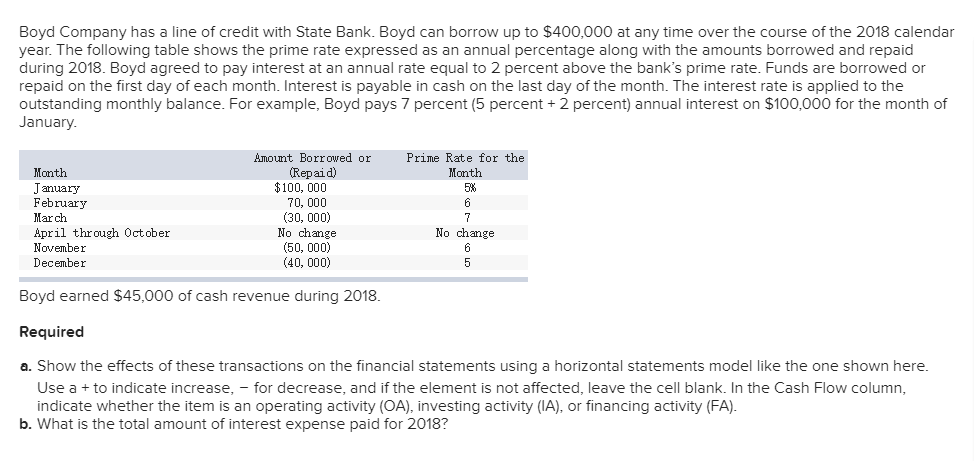

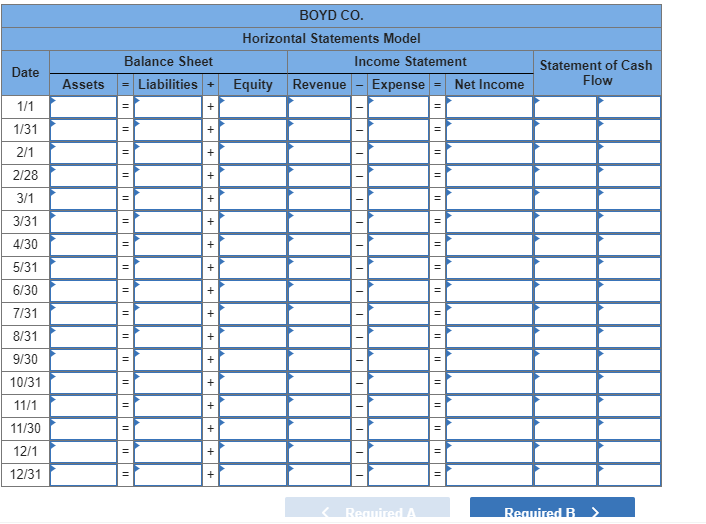

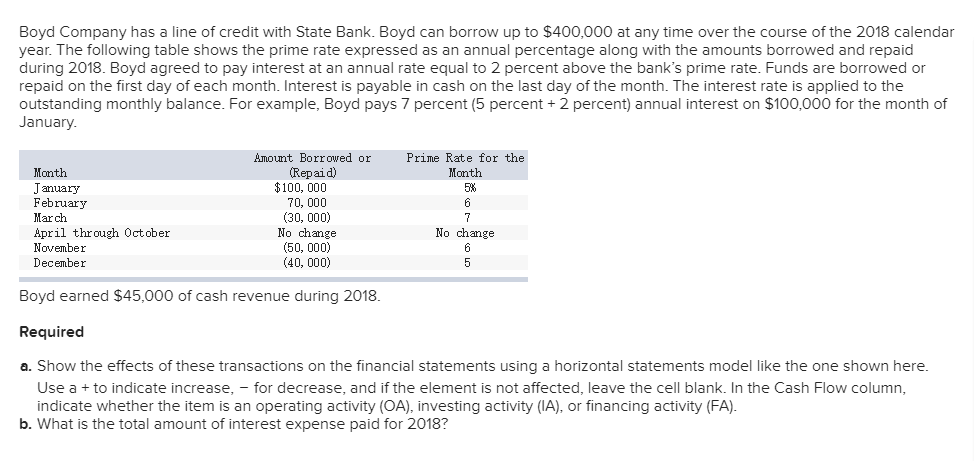

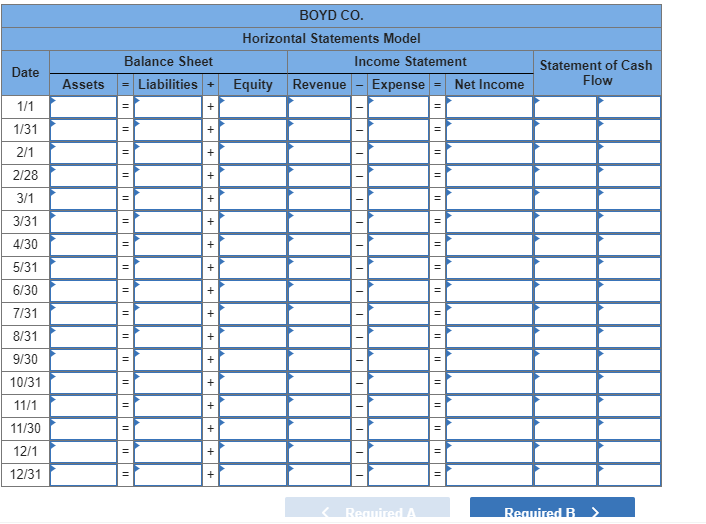

Boyd Company has a line of credit with State Bank. Boyd can borrow up to $400,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during 2018. Boyd agreed to pay interest at an annual rate equal to 2 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Boyd pays 7 percent (5 percent+ 2 percent) annual interest on $100,000 for the month of January Amount Borrowed or Prime Rate for the Month Repaid) Month anuary February March April through October November December $100, 000 5% 70, 000 (30, 000) No change (50, 000) (40, 000) No change Boyd earned $45,000 of cash revenue during 2018 Required a. Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown here Use a + to indicate increase,-for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA) b. What is the total amount of interest expense paid for 2018? BOYD CO Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Flow Date AssetsLiabilitiesEquity Revenue-Expense-Net Income 1/31 2/28 3/31 4/30 5/31 6/30 7/31 8/31 9/30 10/31 11/30 12/1 12/31 Boyd Company has a line of credit with State Bank. Boyd can borrow up to $400,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during 2018. Boyd agreed to pay interest at an annual rate equal to 2 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Boyd pays 7 percent (5 percent+ 2 percent) annual interest on $100,000 for the month of January Amount Borrowed or Prime Rate for the Month Repaid) Month anuary February March April through October November December $100, 000 5% 70, 000 (30, 000) No change (50, 000) (40, 000) No change Boyd earned $45,000 of cash revenue during 2018 Required a. Show the effects of these transactions on the financial statements using a horizontal statements model like the one shown here Use a + to indicate increase,-for decrease, and if the element is not affected, leave the cell blank. In the Cash Flow column indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA) b. What is the total amount of interest expense paid for 2018? BOYD CO Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Flow Date AssetsLiabilitiesEquity Revenue-Expense-Net Income 1/31 2/28 3/31 4/30 5/31 6/30 7/31 8/31 9/30 10/31 11/30 12/1 12/31