Question

Bramble Distribution markets CDs of numerous performing artists. At the beginning of March, Bramble had in beginning inventory 2,480 CDs with a unit cost of

Bramble Distribution markets CDs of numerous performing artists. At the beginning of March, Bramble had in beginning inventory 2,480 CDs with a unit cost of $7. During March, Bramble made the following purchases of CDs.

| March 5 | 2,140 | @ | $8 | March 21 | 4,790 | @ | $10 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| March 13 | 3,470 | @ | $9 | March 26 | 2,030 | @ | $11 |

During March, 11,470 units were sold. Bramble uses a periodic inventory system.

I am confused. Please help me understand how to arrive at FIFO, LIFO, and Average cost for ending inventory and cost of goods sold. Please do not provide an answer that requires a scroll bar to use to view the entire solution. There are other examples on how to work this kind of problem, but I get confused and ill scrolling back and forth to see if a calculation was for LIFO, FIFO, or what.

I thought cost of good sold for LIFO was the qty times cost for each one, minus the initial qty and cost. I thought FIFO was the qty times the cost for each one, minus the final qty and cost. However, these are wrong. I don't understand which ones I am supposed to arbitrarily not count for the average cost. What should these values be and how did you get them? Thank you.

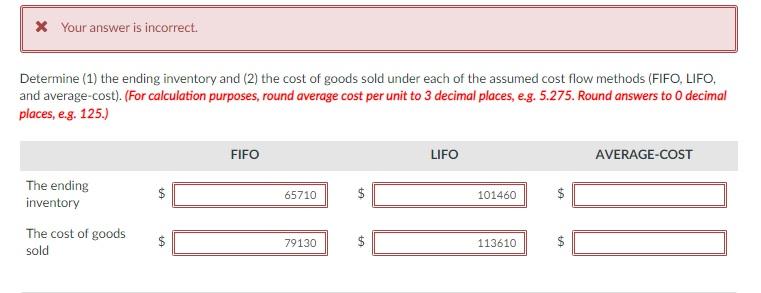

* Your answer is incorrect. Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). (For calculation purposes, round average cost per unit to 3 decimal places, e.g. 5.275. Round answers to 0 decimal places, e.g. 125.) FIFO LIFO AVERAGE-COST $ 65710 $ 101460 $ The ending inventory The cost of goods sold $ 79130 $ 113610 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started