Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brady Company (buyer) and Johnson, Incorporated (seller), engaged in the following transactions during February 201 : BRADY COMPANY DATE TRANSACTIONS February 10, 20X1 Purchased merchandise

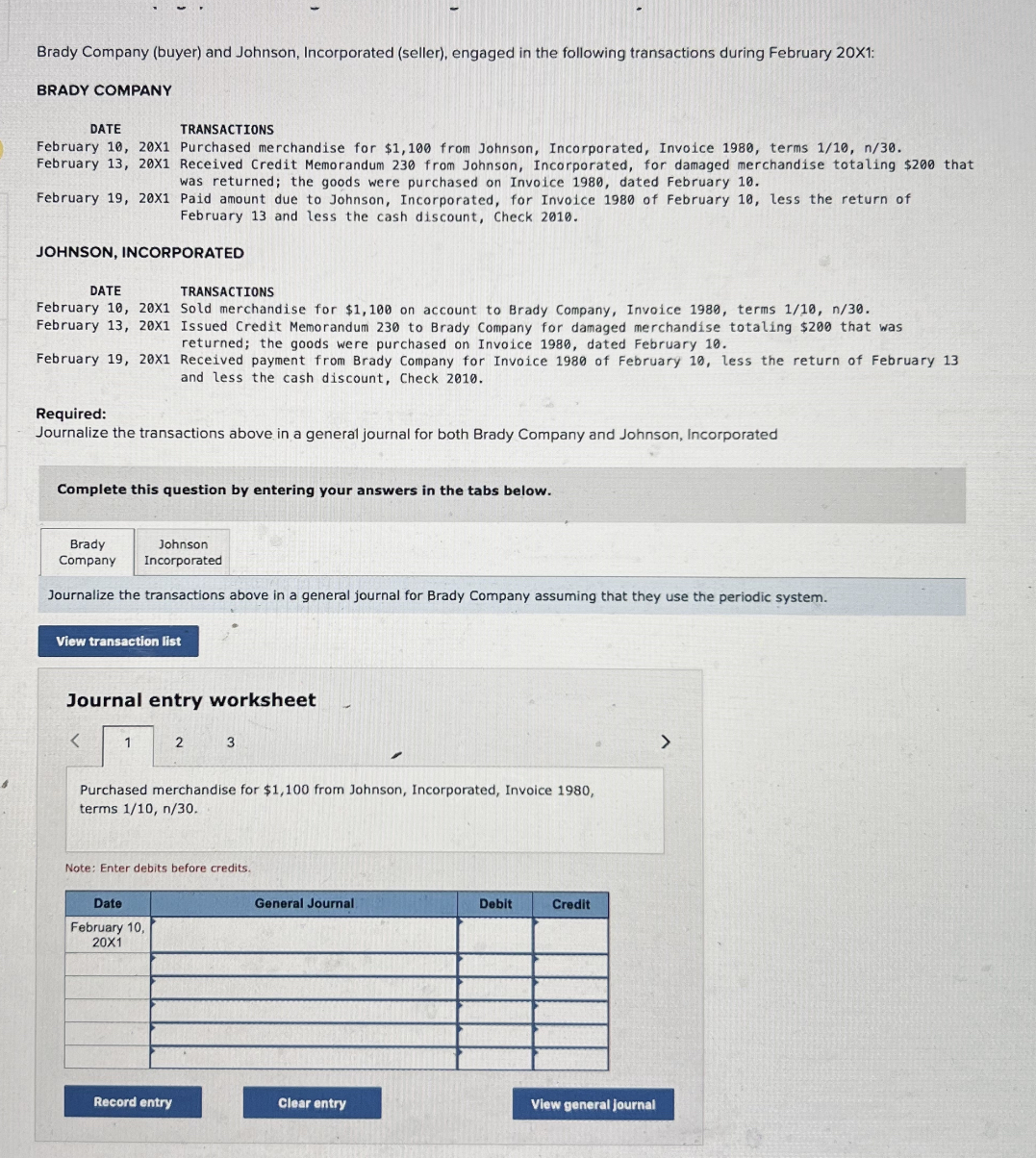

Brady Company (buyer) and Johnson, Incorporated (seller), engaged in the following transactions during February 201 : BRADY COMPANY DATE TRANSACTIONS February 10, 20X1 Purchased merchandise for $1,100 from Johnson, Incorporated, Invoice 1980, terms 1/10, n/30. February 13, 20X1 Received Credit Memorandum 230 from Johnson, Incorporated, for damaged merchandise totaling $200 that was returned; the goods were purchased on Invoice 1980, dated February 10. February 19, 20x1 Paid amount due to Johnson, Incorporated, for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. JOHNSON, INCORPORATED DATE TRANSACTIONS February 10, 20X1 Sold merchandise for $1,100 on account to Brady Company, Invoice 1980 , terms 1/10,n/30. February 13, 20x1 Issued Credit Memorandum 230 to Brady Company for damaged merchandise totaling $200 that was returned; the goods were purchased on Invoice 1980, dated February 10. February 19, 201 Received payment from Brady Company for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Required: Journalize the transactions above in a general journal for both Brady Company and Johnson, Incorporated Complete this question by entering your answers in the tabs below. Journalize the transactions above in a general journal for Brady Company assuming that they use the periodic system. Journal entry worksheet Purchased merchandise for $1,100 from Johnson, Incorporated, Invoice 1980 , terms 1/10,n/30. Note: Enter debits before credits

Brady Company (buyer) and Johnson, Incorporated (seller), engaged in the following transactions during February 201 : BRADY COMPANY DATE TRANSACTIONS February 10, 20X1 Purchased merchandise for $1,100 from Johnson, Incorporated, Invoice 1980, terms 1/10, n/30. February 13, 20X1 Received Credit Memorandum 230 from Johnson, Incorporated, for damaged merchandise totaling $200 that was returned; the goods were purchased on Invoice 1980, dated February 10. February 19, 20x1 Paid amount due to Johnson, Incorporated, for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. JOHNSON, INCORPORATED DATE TRANSACTIONS February 10, 20X1 Sold merchandise for $1,100 on account to Brady Company, Invoice 1980 , terms 1/10,n/30. February 13, 20x1 Issued Credit Memorandum 230 to Brady Company for damaged merchandise totaling $200 that was returned; the goods were purchased on Invoice 1980, dated February 10. February 19, 201 Received payment from Brady Company for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Required: Journalize the transactions above in a general journal for both Brady Company and Johnson, Incorporated Complete this question by entering your answers in the tabs below. Journalize the transactions above in a general journal for Brady Company assuming that they use the periodic system. Journal entry worksheet Purchased merchandise for $1,100 from Johnson, Incorporated, Invoice 1980 , terms 1/10,n/30. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started