Answered step by step

Verified Expert Solution

Question

1 Approved Answer

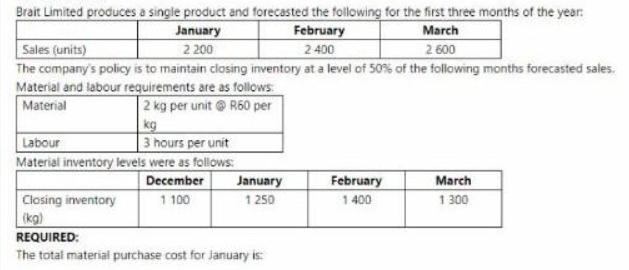

Brait Limited produces a single product and forecasted the following for the first three months of the year: March January 2 200 February 2400

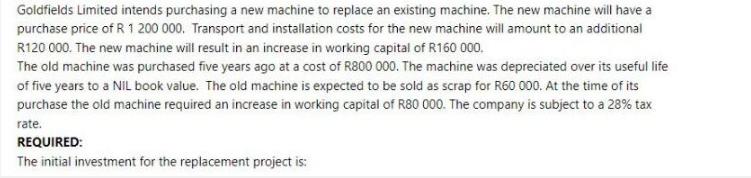

Brait Limited produces a single product and forecasted the following for the first three months of the year: March January 2 200 February 2400 Sales (units) 2.600 The company's policy is to maintain closing inventory at a level of 50% of the following months forecasted sales. Material and labour requirements are as follows: Material 2 kg per unit @ R50 per kg Labour 3 hours per unit Material inventory levels were as follows: December 1:100 Closing inventory (kg) January 1250 REQUIRED: The total material purchase cost for January is: February 1.400 March 1300 Goldfields Limited intends purchasing a new machine to replace an existing machine. The new machine will have a purchase price of R 1 200 000. Transport and installation costs for the new machine will amount to an additional R120 000. The new machine will result in an increase in working capital of R160 000. The old machine was purchased five years ago at a cost of R800 000. The machine was depreciated over its useful life of five years to a NIL book value. The old machine is expected to be sold as scrap for R60 000. At the time of its purchase the old machine required an increase in working capital of R80 000. The company is subject to a 28% tax rate. REQUIRED: The initial investment for the replacement project is:

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Given Information As per the given information Sales Units Jan2200 Feb2400 March2600 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started