Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Braddon Company uses normal costing in its job-costing system. The company produces custom bikes for toddlers. The beginning balances (December 1) and ending balances

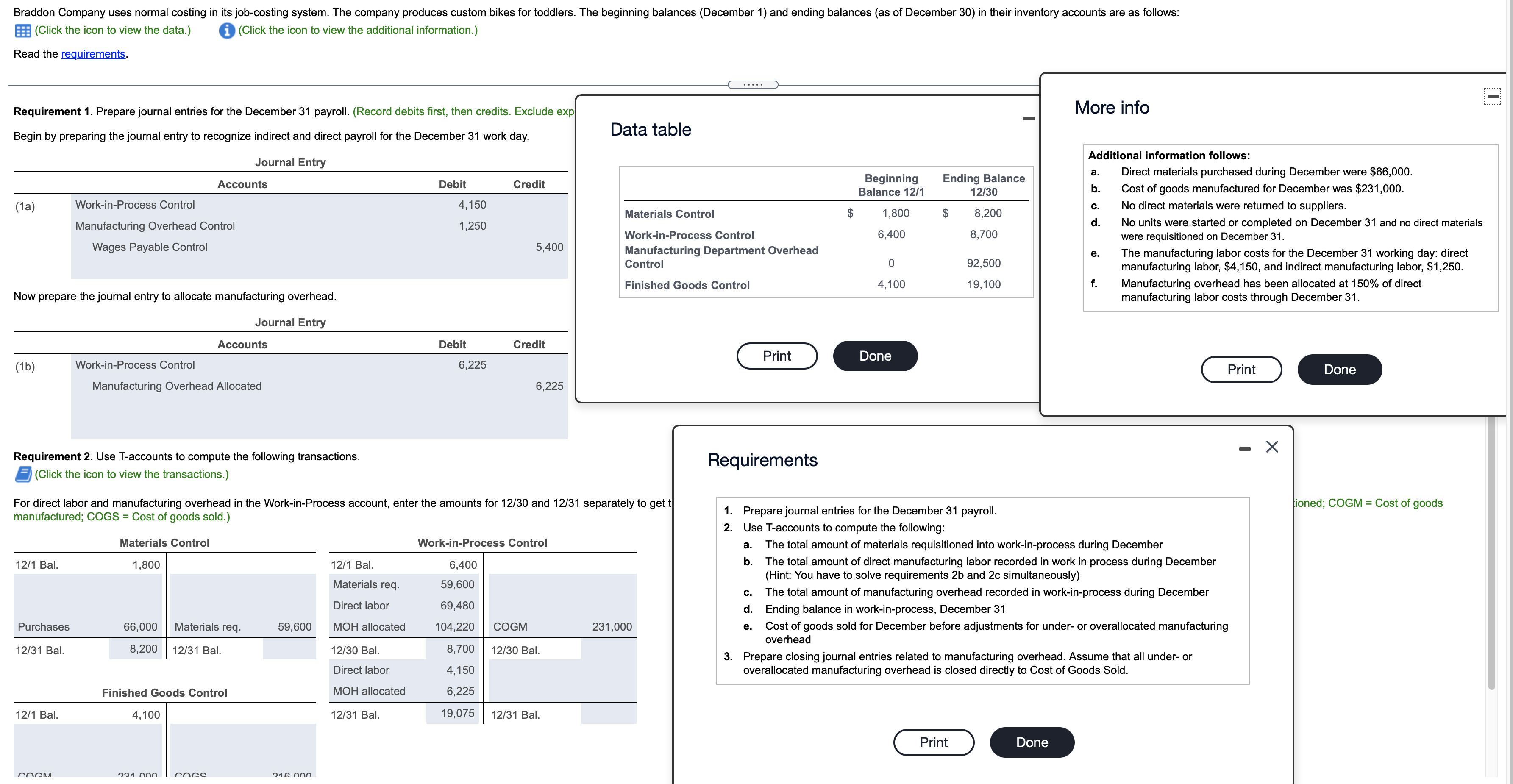

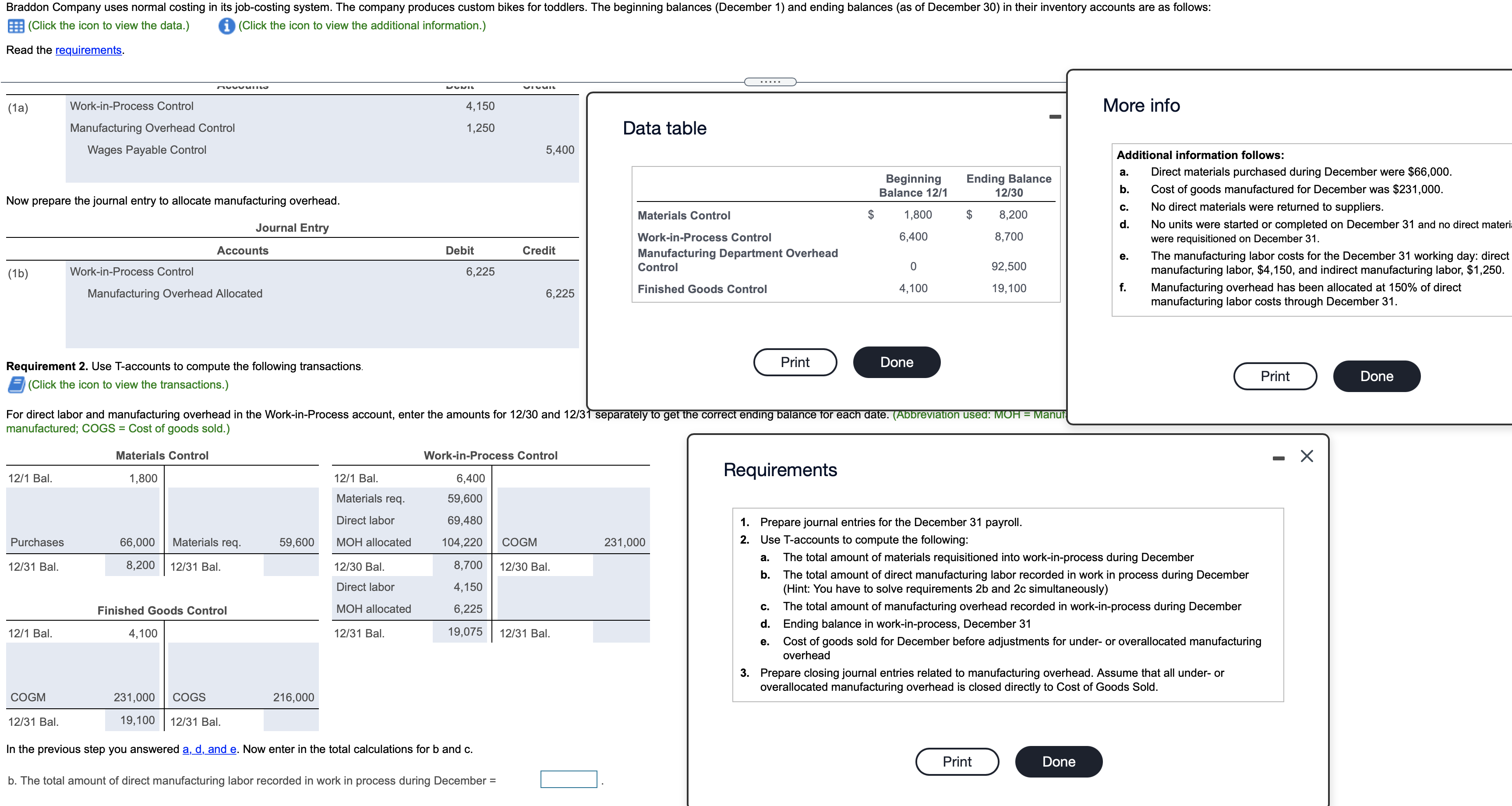

Braddon Company uses normal costing in its job-costing system. The company produces custom bikes for toddlers. The beginning balances (December 1) and ending balances (as of December 30) in their inventory accounts are as follows: (Click the icon to view the data.) i (Click the icon to view the additional information.) Read the requirements. Requirement 1. Prepare journal entries for the December 31 payroll. (Record debits first, then credits. Exclude exp Begin by preparing the journal entry to recognize indirect and direct payroll for the December 31 work day. (1a) Journal Entry Accounts Work-in-Process Control Manufacturing Overhead Control Wages Payable Control Now prepare the journal entry to allocate manufacturing overhead. Data table Debit Credit 4,150 Materials Control 1,250 Work-in-Process Control 5,400 Manufacturing Department Overhead Control Finished Goods Control Journal Entry Accounts Debit Credit (1b) Work-in-Process Control 6,225 Manufacturing Overhead Allocated 6,225 More info Additional information follows: a. Beginning Balance 12/1 Ending Balance 12/30 b. Direct materials purchased during December were $66,000. Cost of goods manufactured for December was $231,000. C. $ 1,800 $ 8,200 No direct materials were returned to suppliers. d. 6,400 8,700 No units were started or completed on December 31 and no direct materials were requisitioned on December 31. e. 0 4,100 92,500 19,100 f. The manufacturing labor costs for the December 31 working day: direct manufacturing labor, $4,150, and indirect manufacturing labor, $1,250. Manufacturing overhead has been allocated at 150% of direct manufacturing labor costs through December 31. Print Done Requirement 2. Use T-accounts to compute the following transactions. (Click the icon to view the transactions.) For direct labor and manufacturing overhead in the Work-in-Process account, enter the amounts for 12/30 and 12/31 separately to get t manufactured; COGS = Cost of goods sold.) 12/1 Bal. Materials Control 1,800 Work-in-Process Control 12/1 Bal. 6,400 Materials req. 59,600 Purchases 12/31 Bal. 66,000 8,200 Materials req. 59,600 Direct labor MOH allocated 69,480 104,220 COGM 231,000 12/31 Bal. Finished Goods Control 12/30 Bal. Direct labor MOH allocated 8,700 12/30 Bal. 4,150 6,225 12/1 Bal. 4,100 12/31 Bal. 19,075 12/31 Bal. Requirements 1. Prepare journal entries for the December 31 payroll. 2. Use T-accounts to compute the following: a. The total amount of materials requisitioned into work-in-process during December b. C. The total amount of direct manufacturing labor recorded in work in process during December (Hint: You have to solve requirements 2b and 2c simultaneously) The total amount of manufacturing overhead recorded in work-in-process during December d. Ending balance in work-in-process, December 31 e. Cost of goods sold for December before adjustments for under- or overallocated manufacturing overhead 3. Prepare closing journal entries related to manufacturing overhead. Assume that all under- or overallocated manufacturing overhead is closed directly to Cost of Goods Sold. COCM 231.000 COGS 216.000 Print Done Print Done - tioned; COGM = Cost of goods Braddon Company uses normal costing in its job-costing system. The company produces custom bikes for toddlers. The beginning balances (December 1) and ending balances (as of December 30) in their inventory accounts are as follows: (Click the icon to view the data.) i (Click the icon to view the additional information.) Read the requirements. (1a) Work-in-Process Control Manufacturing Overhead Control Wages Payable Control Now prepare the journal entry to allocate manufacturing overhead. VIQUI 4,150 1,250 Data table 5,400 ..... More info Additional information follows: a. Beginning Balance 12/1 Ending Balance 12/30 b. C. Direct materials purchased during December were $66,000. Cost of goods manufactured for December was $231,000. No direct materials were returned to suppliers. Materials Control 1,800 8,200 d. Work-in-Process Control Manufacturing Department Overhead Control 6,400 8,700 No units were started or completed on December 31 and no direct materi were requisitioned on December 31. e. 0 92,500 Finished Goods Control 4,100 19,100 f. 6,225 The manufacturing labor costs for the December 31 working day: direct manufacturing labor, $4,150, and indirect manufacturing labor, $1,250. Manufacturing overhead has been allocated at 150% of direct manufacturing labor costs through December 31. Journal Entry Accounts Debit Credit (1b) Work-in-Process Control 6,225 Manufacturing Overhead Allocated Requirement 2. Use T-accounts to compute the following transactions. (Click the icon to view the transactions.) Print Done For direct labor and manufacturing overhead in the Work-in-Process account, enter the amounts for 12/30 and 12/31 separately to get the correct ending balance for each date. (Abbreviation used: MOH = Manuf manufactured; COGS = Cost of goods sold.) Print Done 12/1 Bal. Materials Control 1,800 Work-in-Process Control Requirements 12/1 Bal. 6,400 Materials req. 59,600 Purchases 12/31 Bal. 66,000 8,200 Materials req. 59,600 Direct labor MOH allocated 69,480 104,220 COGM 231,000 1. Prepare journal entries for the December 31 payroll. 2. Use T-accounts to compute the following: 12/31 Bal. 12/30 Bal. Direct labor 8,700 4,150 12/30 Bal. Finished Goods Control MOH allocated 6,225 C. 12/1 Bal. 4,100 12/31 Bal. 19,075 12/31 Bal. a. The total amount of materials requisitioned into work-in-process during December b. The total amount of direct manufacturing labor recorded in work in process during December (Hint: You have to solve requirements 2b and 2c simultaneously) The total amount of manufacturing overhead recorded in work-in-process during December d. Ending balance in work-in-process, December 31 e. Cost of goods sold for December before adjustments for under- or overallocated manufacturing overhead 3. Prepare closing journal entries related to manufacturing overhead. Assume that all under- or overallocated manufacturing overhead is closed directly to Cost of Goods Sold. COGM 231,000 COGS 216,000 12/31 Bal. 19,100 12/31 Bal. In the previous step you answered a, d, and e. Now enter in the total calculations for b and c. b. The total amount of direct manufacturing labor recorded in work in process during December = Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through the requirements step by step Requirement 1 Prepare journal entries for the December 31 payroll The journal entry to recognize indirec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started