Answered step by step

Verified Expert Solution

Question

1 Approved Answer

BP, a UK energy company, has just signed a contract on 1st June 2020 to import $5,500,000 of raw materials from a US company.

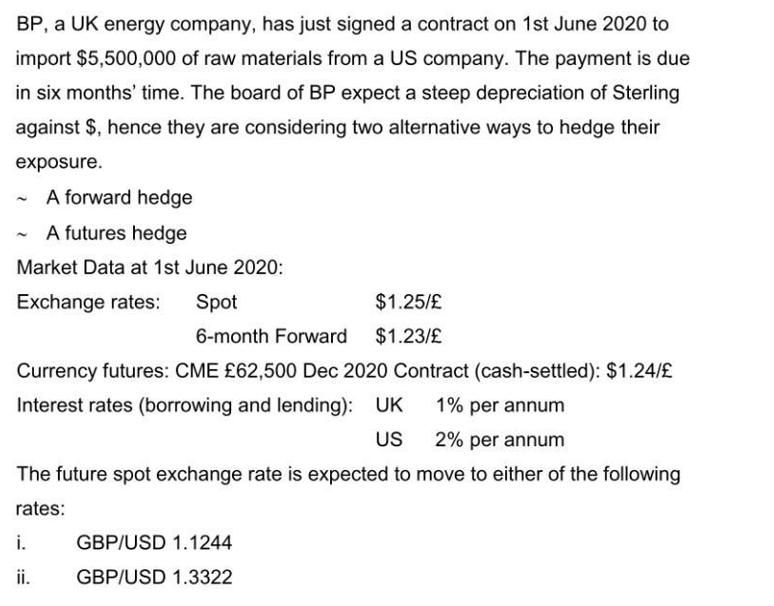

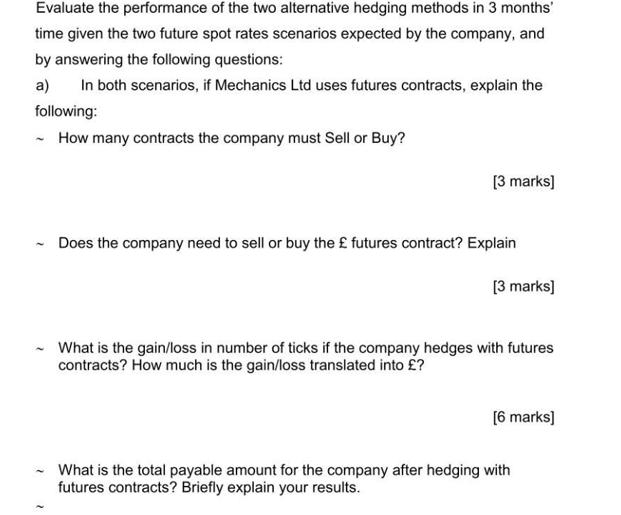

BP, a UK energy company, has just signed a contract on 1st June 2020 to import $5,500,000 of raw materials from a US company. The payment is due in six months' time. The board of BP expect a steep depreciation of Sterling against $, hence they are considering two alternative ways to hedge their exposure. A forward hedge A futures hedge Market Data at 1st June 2020: Exchange rates: Spot 6-month Forward $1.25/ $1.23/ Currency futures: CME 62,500 Dec 2020 Contract (cash-settled): $1.24/ Interest rates (borrowing and lending): UK 1% per annum US 2% per annum The future spot exchange rate is expected to move to either of the following rates: i. GBP/USD 1.1244 ii. GBP/USD 1.3322 Evaluate the performance of the two alternative hedging methods in 3 months' time given the two future spot rates scenarios expected by the company, and by answering the following questions: a) In both scenarios, if Mechanics Ltd uses futures contracts, explain the following: How many contracts the company must Sell or Buy? - [3 marks] Does the company need to sell or buy the futures contract? Explain [3 marks] What is the gain/loss in number of ticks if the company hedges with futures contracts? How much is the gain/loss translated into ? [6 marks] What is the total payable amount for the company after hedging with futures contracts? Briefly explain your results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started