Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Boxed, Inc. is a cargo containers manufacturer. At the beginning of the year, the company expected to produce 1,050 containers with estimated annual overhead costs

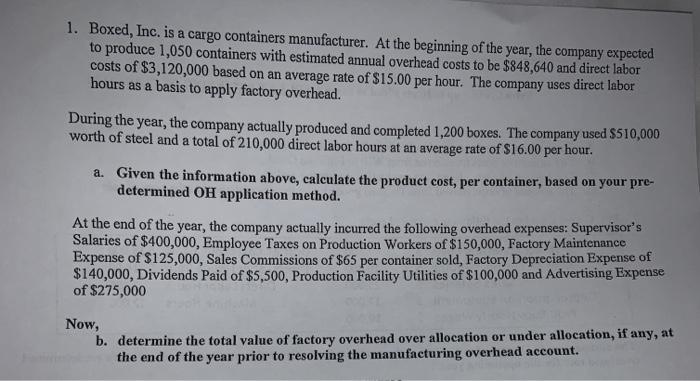

Boxed, Inc. is a cargo containers manufacturer. At the beginning of the year, the company expected to produce 1,050 containers with estimated annual overhead costs to be $848,640 and direct labor costs of $3,120,000 based on an average rate of $15.00 per hour. The company uses direct labor hours as a basis to apply factory overhead.

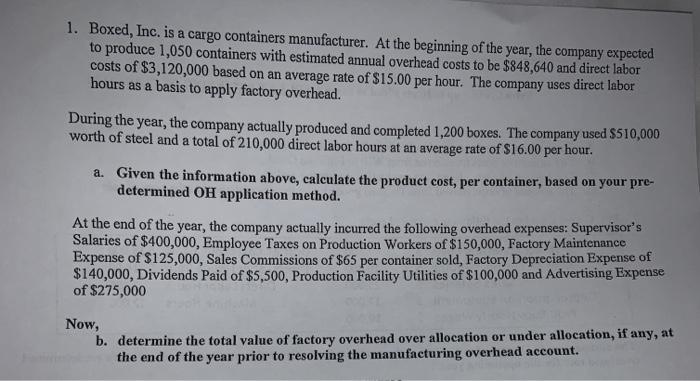

1. Boxed, Inc. is a cargo containers manufacturer. At the beginning of the year, the company expected to produce 1,050 containers with estimated annual overhead costs to be $848,640 and direct labor costs of $3,120,000 based on an average rate of $15.00 per hour. The company uses direct labor hours as a basis to apply factory overhead. During the year, the company actually produced and completed 1,200 boxes. The company used $510,000 worth of steel and a total of 210,000 direct labor hours at an average rate of $16.00 per hour. a. Given the information above, calculate the product cost, per container, based on your pre- determined OH application method. At the end of the year, the company actually incurred the following overhead expenses: Supervisor's Salaries of $400,000, Employee Taxes on Production Workers of $150,000, Factory Maintenance Expense of $125,000, Sales Commissions of $65 per container sold, Factory Depreciation Expense of $140,000, Dividends Paid of $5,500, Production Facility Utilities of $100,000 and Advertising Expense of $275,000 Now, b. determine the total value of factory overhead over allocation or under allocation, if any, at the end of the year prior to resolving the manufacturing overhead account During the year, the company actually produced and completed 1,200 boxes. The company used $510,000 worth of steel and a total of 210,000 direct labor hours at an average rate of $16.00 per hour.

a. Given the information above, calculate the product cost, per container, based on your pre determined OH application method.

At the end of the year, the company actually incurred the following overhead expenses: Supervisor's Salaries of $400,000 Employee Taxes on Production Workers of $150,000 , Factory Maintenance Expense of $125,000, Sales Commissions of $65 per container sold, Factory Depreciation Expense of $ 140,000 Dividends Paid of $5,500 , Production Facility Utilities of $100,000 and Advertising Expense of $275,000

b. determine the total value of factory overhead over allocation or under allocation, if any, at the end of the year prior to resolving the manufacturing overhead account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started