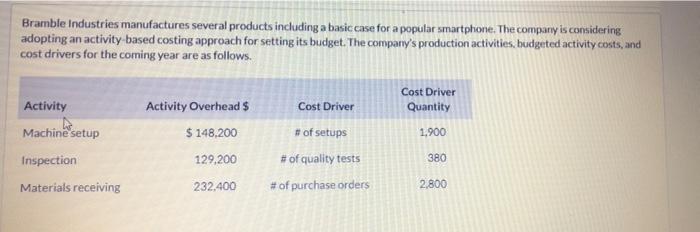

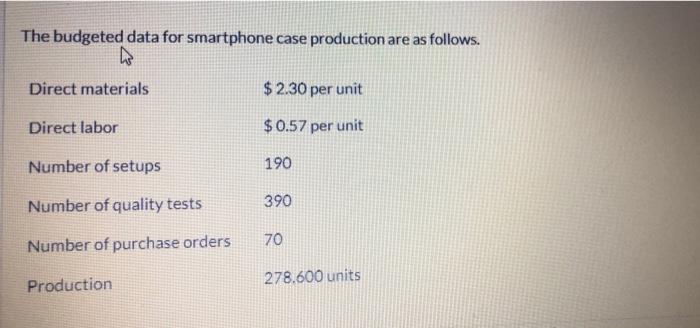

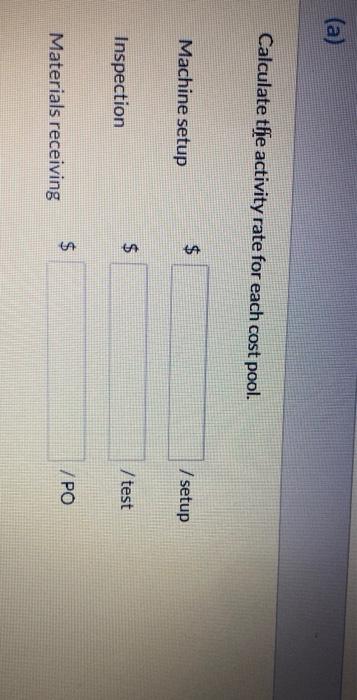

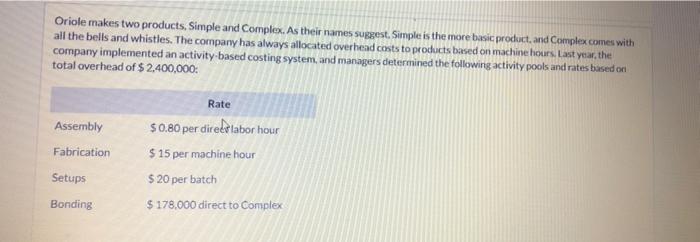

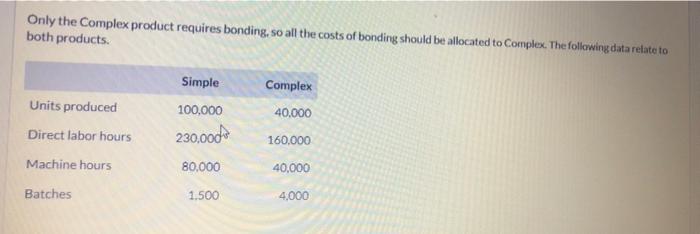

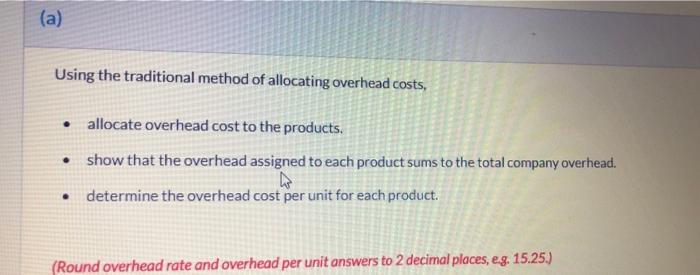

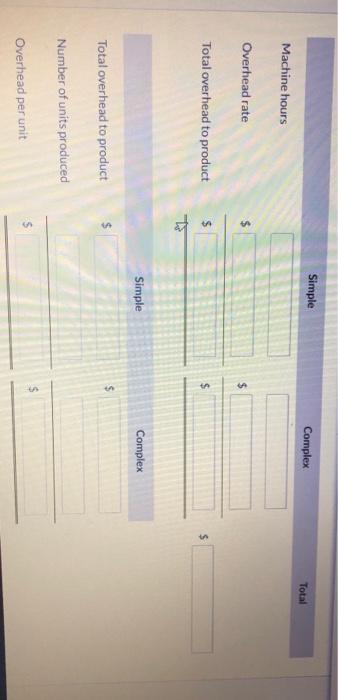

Bramble Industries manufactures several products including a basic case for a popular smartphone. The company is considering adopting an activity based costing approach for setting its budget. The company's production activities, budgeted activity costs, and cost drivers for the coming year are as follows. Cost Driver Quantity Cost Driver Activity Overhead $ $ 148,200 1.900 Activity Machine setup Inspection Materials receiving # of setups # of quality tests 129,200 380 232.400 #of purchase orders 2,800 The budgeted data for smartphone case production are as follows. Q Direct materials $ 2.30 per unit Direct labor $ 0.57 per unit Number of setups 190 Number of quality tests 390 70 Number of purchase orders Production 278.600 units (a) Calculate the activity rate for each cost pool. Machine setup $ / setup $ Inspection / test $ / PO Materials receiving Oriole makes two products. Simple and complex. As their names suggest. Simple is the more basic product, and Complex comes with all the bells and whistles. The company has always allocated overhead costs to products based on machine hours. Last year, the company implemented an activity-based costing system, and managers determined the following activity pools and rates based on total overhead of $ 2,400,000: Rate Assembly $ 0.80 per direct labor hour $15 per machine hour Fabrication Setups $ 20 per batch Bonding $ 178,000 direct to Complex Only the Complex product requires bonding, so all the costs of bonding should be allocated to Complex. The following data relate to both products. Simple Complex 40.000 Units produced Direct labor hours 100,000 230,000 160.000 Machine hours 80,000 40,000 Batches 1.500 4,000 (a) Using the traditional method of allocating overhead costs, allocate overhead cost to the products. show that the overhead assigned to each product sums to the total company overhead. determine the overhead cost per unit for each product. (Round overhead rate and overhead per unit answers to 2 decimal places, e.g. 15.25.) Simple Complex Total Machine hours Overhead rate $ GA $ Total overhead to product $ $ $ Simple Complex $ $ Total overhead to product Number of units produced $ $ Overhead per unit $