Answered step by step

Verified Expert Solution

Question

1 Approved Answer

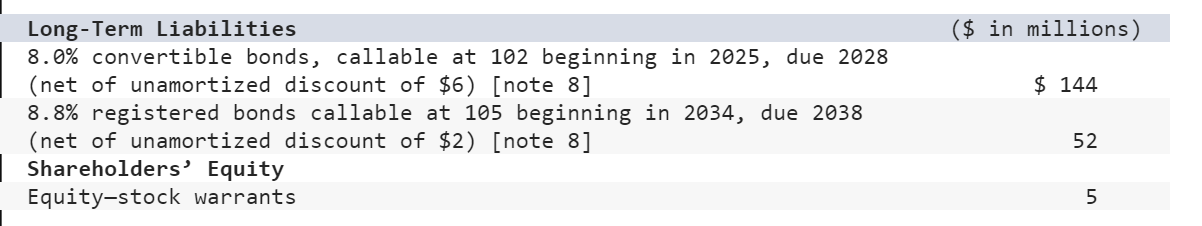

Bradley-Links December 31, 2024, balance sheet included the following items: Long-Term Liabilities ($ in millions) Note 8: Bonds (in part) The 8.0% bonds were issued

Bradley-Links December 31, 2024, balance sheet included the following items:

Long-Term Liabilities ($ in millions)

Note 8: Bonds (in part)

- The 8.0% bonds were issued in 2011 at 94.0 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,000 bond is convertible into 50 shares of the Companys no par common stock.

- The 8.8% bonds were issued in 2015 at 103 to yield 10%. Interest is paid semiannually on June 30 and December 31. Each $1,000 bond was issued with 50 detachable stock warrants, each of which entitles the holder to purchase one share of the Companys no par common stock for $30, beginning 2025.

On January 3, 2025, when Bradley-Links common stock had a market price of $37 per share, Bradley-Link called the convertible bonds to force conversion. Ninety percent were converted; the remainder were acquired at the call price. When the common stock price reached an all-time high of $42 in December of 2025, 40% of the warrants were exercised.

Required:

- Prepare the journal entries that were recorded when each of the two bond issues was originally sold in 2011 and 2015.

- Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2025 and the retirement of the remainder. Assume Bradley-Link induced conversion by offering $120 cash for each bond converted.

- Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2025. Assume Bradley-Link induced conversion by modifying the conversion ratio to exchange 55 shares for each bond rather than the 50 shares provided in the contract.

- Prepare the journal entry to record (book value method) the conversion of 90% of the convertible bonds in January 2025.

- Prepare the journal entry to record the exercise of the warrants in December 2025.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started