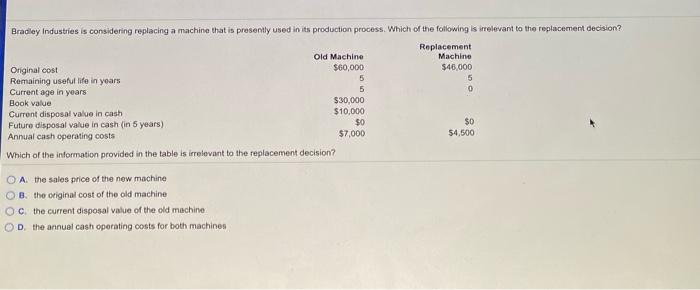

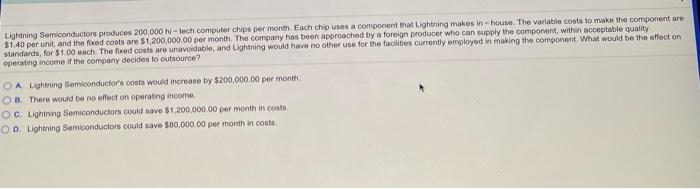

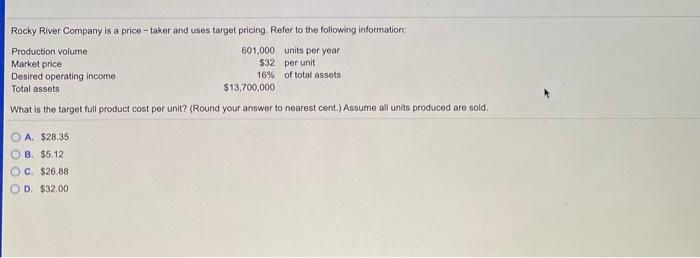

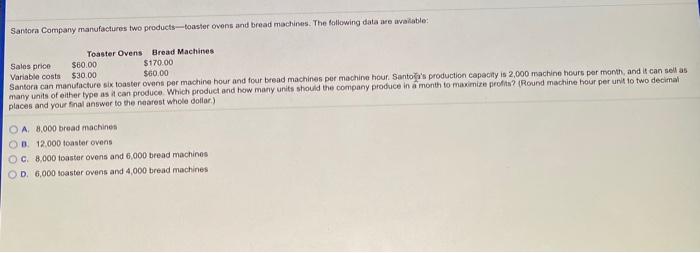

Bradley Industries is considering replacing a machine that is presently used in its production process. Which of the following is irrelevant to the replacement decision? Replacement Machine $46.000 5 0 Original cost Remaining useful life in years Current age in years Book value Current disposal value in cash Future disposal value in cash (in 5 years) Annual cash operating costs Old Machine $60,000 5 5 $30,000 $10,000 $0 $7,000 $D $4,500 Which of the information provided in the table is irrelevant to the replacement decision? OA the sales price of the new machine B. the original cost of the old machine OC the current disposal value of the old machine OD. the annual cash operating costs for both machines Lightning Semiconductors produces 200,000 hi-tech computer chips per month. Each chip uses a component that Lightning makes in-house. The variable costs to make the component are 51.40 per unit, and the foxed costs are $1,200,000.00 per month. The company has been approached by a foreign producer who can supply the component within acceptable quality standards, for $1.00 each. The fixed costs are unavoidable, and Lightning would have no other use for the facilities currently employed in making the component. What would be the effect on operating income of the company decides to outsource O A Lightning Semiconductor's costs would increase by $200,000.00 per month OB There would be no effect on operating income OG Lightning Semiconductors could save $1.200.000,00 per month in costs OD. Lightning Semiconductors could save $80,000.00 per month in costs Rocky River Company is a price-taker and uses target pricing. Refer to the following information: Production volume Market price Desired operating income Total assets 601,000 units per year $32 per unit 16% of total assets $13,700,000 What is the target full product cost per unit? (Round your answer to nearest cont.) Assume all units produced are sold A $28,35 B. $5.12 C. $26.88 OD $32.00 Santora Company manufactures two products-toaster ovens and bread machines. The following data are available: Toaster Ovens Bread Machines Salos price $60.00 $170.00 Variable costs $30,00 $60.00 Santora can manufacture six toaster ovens per machine hour and four bread machines per machine hour. Santos's production capacity is 2,000 machine hours per month, and it can sellas many units of other type as it can produce which product and how many units should the company produce in a month to maximize profita (Round machine hour per unit to two decimal places and your final answer to the nearest whole dollar) O A 8.000 bread machines 012000 toaster ovens C 8.000 toaster ovens and 6,000 bread machines OD 6,000 toaster ovens and 4,000 bread machines