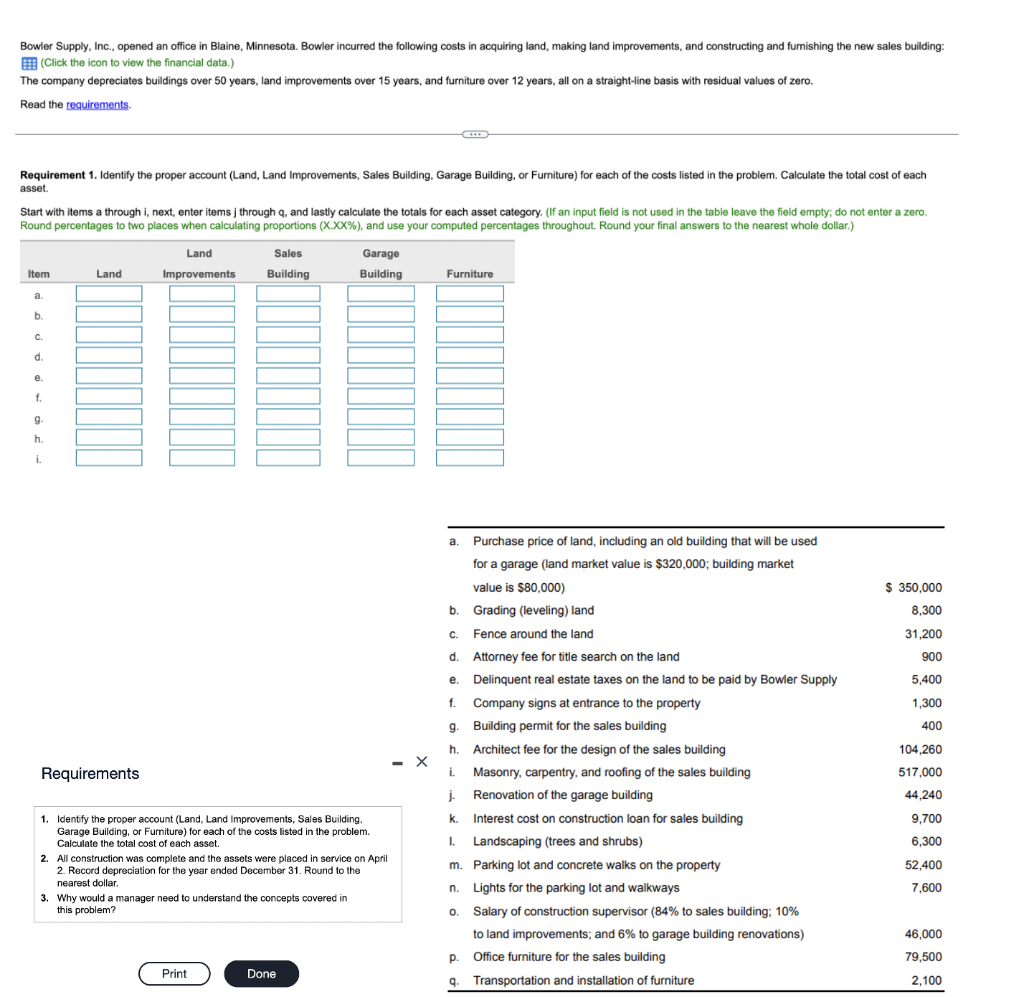

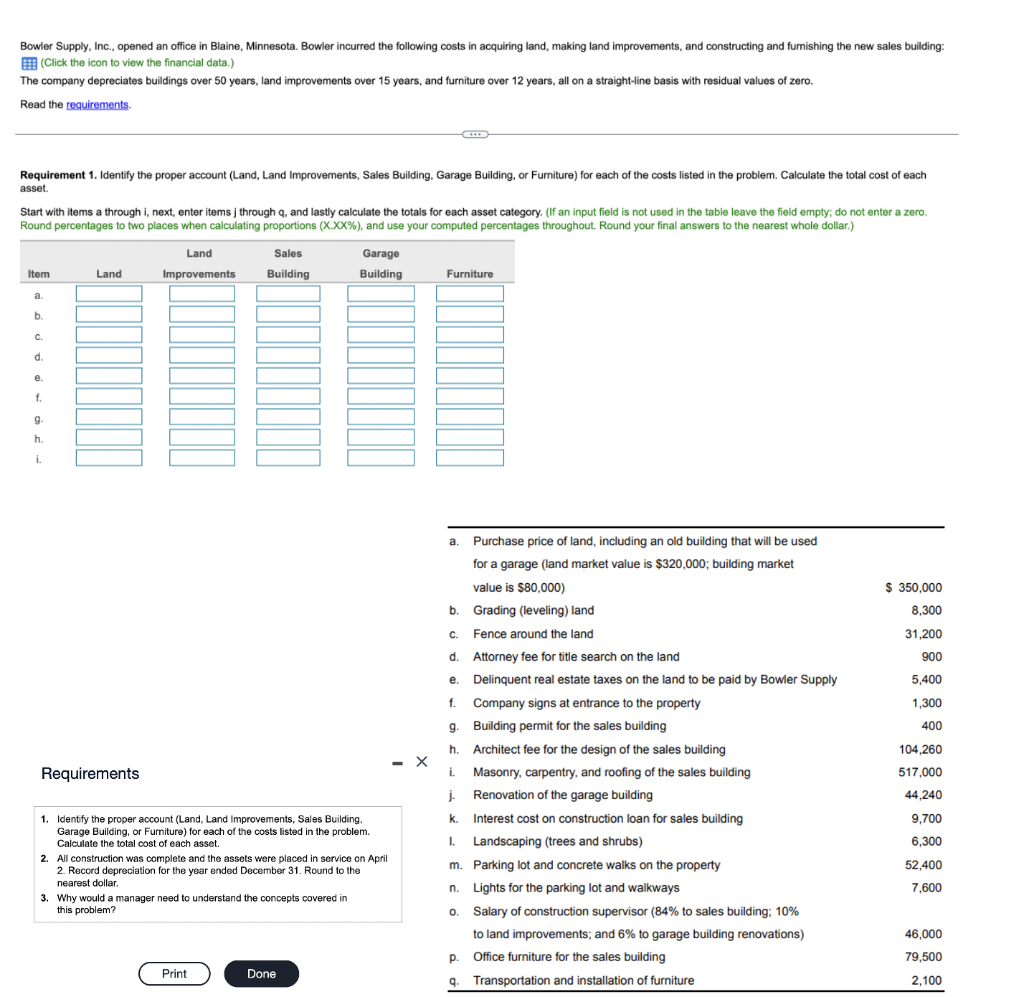

Bowler Supply, Inc., opened an office in Blaine, Minnesota. Bowler incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: (Click the icon to view the financial data.) The company depreciates buildings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis with residual values of zero. Read the requirements. Requirement 1. Identify the proper account (Land, Land Improvements, Sales Building, Garage Building, or Furniture) for each of the costs listed in the problem. Calculate the total cost of each asset. Start with items a through i, next, enter items j through q, and lastly calculate the totals for each asset category. (If an input field is not used in the table leave the field empty; do not enter a zero. Round percentages to two places when calculating proportions (X.XX\%), and use your computed percentages throughout. Round your final answers to the nearest whole dollar.) x Requirements 1. Identify the proper account (Land, Land Improvements, Sales Building. Garage Building, or Furniture) for each of the costs listed in the problem. Calculate the total cost of each asset. 2. All construction was complete and the assets were placed in service on April 2. Record depreciation for the year ended December 31 . Round to the nearest dollar. 3. Why would a manager need to understand the concepts covered in this problem? Bowler Supply, Inc., opened an office in Blaine, Minnesota. Bowler incurred the following costs in acquiring land, making land improvements, and constructing and furnishing the new sales building: (Click the icon to view the financial data.) The company depreciates buildings over 50 years, land improvements over 15 years, and furniture over 12 years, all on a straight-line basis with residual values of zero. Read the requirements. Requirement 1. Identify the proper account (Land, Land Improvements, Sales Building, Garage Building, or Furniture) for each of the costs listed in the problem. Calculate the total cost of each asset. Start with items a through i, next, enter items j through q, and lastly calculate the totals for each asset category. (If an input field is not used in the table leave the field empty; do not enter a zero. Round percentages to two places when calculating proportions (X.XX\%), and use your computed percentages throughout. Round your final answers to the nearest whole dollar.) x Requirements 1. Identify the proper account (Land, Land Improvements, Sales Building. Garage Building, or Furniture) for each of the costs listed in the problem. Calculate the total cost of each asset. 2. All construction was complete and the assets were placed in service on April 2. Record depreciation for the year ended December 31 . Round to the nearest dollar. 3. Why would a manager need to understand the concepts covered in this