Question: *BPS prides itself on being a growing, prosperous company, its success being partly due to a good management team which fully participates in its

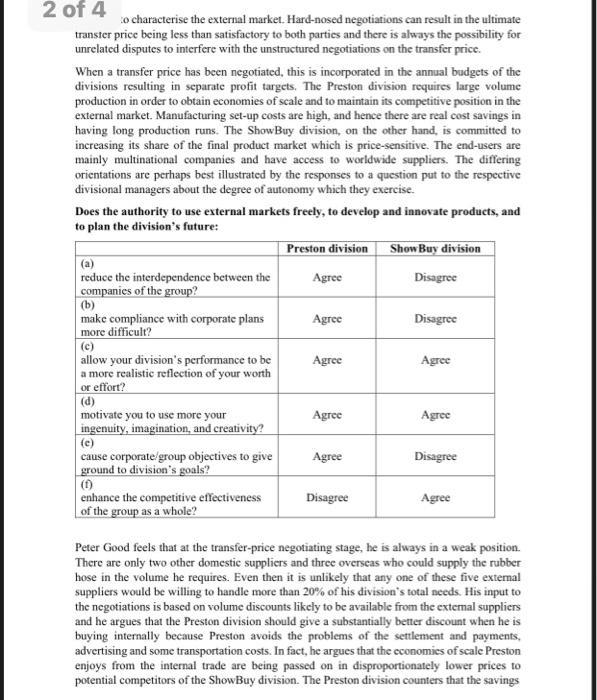

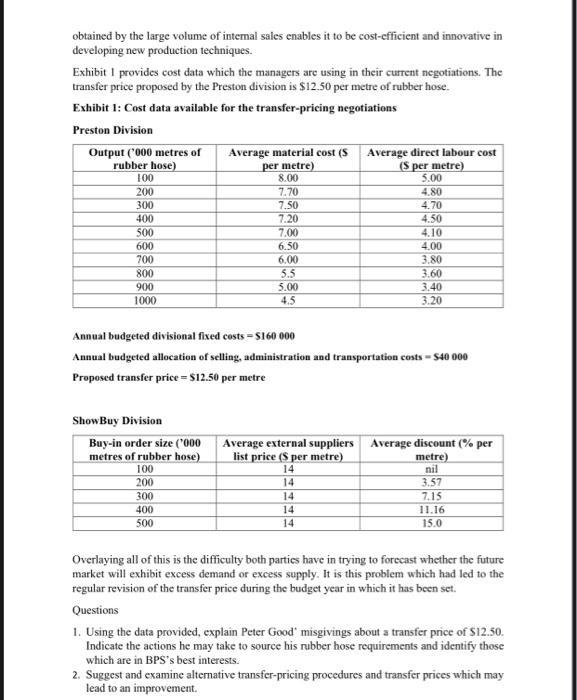

*BPS prides itself on being a growing, prosperous company, its success being partly due to a good management team which fully participates in its development via a decentralised control system. This statement was questioned at the meeting which took place between Alex South, group finance director of BPS and Peter Good, divisional general manager of the Show Buy plant. The surprise came when Peter revealed that he did not believe he was responsible for his division's profitability. This, he claimed, was due to the company's transfer-pricing policy. Historically, Peter's division bought over 50% of its total input of rubber hose from a sister division located in Preston. This trade annually accounted for about 25-35% of the Preston division's total output. Peter felt that the transfer price was unfair, and hence his division's reported profit was not a true reflection of his operational effectiveness. In the ensuing conversation both men agreed in principle that divisional general managers are delegated discretionary control over short-term strategy development, day-to-day operating decisions and capital expenditure decisions up to a prescribed limit. However, Peter claimed that in practice other factors intervened to reduce the divisional manager's degree of control and took, as an example, the inter-divisional trade in rubber hose. The rubber hose trade Fundamentally, the Preston division produces rubber hose which is then sold to, among others, Peter's ShowBuy division where it is "tailored for hydraulic uses in pit props, aircraft undercarriages and heavy plant and equipment. Before the annual budgets are compiled, the divisional general managers enter into negotiations about fixing the transfer price. Three months' notice is required before any mutually agreed price can be revised. The managers themselves spend one or two days negotiating the transfer price for the forthcoming months. At this meeting, information provided by their respective management accountants and annual cost variances provided by the central purchasing officer of BPS are available. The Preston division provides cost data relating to standard variable and fixed costs traceable to the division, plus an apportionment for selling, administrative and distribution costs. Normally, these data provide a platform price for the negotiations. The forecasts given by the central purchasing officer are included in these cost estimates. The Preston subsidiary is unaware of the assumptions on which the purchasing forecasts are based. but nevertheless accepts them as relevant to the fixing of the transfer price. The ShowBuy division also compiles standard cost data, and in addition presents price list information with the likely allowable discounts it can hope to receive from alternative suppliers. On some occasions these latter estimates from the ceiling price for the negotiations on the transfer price. One of the difficulties that has been experienced is that the range between the cost estimates at Preston and the competitor list prices at ShowBuy can be vast. So much so that the platform price exceeds the ceiling price. This may occur when excess supply is 2 of 4 to characterise the external market. Hard-nosed negotiations can result in the ultimate transter price being less than satisfactory to both parties and there is always the possibility for unrelated disputes to interfere with the unstructured negotiations on the transfer price. When a transfer price has been negotiated, this is incorporated in the annual budgets of the divisions resulting in separate profit targets. The Preston division requires large volume production in order to obtain economies of scale and to maintain its competitive position in the external market. Manufacturing set-up costs are high, and hence there are real cost savings in having long production runs. The ShowBuy division, on the other hand, is committed to increasing its share of the final product market which is price-sensitive. The end-users are mainly multinational companies and have access to worldwide suppliers. The differing orientations are perhaps best illustrated by the responses to a question put to the respective divisional managers about the degree of autonomy which they exercise. Does the authority to use external markets freely, to develop and innovate products, and to plan the division's future: (a) reduce the interdependence between the companies of the group? (b) make compliance with corporate plans more difficult? (c) allow your division's performance to be a more realistic reflection of your worth or effort? (d) motivate you to use more your ingenuity, imagination, and creativity? (c) cause corporate/group objectives to give ground to division's goals? (1) enhance the competitive effectiveness of the group as a whole? Preston division Agree Agree Agree Agree Agree Disagree Show Buy division Disagree Disagree Agree Agree Disagree Agree Peter Good feels that at the transfer-price negotiating stage, he is always in a weak position. There are only two other domestic suppliers and three overseas who could supply the rubber hose in the volume he requires. Even then it is unlikely that any one of these five external suppliers would be willing to handle more than 20% of his division's total needs. His input to the negotiations is based on volume discounts likely to be available from the external suppliers and he argues that the Preston division should give a substantially better discount when he is buying internally because Preston avoids the problems of the settlement and payments, advertising and some transportation costs. In fact, he argues that the economies of scale Preston enjoys from the internal trade are being passed on in disproportionately lower prices to potential competitors of the ShowBuy division. The Preston division counters that the savings obtained by the large volume of internal sales enables it to be cost-efficient and innovative in developing new production techniques. Exhibit I provides cost data which the managers are using in their current negotiations. The transfer price proposed by the Preston division is $12.50 per metre of rubber hose. Exhibit 1: Cost data available for the transfer-pricing negotiations Preston Division Output ('000 metres of rubber hose) 100 200 300 400 500 600 700 800 900 1000 Show Buy Division Average material cost (S per metre) Buy-in order size (000 metres of rubber hose) 100 200 300 400 500 8.00 7.70 7.50 7.20 7.00 6.50 6.00 5.5 5.00 4.5 Annual budgeted divisional fixed costs = $160 000 Annual budgeted allocation of selling, administration and transportation costs - $40 000 Proposed transfer price = $12.50 per metre Average direct labour cost (S per metre) 5.00 4.80 4.70 4.50 4.10 4.00 3.80 3.60 3.40 3.20 14 14 Average external suppliers Average discount (% per list price ($ per metre) metre) 14 nil 14 3.57 7.15 11.16 15.0 Overlaying all of this is the difficulty both parties have in trying to forecast whether the future market will exhibit excess demand or excess supply. It is this problem which had led to the regular revision of the transfer price during the budget year in which it has been set. Questions 1. Using the data provided, explain Peter Good" misgivings about a transfer price of $12.50. Indicate the actions he may take to source his rubber hose requirements and identify those which are in BPS's best interests. 2. Suggest and examine alternative transfer-pricing procedures and transfer prices which may lead to an improvement.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

ANSWER Based on the information provided Peter Goods misgivings about a transfer price of 1250 are primarily due to the fact that it does not reflect ... View full answer

Get step-by-step solutions from verified subject matter experts