Question

Bowling purchased $375,000 in inventory on credit. Bowling received $17,000 in cash from customers for subscriptions that will not begin until the following month. Bowling

Bowling purchased $375,000 in inventory on credit.

Bowling received $17,000 in cash from customers for subscriptions that will not begin until the following month.

Bowling signed a note from Midwest Bank for $75,000.

Bowling sold all the inventory purchased in (1) above for $600,000 on account.

Bowling paid employees $107,000 for some of the services performed during January.

Bowling purchased land for $66,000 in cash.

Bowling received $500,000 in cash from customers paying off some of Januarys accounts receivable.

Bowling paid dividends to stockholders in the amount of $3,500.

Bowling owes its employees $103,000 for work performed during February but not yet paid.

Bowling paid $330,000 on its accounts payable.

Bowling paid taxes in cash of $55,000.

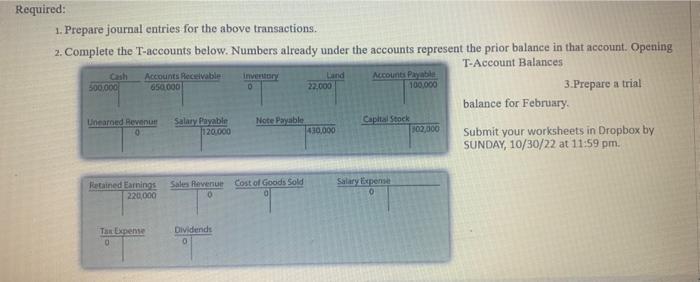

1. Prepare journal entries for the above transactions. 2. Complete the T-accounts below. Numbers already under the accounts represent the prior balance in that account. Opening T-Account Balances 3.Prepare a trial balance for February. Submit your worksheets in Dropbox by SUNDAY, 10/30/22 at 11:59 pmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started