Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bramble Co. uses the percentage-of-receivables basis to record bad debt expense and concludes that 2% of accounts receivable wil become uncollectible. Accounts receivable are $370,200

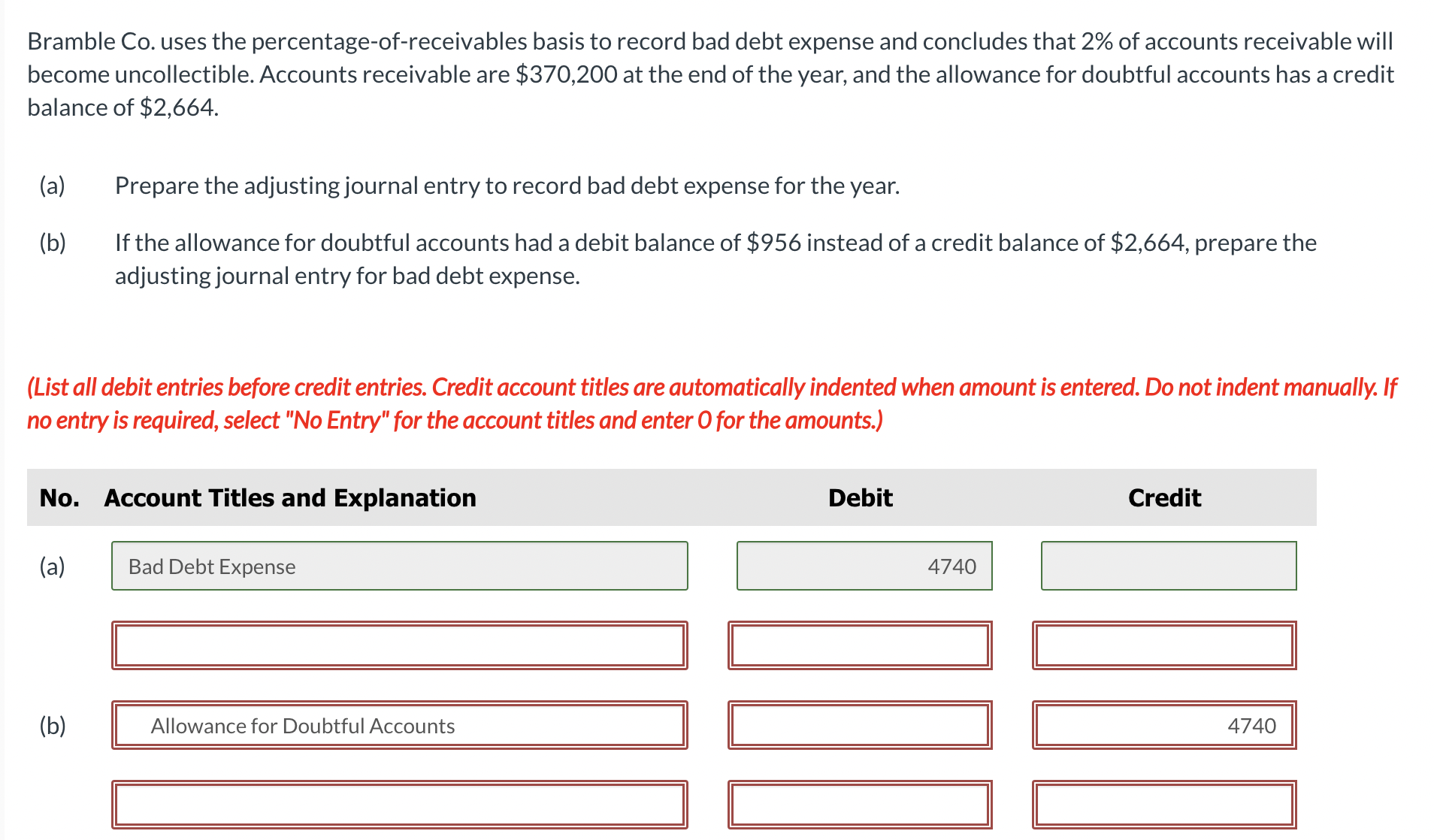

Bramble Co. uses the percentage-of-receivables basis to record bad debt expense and concludes that 2% of accounts receivable wil become uncollectible. Accounts receivable are $370,200 at the end of the year, and the allowance for doubtful accounts has a credi balance of $2,664. (a) Prepare the adjusting journal entry to record bad debt expense for the year. (b) If the allowance for doubtful accounts had a debit balance of $956 instead of a credit balance of $2,664, prepare the adjusting journal entry for bad debt expense. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. I no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Bramble Co. uses the percentage-of-receivables basis to record bad debt expense and concludes that 2% of accounts receivable wil become uncollectible. Accounts receivable are $370,200 at the end of the year, and the allowance for doubtful accounts has a credi balance of $2,664. (a) Prepare the adjusting journal entry to record bad debt expense for the year. (b) If the allowance for doubtful accounts had a debit balance of $956 instead of a credit balance of $2,664, prepare the adjusting journal entry for bad debt expense. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. I no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started