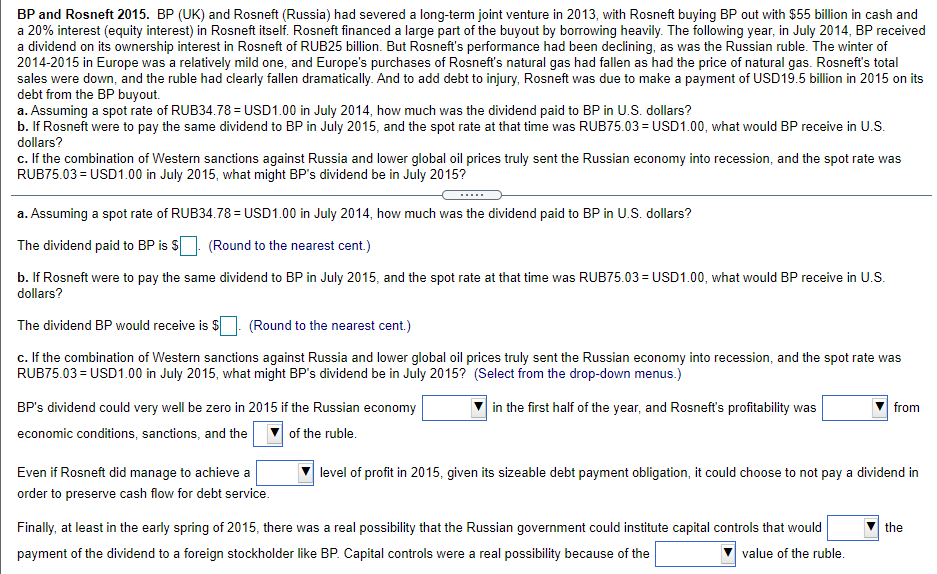

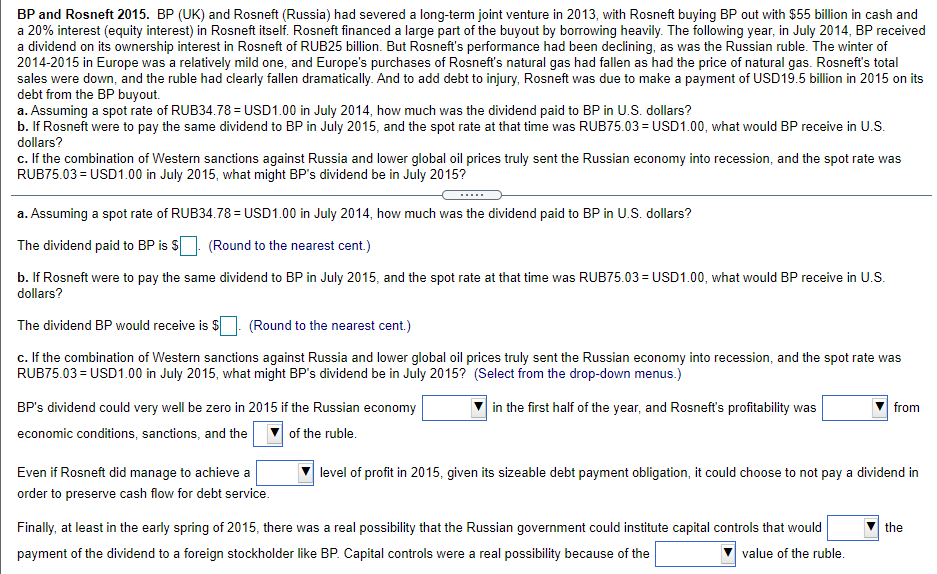

BP and Rosneft 2015. BP (UK) and Rosneft (Russia) had severed a long-term joint venture in 2013, with Rosneft buying BP out with $55 billion in cash and a 20% interest (equity interest) in Rosneft itself. Rosneft financed a large part of the buyout by borrowing heavily. The following year, in July 2014, BP received a dividend on its ownership interest in Rosneft of RUB25 billion. But Rosneft's performance had been declining, as was the Russian ruble. The winter of 2014-2015 in Europe was a relatively mild one, and Europe's purchases of Rosneft's natural gas had fallen as had the price of natural gas. Rosneft's total sales were down, and the ruble had clearly fallen dramatically. And to add debt to injury, Rosneft was due to make a payment of USD 19.5 billion in 2015 on its debt from the BP buyout. a. Assuming a spot rate of RUB34.78 = USD1.00 in July 2014, how much was the dividend paid to BP in U.S. dollars? b. If Rosneft were to pay the same dividend to BP in July 2015, and the spot rate at that time was RUB75.03 = USD 1.00, what would BP receive in U.S. dollars? c. If the combination of Western sanctions against Russia and lower global oil prices truly sent the Russian economy into recession, and the spot rate was RUB75.03 = USD1.00 in July 2015, what might BP's dividend be in July 2015? a. Assuming a spot rate of RUB34.78 = USD 1.00 in July 2014, how much was the dividend paid to BP in U.S. dollars? The dividend paid to BP is $[ (Round to the nearest cent.) b. If Rosneft were to pay the same dividend to BP in July 2015, and the spot rate at that time was RUB75.03 = USD 1.00, what would BP receive in U.S. dollars? The dividend BP would receive is $ (Round to the nearest cent.) c. If the combination of Western sanctions against Russia and lower global oil prices truly sent the Russian economy into recession, and the spot rate was RUB75.03 = USD 1.00 in July 2015, what might BP's dividend be in July 2015? (Select from the drop-down menus.) BP's dividend could very well be zero in 2015 if the Russian economy in the first half of the year, and Rosneft's profitability was from economic conditions, sanctions, and the of the ruble. Even if Rosneft did manage to achieve a order to preserve cash flow for debt service. level of profit in 2015, given its sizeable debt payment obligation, it could choose to not pay a dividend in the Finally, at least in the early spring of 2015, there was a real possibility that the Russian government could institute capital controls that would payment of the dividend to a foreign stockholder like BP. Capital controls were a real possibility because of the value of the ruble. BP and Rosneft 2015. BP (UK) and Rosneft (Russia) had severed a long-term joint venture in 2013, with Rosneft buying BP out with $55 billion in cash and a 20% interest (equity interest) in Rosneft itself. Rosneft financed a large part of the buyout by borrowing heavily. The following year, in July 2014, BP received a dividend on its ownership interest in Rosneft of RUB25 billion. But Rosneft's performance had been declining, as was the Russian ruble. The winter of 2014-2015 in Europe was a relatively mild one, and Europe's purchases of Rosneft's natural gas had fallen as had the price of natural gas. Rosneft's total sales were down, and the ruble had clearly fallen dramatically. And to add debt to injury, Rosneft was due to make a payment of USD 19.5 billion in 2015 on its debt from the BP buyout. a. Assuming a spot rate of RUB34.78 = USD1.00 in July 2014, how much was the dividend paid to BP in U.S. dollars? b. If Rosneft were to pay the same dividend to BP in July 2015, and the spot rate at that time was RUB75.03 = USD 1.00, what would BP receive in U.S. dollars? c. If the combination of Western sanctions against Russia and lower global oil prices truly sent the Russian economy into recession, and the spot rate was RUB75.03 = USD1.00 in July 2015, what might BP's dividend be in July 2015? a. Assuming a spot rate of RUB34.78 = USD 1.00 in July 2014, how much was the dividend paid to BP in U.S. dollars? The dividend paid to BP is $[ (Round to the nearest cent.) b. If Rosneft were to pay the same dividend to BP in July 2015, and the spot rate at that time was RUB75.03 = USD 1.00, what would BP receive in U.S. dollars? The dividend BP would receive is $ (Round to the nearest cent.) c. If the combination of Western sanctions against Russia and lower global oil prices truly sent the Russian economy into recession, and the spot rate was RUB75.03 = USD 1.00 in July 2015, what might BP's dividend be in July 2015? (Select from the drop-down menus.) BP's dividend could very well be zero in 2015 if the Russian economy in the first half of the year, and Rosneft's profitability was from economic conditions, sanctions, and the of the ruble. Even if Rosneft did manage to achieve a order to preserve cash flow for debt service. level of profit in 2015, given its sizeable debt payment obligation, it could choose to not pay a dividend in the Finally, at least in the early spring of 2015, there was a real possibility that the Russian government could institute capital controls that would payment of the dividend to a foreign stockholder like BP. Capital controls were a real possibility because of the value of the ruble