Answered step by step

Verified Expert Solution

Question

1 Approved Answer

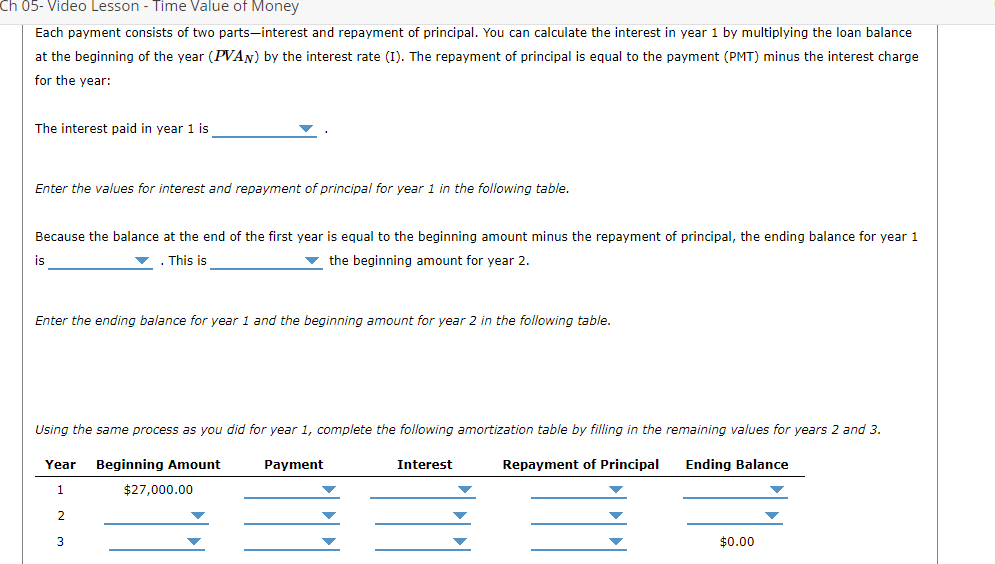

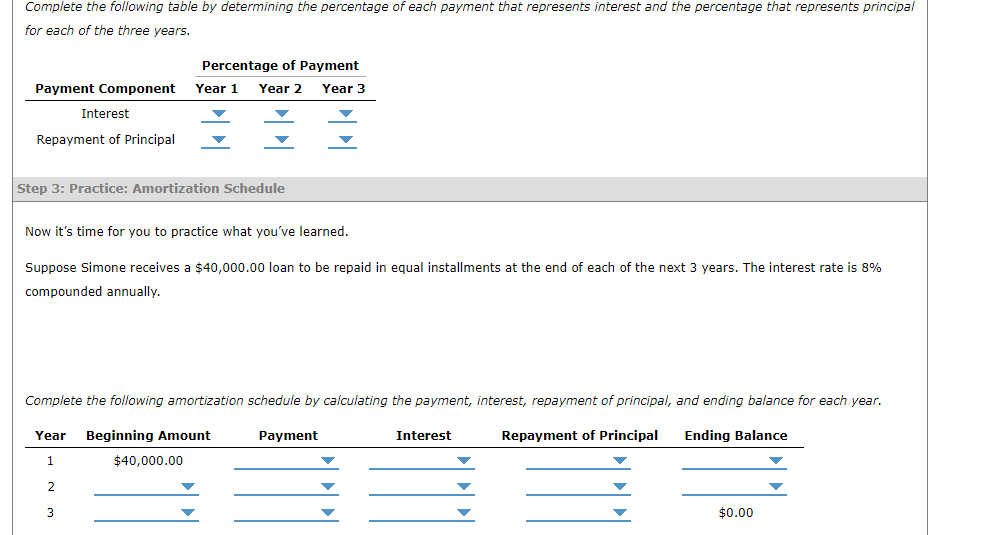

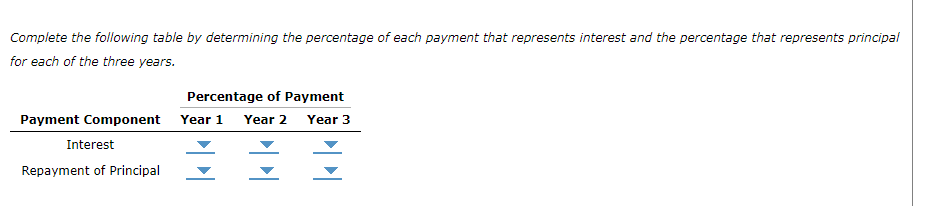

An amortized loan is a loan that is to be repaid in equal amounts on a monthly, quarterly, or annual basis. Many loans such

![]()

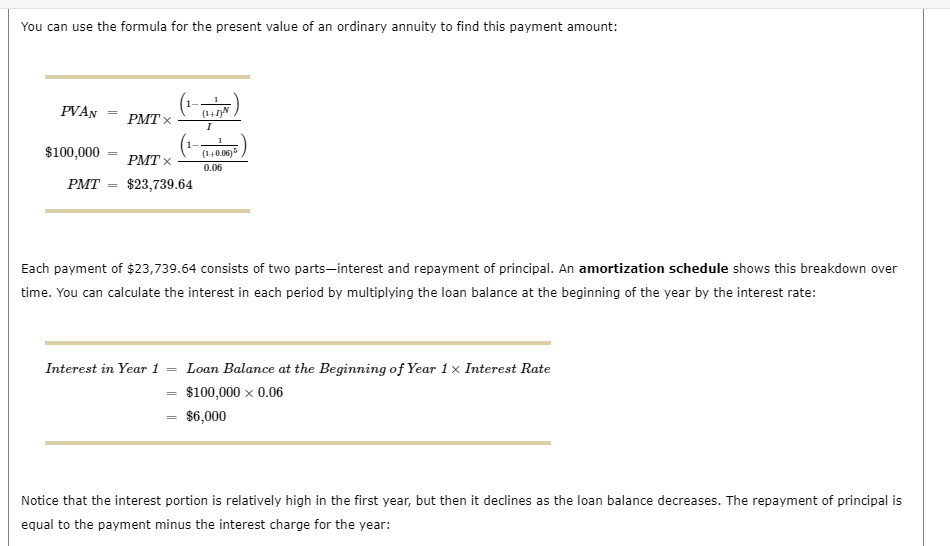

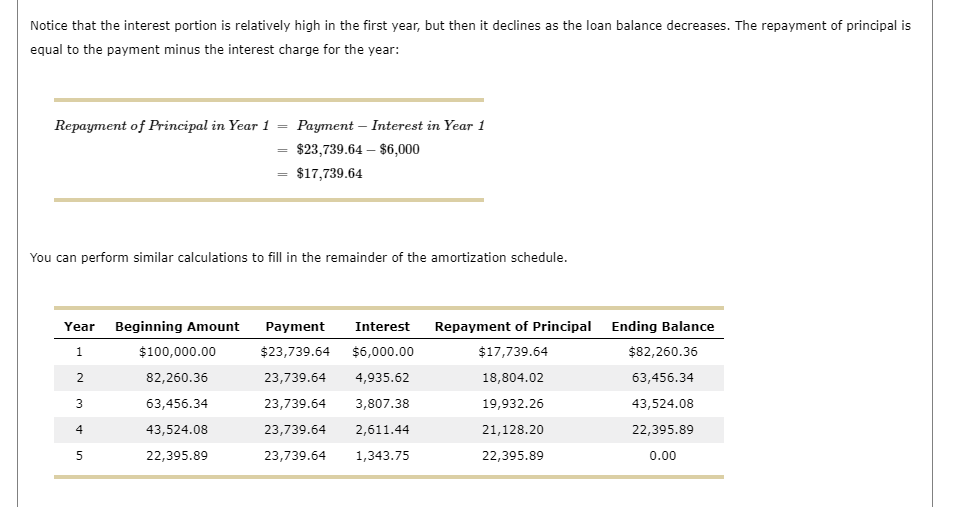

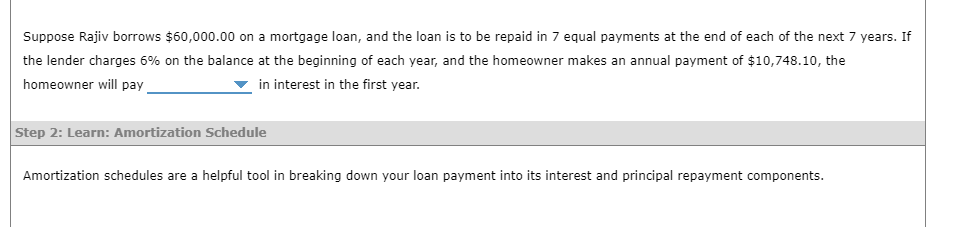

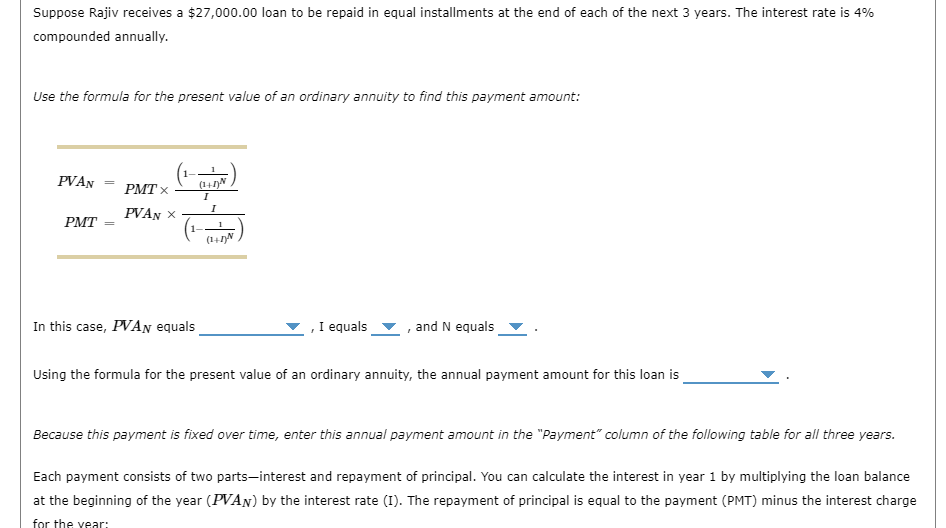

An amortized loan is a loan that is to be repaid in equal amounts on a monthly, quarterly, or annual basis. Many loans such as car loans, home mortgage loans, and student loans are paid off over time in regular, fixed installments; these loans are a great real-world application of compound interest. For example, suppose a homeowner borrows $100,000 on a mortgage loan, and the loan is to be repaid in 5 equal payments at the end of each of the next 5 years. If the lender charges 6% on the balance at the beginning of each year, what is the payment the homeowner must make each year? Given what you know about present value (PV) and future value (FV), you can deduce that the sum of the PV of each payment the homeowner makes must add up to $100,000: $100,000 = 1.06 PMT PMT PMT + + 1.062 1.063 5 PMT 1.06 t=1 + PMT 1.064 + PMT 1.06 What is an amortization schedule? You can use the formula for the present value of an ordinary annuity to find this payment amount: PVAN $100,000 PMT PMT X PMT X $23,739.64 Interest in Year 1 Each payment of $23,739.64 consists of two parts-interest and repayment of principal. An amortization schedule shows this breakdown over time. You can calculate the interest in each period by multiplying the loan balance at the beginning of the year by the interest rate: = (1+1)N I = (1+0.06) 0.06 Loan Balance at the Beginning of Year 1 x Interest Rate $100,000 x 0.06 $6,000 Notice that the interest portion is relatively high in the first year, but then it declines as the loan balance decreases. The repayment of principal is equal to the payment minus the interest charge for the year: Notice that the interest portion is relatively high in the first year, but then it declines as the loan balance decreases. The repayment of principal is equal to the payment minus the interest charge for the year: Repayment of Principal in Year 1 = Payment Interest in Year 1 = $23,739.64 - $6,000 = $17,739.64 You can perform similar calculations to fill in the remainder of the amortization schedule. Year 1 2 3 4 5 Beginning Amount Payment Interest $23,739.64 $6,000.00 23,739.64 4,935.62 23,739.64 3,807.38 23,739.64 2,611.44 23,739.64 1,343.75 $100,000.00 82,260.36 63,456.34 43,524.08 22,395.89 Repayment of Principal $17,739.64 18,804.02 19,932.26 21,128.20 22,395.89 Ending Balance $82,260.36 63,456.34 43,524.08 22,395.89 0.00 Suppose Rajiv borrows $60,000.00 on a mortgage loan, and the loan is to be repaid in 7 equal payments at the end of each of the next 7 years. If the lender charges 6% on the balance at the beginning of each year, and the homeowner makes an annual payment of $10,748.10, the homeowner will pay in interest in the first year. Step 2: Learn: Amortization Schedule Amortization schedules are a helpful tool in breaking down your loan payment into its interest and principal repayment components. Suppose Rajiv receives a $27,000.00 loan to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 4% compounded annually. Use the formula for the present value of an ordinary annuity to find this payment amount: PVAN PMT = PMT x PVAN X (1+1)N I I 1. In this case, PVAN equals (1+1)N , I equals and N equals Using the formula for the present value of an ordinary annuity, the annual payment amount for this loan is Because this payment is fixed over time, enter this annual payment amount in the "Payment" column of the following table for all three years. Each payment consists of two parts-interest and repayment of principal. You can calculate the interest in year 1 by multiplying the loan balance at the beginning of the year (PVAN) by the interest rate (I). The repayment of principal is equal to the payment (PMT) minus the interest charge for the year: Ch 05- Video Lesson - Time Value of Money Each payment consists of two parts-interest and repayment of principal. You can calculate the interest in year 1 by multiplying the loan balance at the beginning of the year (PVAN) by the interest rate (I). The repayment of principal is equal to the payment (PMT) minus the interest charge for the year: The interest paid in year 1 is Enter the values for interest and repayment of principal for year 1 in the following table. Because the balance at the end of the first year is equal to the beginning amount minus the repayment of principal, the ending balance for year 1 . This is the beginning amount for year 2. is Enter the ending balance for year 1 and the beginning amount for year 2 in the following table. Using the same process as you did for year 1, complete the following amortization table by filling in the remaining values for years 2 and 3. Repayment of Principal Year Beginning Amount 1 2 3 $27,000.00 Payment Interest Ending Balance $0.00 Complete the following table by determining the percentage of each payment that represents interest and the percentage that represents principal for each of the three years. Payment Component Interest Repayment of Principal Percentage of Payment Year 1 Year 2 Year 3 Step 3: Practice: Amortization Schedule Now it's time for you to practice what you've learned. Suppose Simone receives a $40,000.00 loan to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 8% compounded annually. Complete the following amortization schedule by calculating the payment, interest, repayment of principal, and ending balance for each year. Year Beginning Amount Repayment of Principal Ending Balance 1 2 3 $40,000.00 Payment Interest $0.00 Complete the following table by determining the percentage of each payment that represents interest and the percentage that represents principal for each of the three years. Payment Component Interest Repayment of Principal Percentage of Payment Year 1 Year 2 Year 3 =

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

An amortization schedule is a table that shows how a loan will be repaid over time including the amount of each payment the amount of interest paid an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started