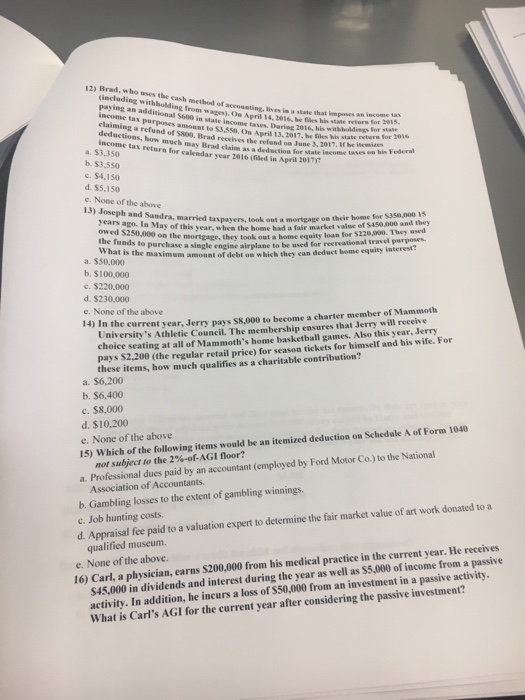

Brad, who uses the each method of accounting, lives in a state that improve an income tax (including withholding from wages). On April 14, 2016, he files his state return for 2015, paying an additional $600 in state income taxes. During 2016, his withholdings for state income tax purpose amount to $3, 550. On April 13, 2017, he files his state return for 2016 claiming a refund of $800. Brad receives the refund on June 3, 2017. If he itemizes deductions, how much may Brad claim as a deduction for state income taxes on the Federal income tax return for calendar year 2016 (filed in April 2017)? $3, 350 $3, 550 $4, 150 $5, 150 None of the above Joseph and Sandra, married taxpayers, took out a mortgage on their home for $350,000 years ago. In many of this year, when the home had a fair market value of $450,000 and they owed $250,000 on the mortgage, they took out a home equity loan for $220,000. They used the funds to purchase a single engine airplane to be used for recreational travel purpose. What is the maximum amount of debt on which they can deduct home equity interest? $50,000 $100,000 $220,000 $230,000 None of the above In the current year, Jerry pay $8,000 to become a charter member of Mammoth University's Athletic Council. The membership ensures that Jerry will receive choice seating at all of Mammoth's home basketball games. Also this year, Jerry pays $2, 200 (the regular retail price) for season tickets for himself and his wife. For these items, how much qualifies as a charitable contribution? $6, 200 $6.400 $8,000 $10, 200 None of the above Which of the following items would be an itemized deduction on Schedule A of From 1040 not subject to the 2%-of AGI floor? Professional dues paid by an accountant (employed by Ford Motor Co.) to the National Association of Accountants. Gambling losses to the extent of gambling winnings. Job hunting costs. Appraisal fee paid to a valuation expert to determine the fair market value of art work donated to a qualified museum. None of the above. Carl, a physician, earns $200,000 from his medical practice in the current year. He receives $450,000 in dividends and the interest during the year as well as $35,000 of income from a passive activity. In addition, he incurs a loss of $50,000 from an investment in investment? What is Carl's AGI for the current year after considering the passive investment