Brad and Angelina are applying for a mortgage with you, their local Mortgage Agent, to purchase a new home. After reviewing their application you have

Brad and Angelina are applying for a mortgage with you, their local Mortgage Agent, to purchase a new home. After reviewing their application you have decided that they do not qualify for an institutional lender and therefore you are going to submit their application to a private lender. In submitting this application to the private lender using the proper disclosure, which one of the following statements best accurately reflects information that must be disclosed to

the investor

Select one:

o a. If you are charging Brad and Angelina a fee

- If a realtor is charging them a fee

- If they are paying for title insurance

- If they are paying for a new survey

You are arranging a mortgage for your client and the lender has given you the option to offer her client a rate of 6%, in which case the lender will pay a finders fee of 70 Bps, or a rate of 6.2%, in which case the lender will pay a finders fee of

80 Bps. If you choose to offer your client the higher rate, which one of the following statements regarding disclosing this information, as legislated by the MBLAA, is most accurate?

Select one:

- You must provide written disclosure and the borrower must reply in writing

- You may provide either written or verbal disclosure and the borrower must reply in

Writing

1 c. You should disclose this information but it is not required by the MBLA,

d. You must provide written disclosure to the borrower and the borrower does not need to reply

When presenting the investor/Lender disclosure to a prospective investor the Mortgage Agent is also required to provide

him or ner with:

Finish attempt

select one

a. An amortization schedule

© b. Proot of the value of the property

C. A creditor insurance Request or Waiver

d. A PIPEDA consent form

Pauline Navratalova has a variable rate mortgage with a 3 year term. 24 months into this term she decides that she would like to refinance this loan with another lender who is offering her a much lower rate. However her mortgage broker has told her that she cannot repay the mortgage unless she sells the house in an arm's length transaction. That is because this type of mortgage is a:

Select one:

- constant payment morteage

- Reverse morteage

- Closed mortgage

- Straight-line principal reduction mortgage

A client has just submitted an online application to you. In the application he has listed his employer as Blue Landscaping LLC where he is employed as a Sales Manager earning an hourly rate. In addition, he works part-time as a bartender and earns tips, which he pays taxes on. You have decided that you will need these tips for him to qualify for the mortgage.

Given this scenario, what documentation will you request from him?

Select one:

- An Income tax return from the bar and NOA from Blue Landscaping

- A job letter from both Blue Landscaping and the bar showing salary

- T4As and T4s from both Blue Landscaping and the bar

- A T4 from the bar and a job letter from Blue Landscaping

A real estate agent has referred you a married couple who wish to purchase a home. After reviewing their application you have calculated that they need $299,000. In reviewing the products in the market you are advising that they take weekly payments over a 3 year term at 3.89% compounded semi-annually with a 25 year amortization. You have calculated that the payment for this proposed mortgage is $358.41. They have told you that they also have a car payment of $525 per month, annual car insurance of $3,000, an RRSP contribution of $30 per month by payroll deduction, a weekly loan payment of $65 and total monthly credit card payments of $700. Their property taxes are $2,800 per year. His annual income is $52,500 and she earns 4,750 per month. Given this information what is their TDS? (Use $75 per month for heat)

Select one:

a. 39.64%

b. 36.08%

c. 36.91%

d. 23.82%

When presenting the borrower disclosure to a prospective borrower, the mortgage agent is also required to provide him or her with:

Select one:

- The Lender's Commitment Letter

- A Creditor Insurance Request or Waiver

- A PIPEDA consent form

- An Amortization Schedule

A mortgage agent is arranging a private mortgage for her client, and the agent's brother will be the lender. Which of the following statements best describes this scenario?

Concepts

Select one:

- This is not a potential conflict of interest because the lender is related to the mortgage agent

- This is not a potential conflict of interest as long as it is disclosed to the borrower

- This is a potential conflict of interest and must be disclosed to the borrower

- This is a potential conflict of intesest, and this mortgage cannot be done

When using the ethical decision-making model, acting in the best interests of your client means.

Select one:

- You must ensure that you get the client the lowest interest rate

- You must perform a detailed needs assessment on your client

- You must get the client an institutional mortgage

- You should perform a needs assessment on your client

The MBRCC Code of Conduct is designed primarily to deal with:

Select one:

a. Ensuring mortgage agents act legally at all times

• b. Creating national regulatory standards

- Creating a national regulator

- Outlining professional behavior and conduct

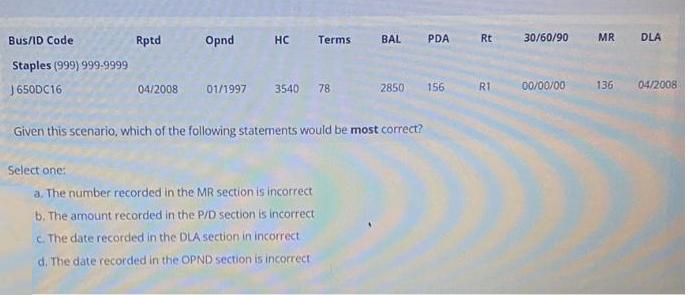

- Answer the Following according to given data:

Bus/ID Code Staples (999) 999-9999 J 650DC16 Rptd 04/2008 Opnd 01/1997 HC Terms 3540 78 Select one: a. The number recorded in the MR section is incorrect b. The amount recorded in the P/D section is incorrect c. The date recorded in the DLA section in incorrect d. The date recorded in the OPND section is incorrect BAL PDA 2850 Given this scenario, which of the following statements would be most correct? 156 Rt R1 30/60/90 00/00/00 MR 136 DLA 04/2008

Step by Step Solution

3.47 Rating (190 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 1 Answer a If you are charging Brad and Angelina a fee Explanation When submitting a mortgage application to a private lender the ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards