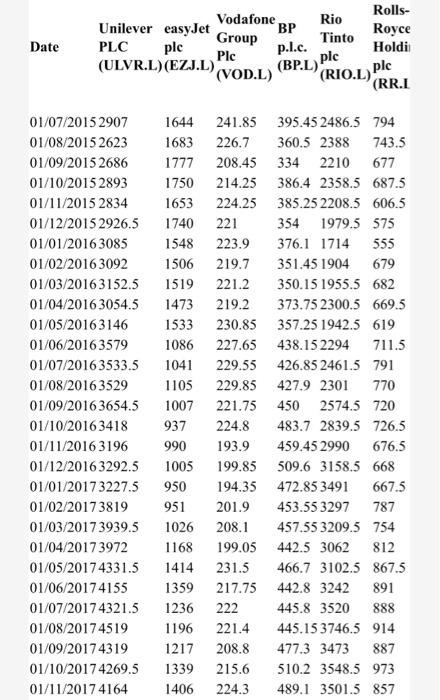

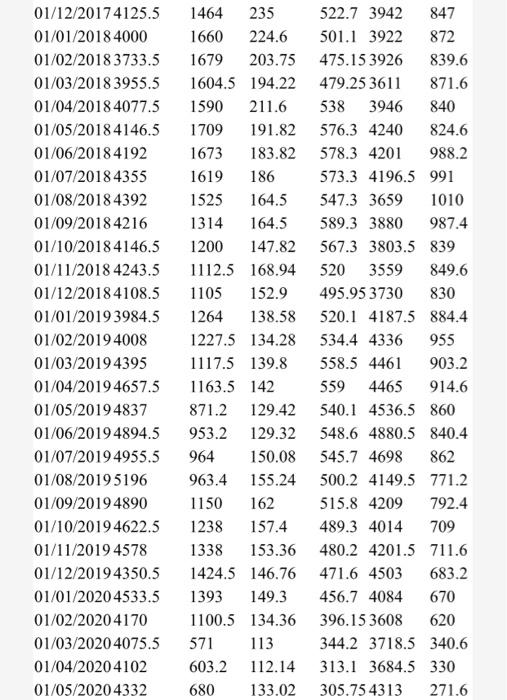

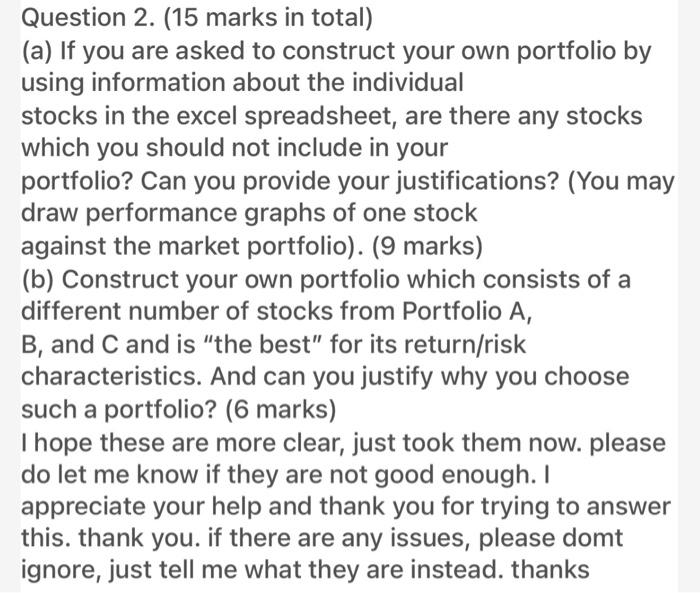

BP Rolls- Royce Holdi Vodafone Rio Unilever easyJet Tinto PLC Group plc Plc p.l.c. (ULVR.L)(EZJ.L) (BP.L) '(VOD.L) Date plc (RIO.L) Ple (RR.I 01/07/2015 2907 01/08/20152623 01/09/20152686 01/10/20152893 01/11/2015 2834 01/12/2015 2926.5 01/01/2016 3085 01/02/2016 3092 01/03/20163152.5 01/04/2016 3054.5 01/05/20163146 01/06/2016 3579 01/07/20163533.5 01/08/20163529 01/09/20163654.5 01/10/20163418 01/11/2016 3196 01/12/20163292.5 01/01/20173227.5 01/02/20173819 01/03/2017 3939.5 01/04/2017 3972 01/05/20174331.5 01/06/20174155 01/07/20174321.5 01/08/20174519 01/09/20174319 01/10/20174269.5 01/11/20174164 1644 241.85 395.45 2486.5 794 1683 226.7 360.5 2388 743.5 1777 208.45 334 2210 677 1750 214.25 386.4 2358.5 687.5 1653 224.25 385.252208.5 606.5 1740 221 354 1979.5 575 1548 223.9 376.1 1714 555 1506 219.7 351.45 1904 679 1519 221.2 350.151955.5 682 1473 219.2 373.752300.5 669.5 1533 230.85 357.25 1942.5 619 1086 227.65 438.15 2294 711.5 1041 229.55 426.85 2461.5 791 1105 229.85 427.9 2301 770 1007 221.75 450 2574.5 720 937 224.8 483.7 2839.5 726.5 990 193.9 459.45 2990 676.5 1005 199.85 509.6 3158.5 668 950 194.35 472.85 3491 667.5 201.9 453.55 3297 787 1026 208.1 457.553209.5 754 1168 199.05 442.5 3062 812 1414 231.5 466.7 3102.5 867.5 1359 217.75 442.8 3242 1236 222 445.8 3520 888 1196 221.4 445.153746.5 914 1217 208.8 477.3 3473 887 1339 215.6 510.2 3548.5 973 1406 224.3 489.1 3501.5 857 951 891 235 01/12/20174125.5 01/01/2018 4000 01/02/2018 3733.5 01/03/2018 3955.5 01/04/2018 4077.5 01/05/2018 4146.5 01/06/2018 4192 01/07/20184355 01/08/2018 4392 01/09/2018 4216 01/10/2018 4146.5 01/11/2018 4243.5 01/12/2018 4108.5 01/01/2019 3984.5 01/02/2019 4008 01/03/20194395 01/04/2019 4657.5 01/05/20194837 01/06/20194894.5 01/07/20194955.5 01/08/2019 5196 01/09/2019 4890 01/10/20194622.5 01/11/2019 4578 01/12/20194350.5 01/01/20204533.5 01/02/20204170 01/03/20204075.5 01/04/20204102 01/05/20204332 1464 1660 224.6 1679 203.75 1604.5 194.22 1590 211.6 1709 191.82 1673 183.82 1619 186 1525 164.5 1314 164.5 1200 147.82 1112.5 168.94 1105 152.9 1264 138.58 1227.5 134.28 1117.5 139.8 1163.5 142 871.2 129.42 953.2 129.32 964 150.08 963.4 155.24 1150 1238 157.4 1338 153.36 1424.5 146.76 1393 149.3 1100.5 134.36 571 113 603.2 112.14 680 133.02 522.7 3942 847 501.1 3922 872 475.15 3926 839.6 479.25 3611 871.6 538 3946 840 576.3 4240 824.6 578.3 4201 988.2 573.3 4196.5 991 547.3 3659 1010 589.3 3880 987.4 567.3 3803.5 839 520 3559 849.6 495.95 3730 830 520.1 4187.5 884.4 534.4 4336 955 558.5 4461 903.2 559 4465 914.6 540.1 4536.5 860 548.6 4880.5 840.4 545.7 4698 862 500.2 4149.5 771.2 515.8 4209 792.4 489.3 4014 709 480.2 4201.5 711.6 471.6 4503 683.2 456.7 4084 670 396.153608 620 344.2 3718.5 340.6 313.1 3684.5 330 305.75 4313 271.6 162 Question 2. (15 marks in total) (a) If you are asked to construct your own portfolio by using information about the individual stocks in the excel spreadsheet, are there any stocks which you should not include in your portfolio? Can you provide your justifications? (You may draw performance graphs of one stock against the market portfolio). (9 marks) (b) Construct your own portfolio which consists of a different number of stocks from Portfolio A, B, and C and is "the best" for its return/risk characteristics. And can you justify why you choose such a portfolio? (6 marks) I hope these are more clear, just took them now. please do let me know if they are not good enough. I appreciate your help and thank you for trying to answer this. thank you. if there are any issues, please domt ignore, just tell me what they are instead. thanks