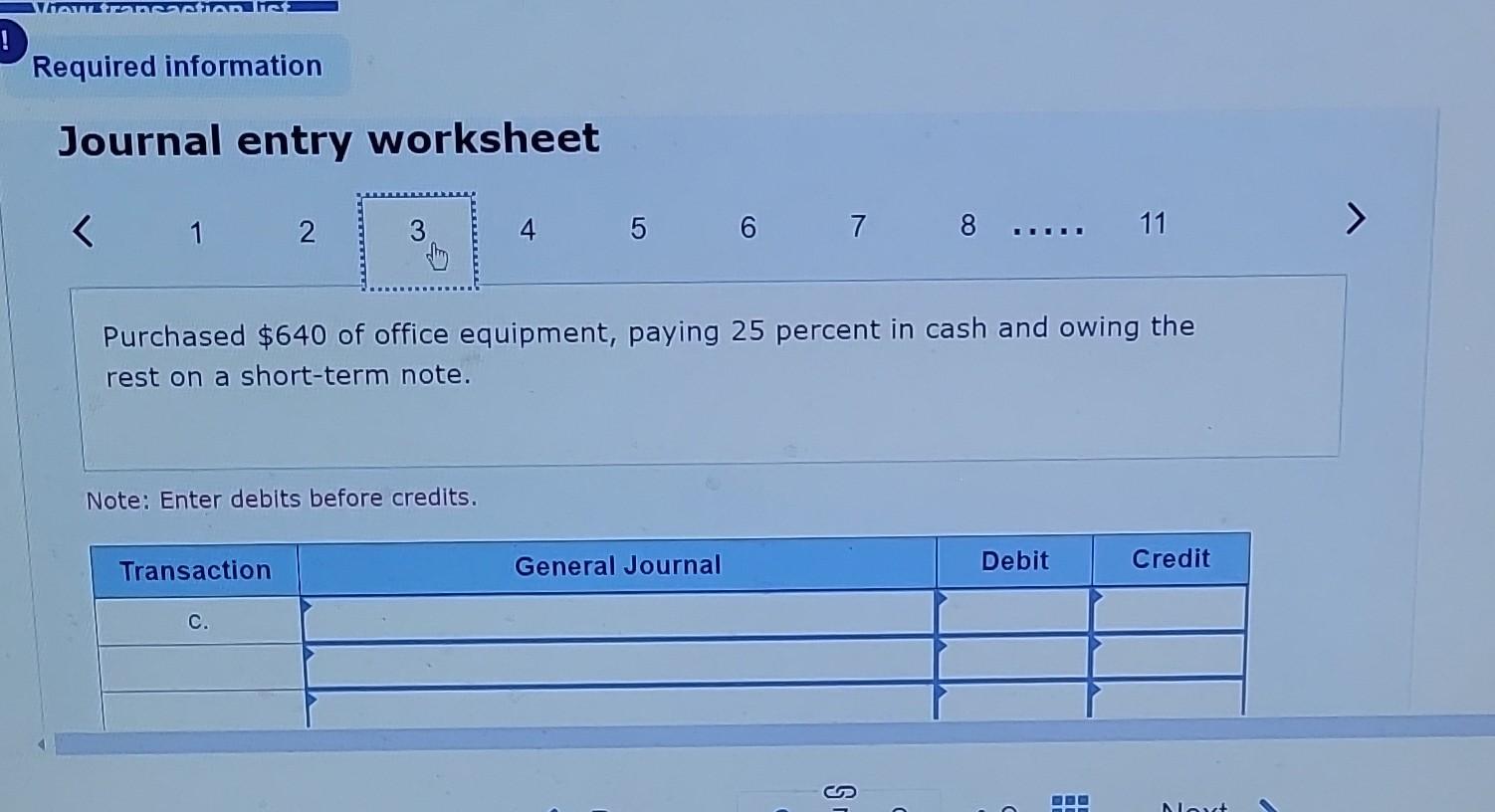

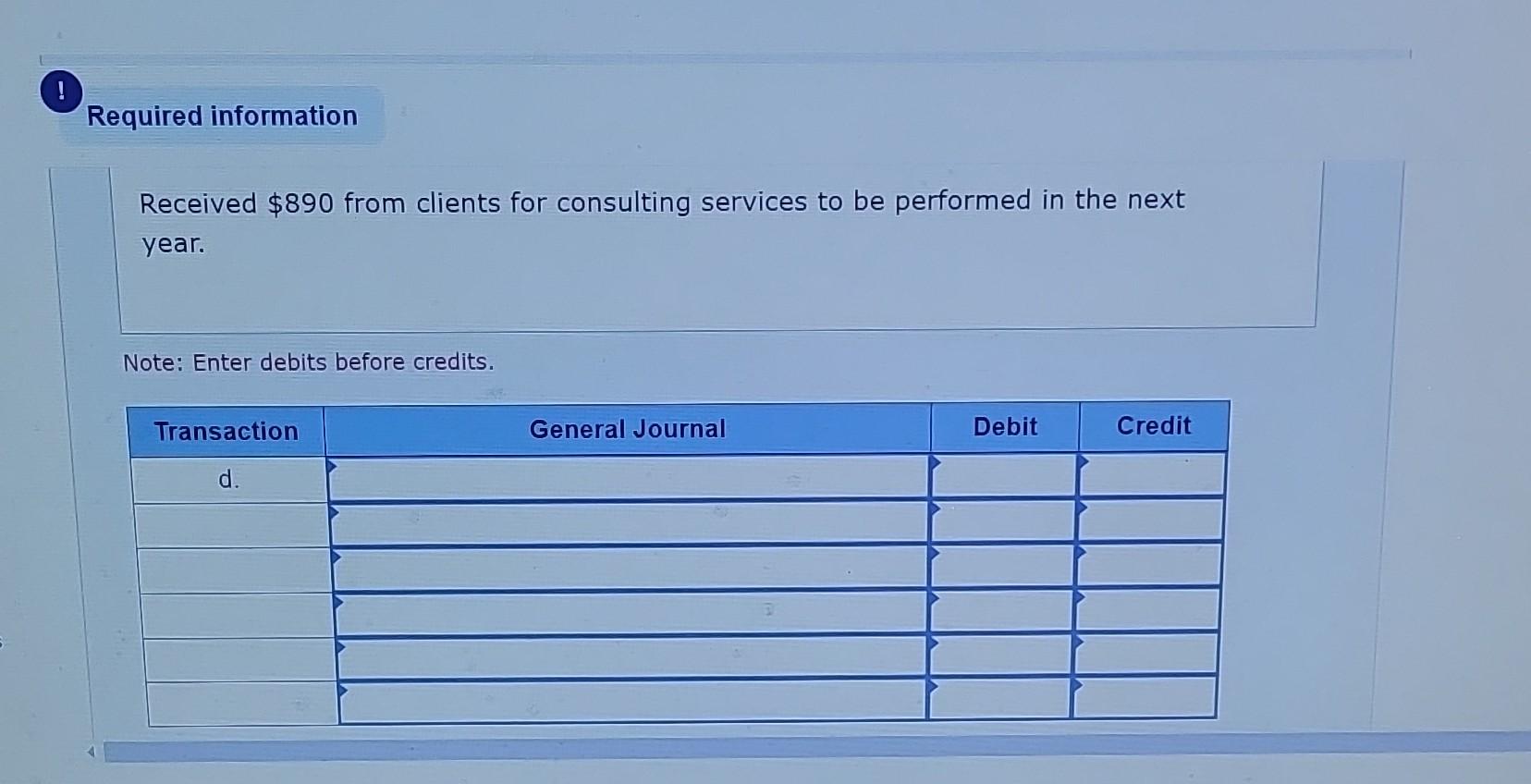

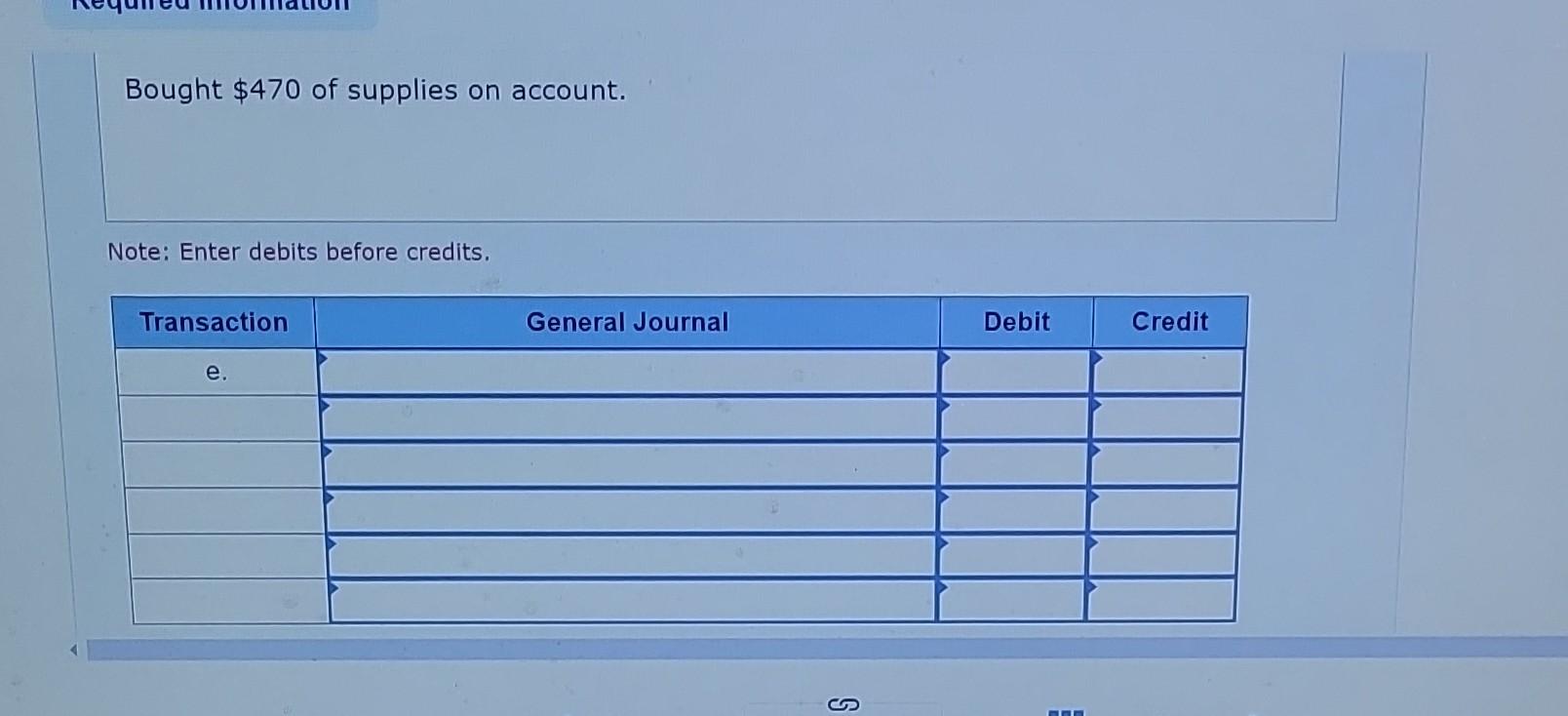

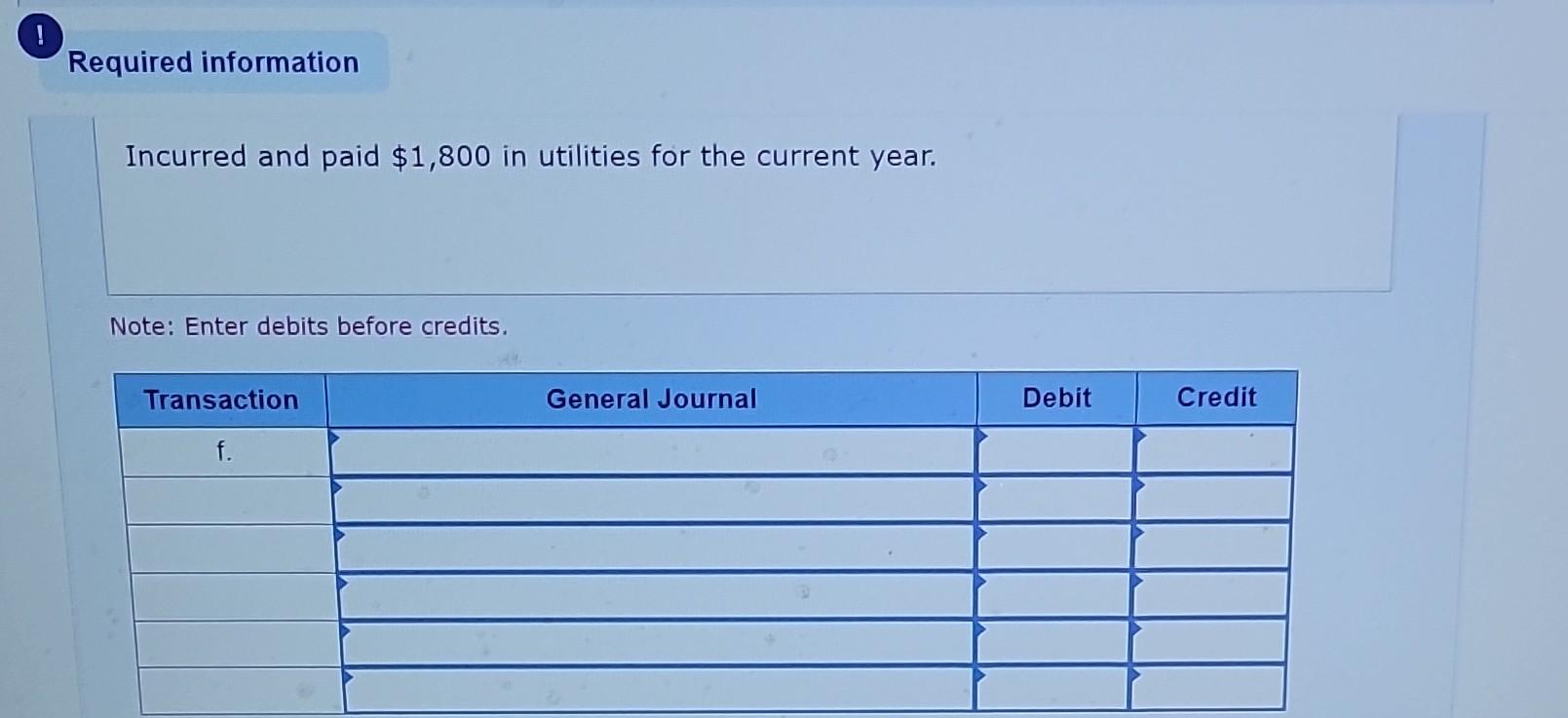

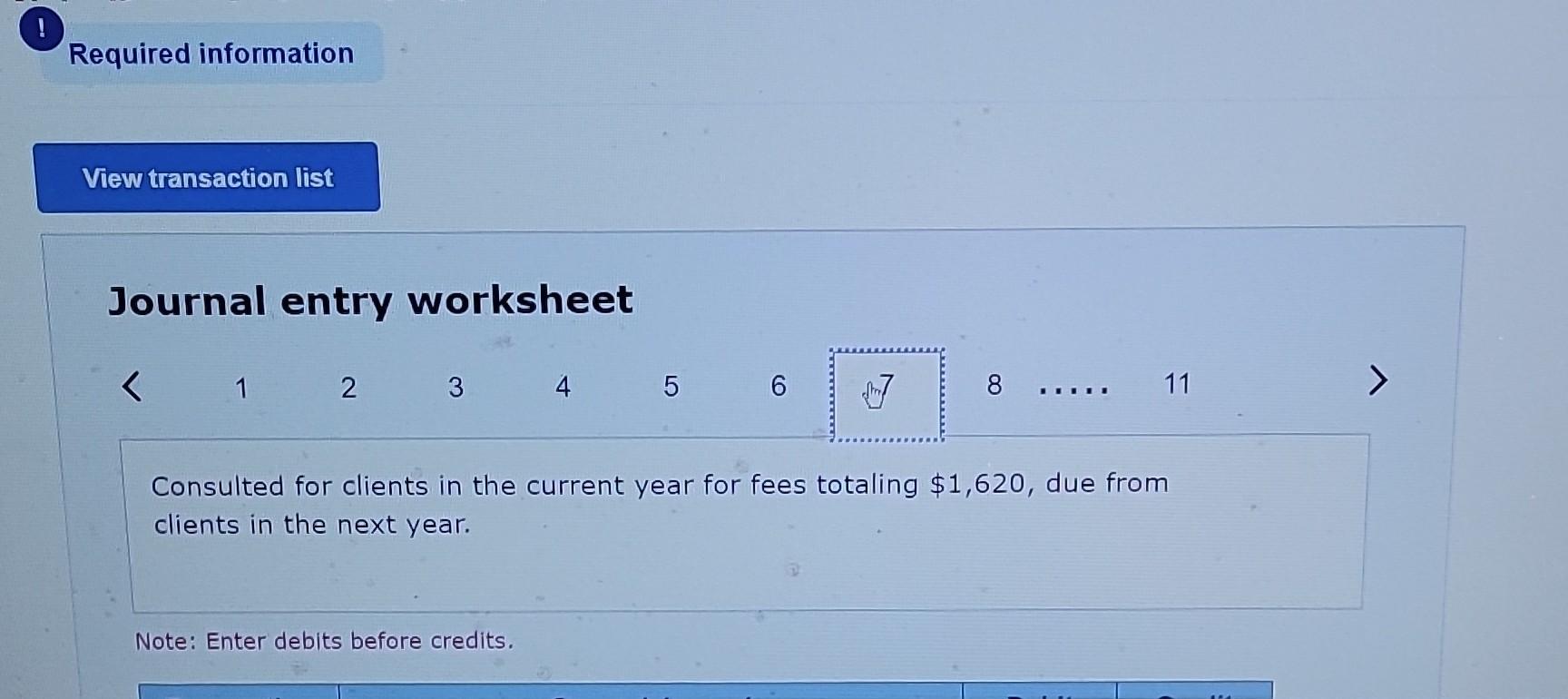

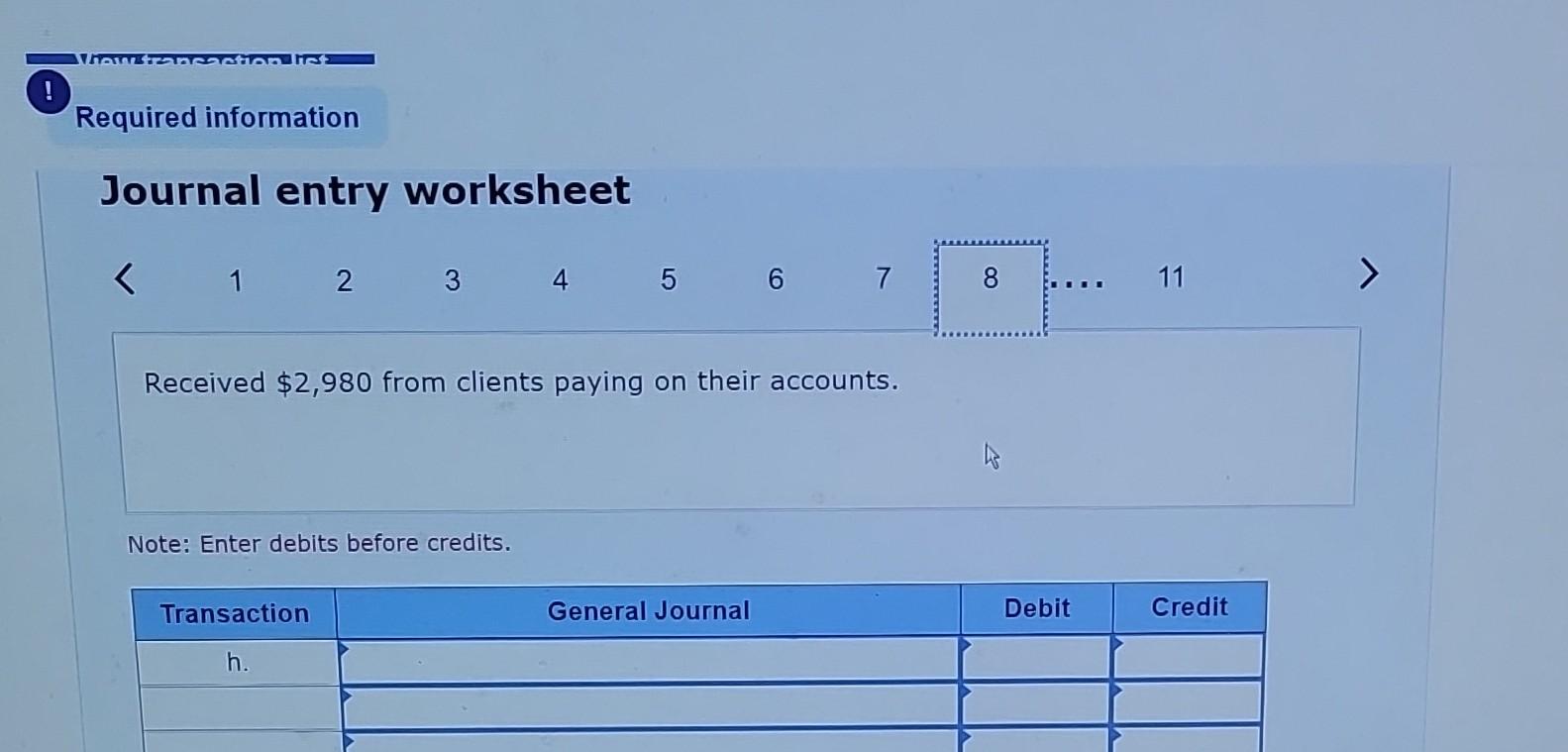

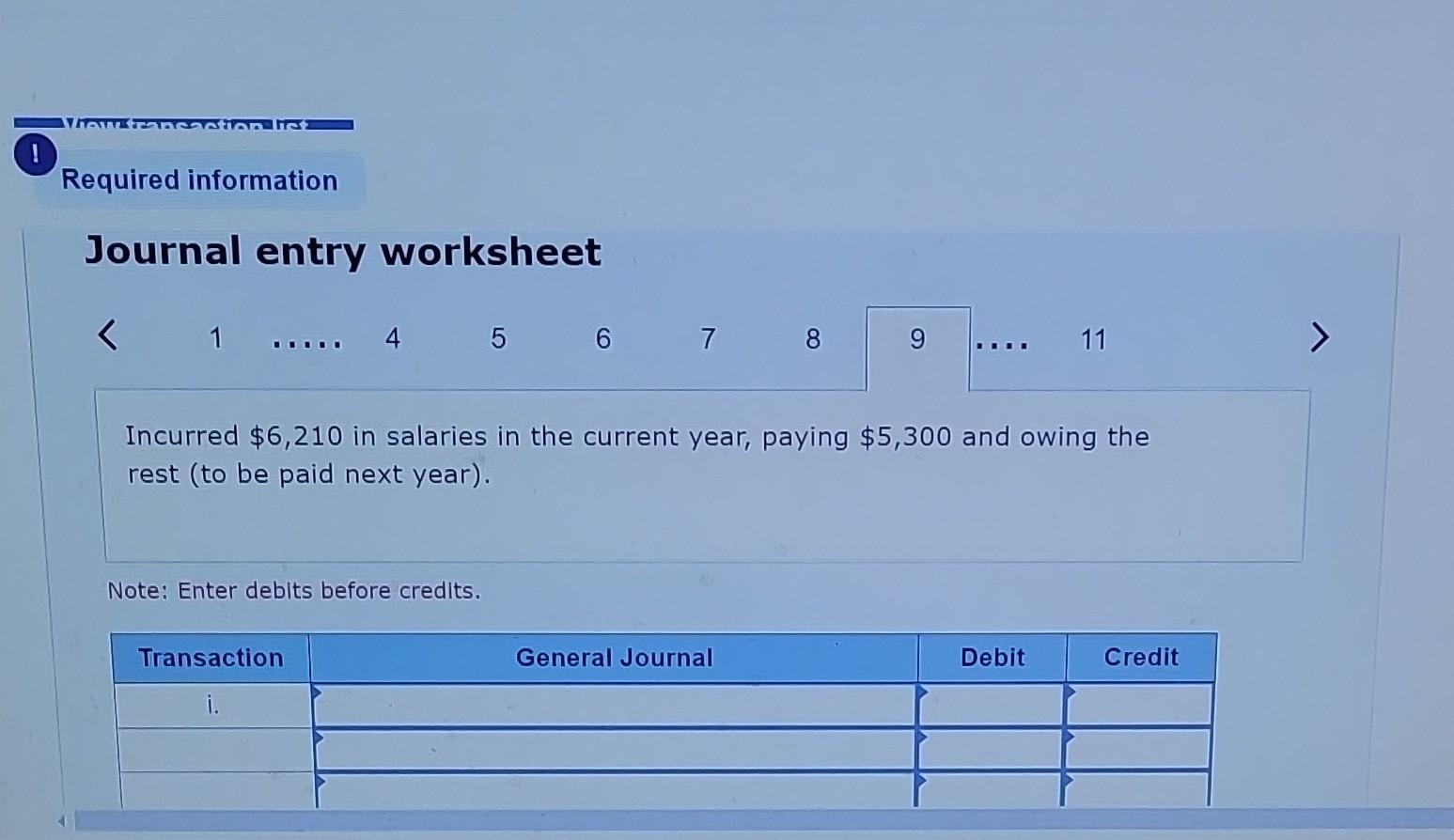

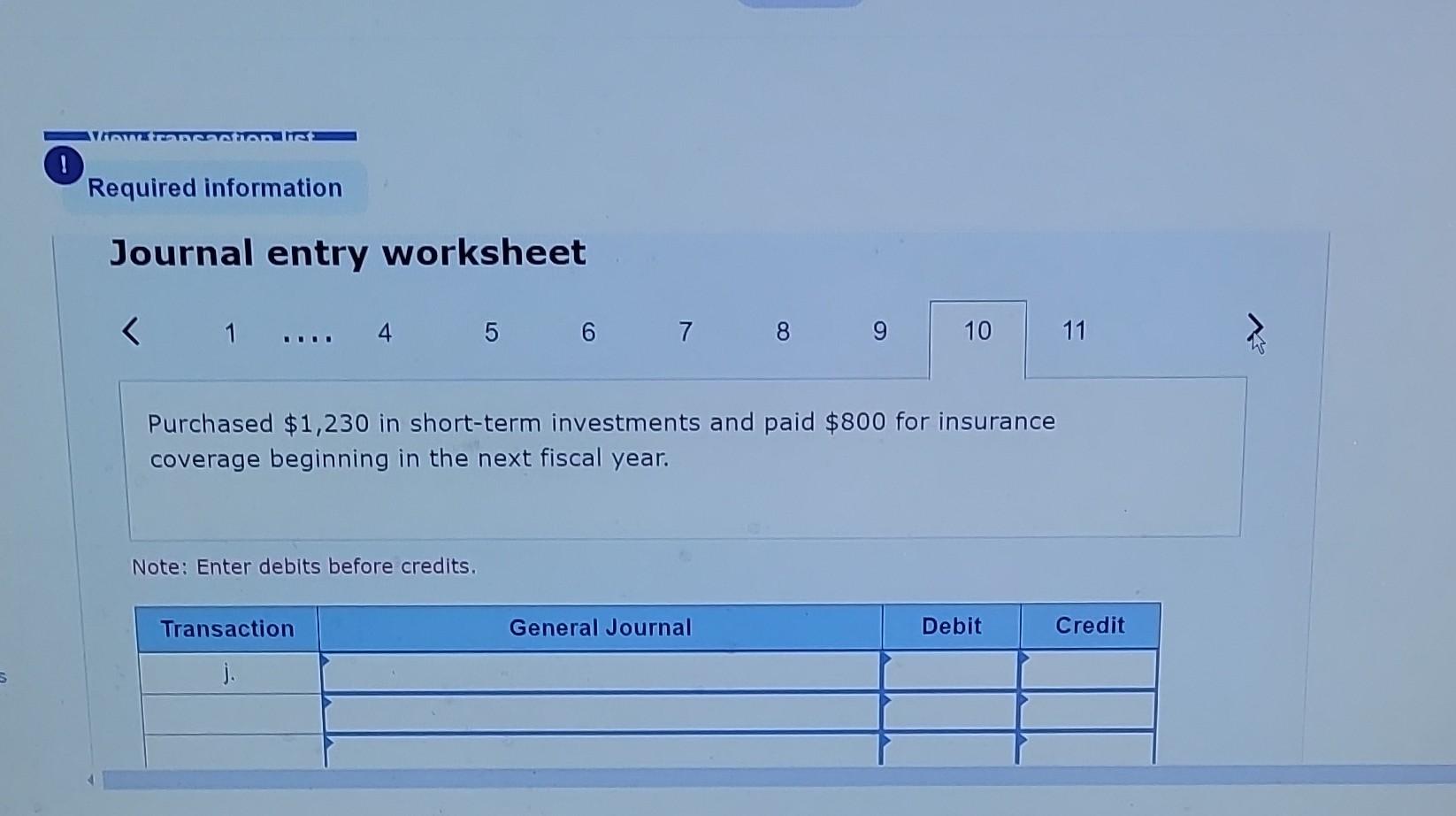

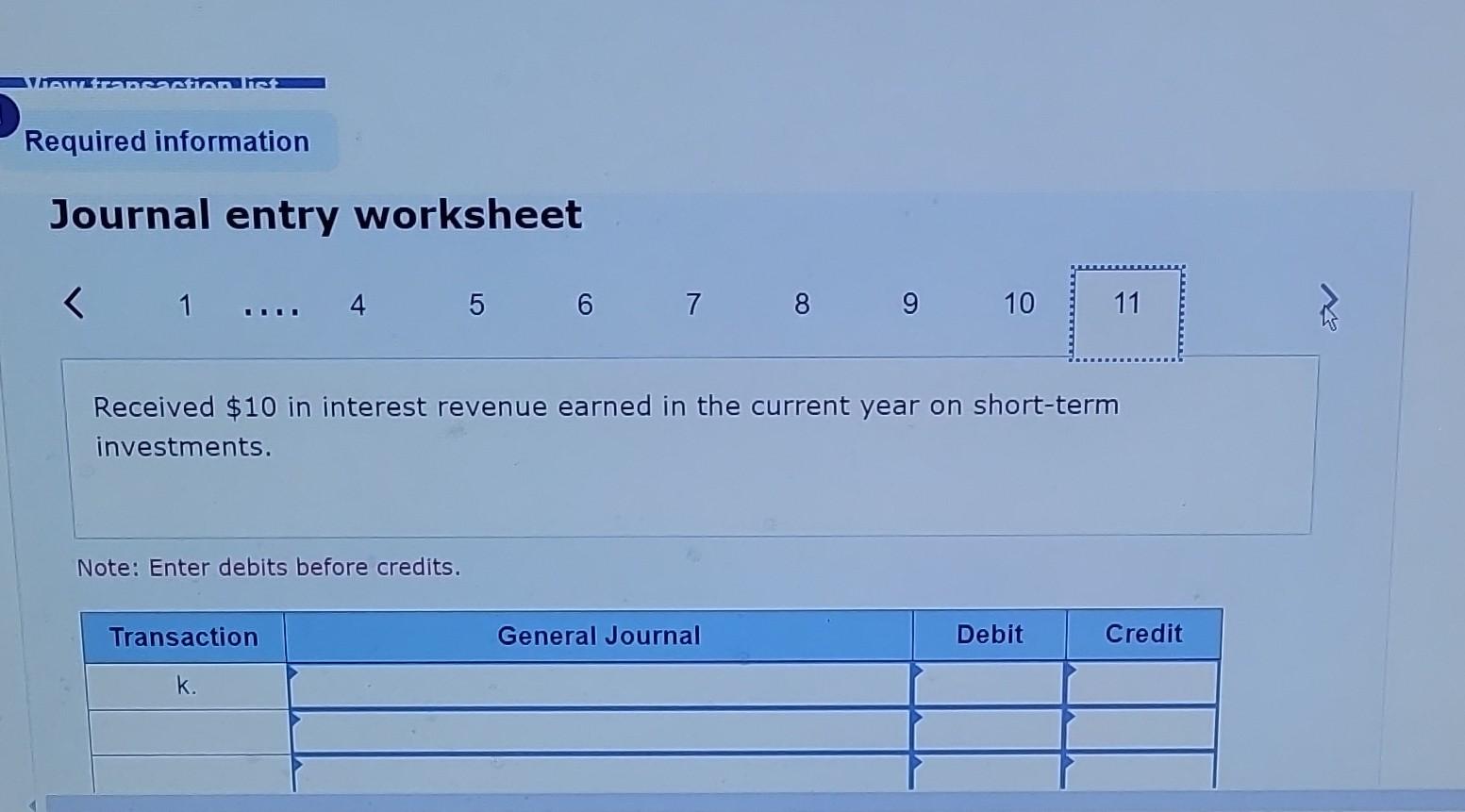

Bought $470 of supplies on account. Note: Enter debits before credits. Journal entry worksheet Received $9,500 cash for consulting services rendered. Note: Enter debits before credits. Incurred and paid $1,800 in utilities for the current year. Note: Enter debits before credits. Journal entry worksheet Purchased $1,230 in short-term investments and paid $800 for insurance coverage beginning in the next fiscal year. Note: Enter debits before credits. Journal entry worksheet Consulted for clients in the current year for fees totaling $1,620, due from clients in the next year. Note: Enter debits before credits. Journal entry worksheet Issued 10 additional shares of common stock at a market price of $120 per share. Note: Enter debits before credits. Journal entry worksheet 567 Received $2,980 from clients paying on their accounts. Note: Enter debits before credits. Journal entry worksheet Incurred $6,210 in salaries in the current year, paying $5,300 and owing the rest (to be paid next year). Note: Enter deblts before credits. Required: 1. Prepare journal entries for each transaction for the current year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands, not in dollars. a. Received $9,500 cash for consulting services rendered. b. Issued 10 additional shares of common stock at a market price of $120 per share. c. Purchased $640 of office equipment, paying 25 percent in cash and owing the rest on a short-term note. d. Received $890 from clients for consulting services to be performed in the next year. e. Bought $470 of supplies on account. f. Incurred and paid $1,800 in utilities for the current year. g. Consulted for clients in the current year for fees totaling $1,620, due from clients in the next year. h. Received $2,980 from clients paying on their accounts. i. Incurred $6,210 in salaries in the current year, paying $5,300 and owing the rest (to be paid next year). j. Purchased $1,230 in short-term investments and paid $800 for insurance coverage beginning in the next fiscal year. k. Received $10 in interest revenue earned in the current year on short-term investments. Received $890 from clients for consulting services to be performed in the next year. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] At January 1 (beginning of its fiscal year), Freeman, Incorporated, a financial services consulting firm, reported the following account balances (in thousands, except for par and market value per share): Journal entry worksheet Purchased $640 of office equipment, paying 25 percent in cash and owing the rest on a short-term note. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started