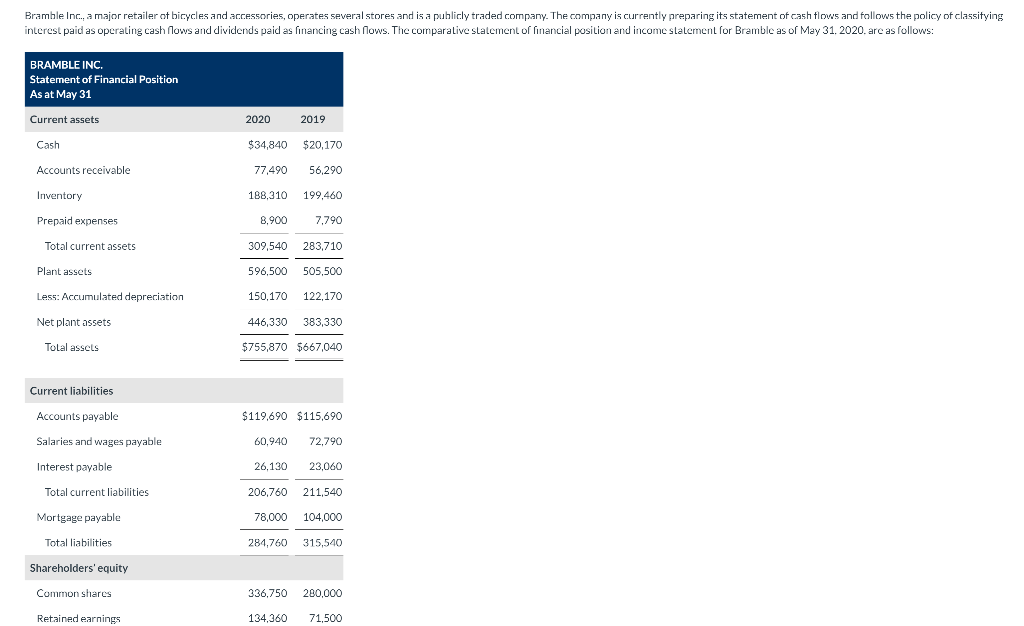

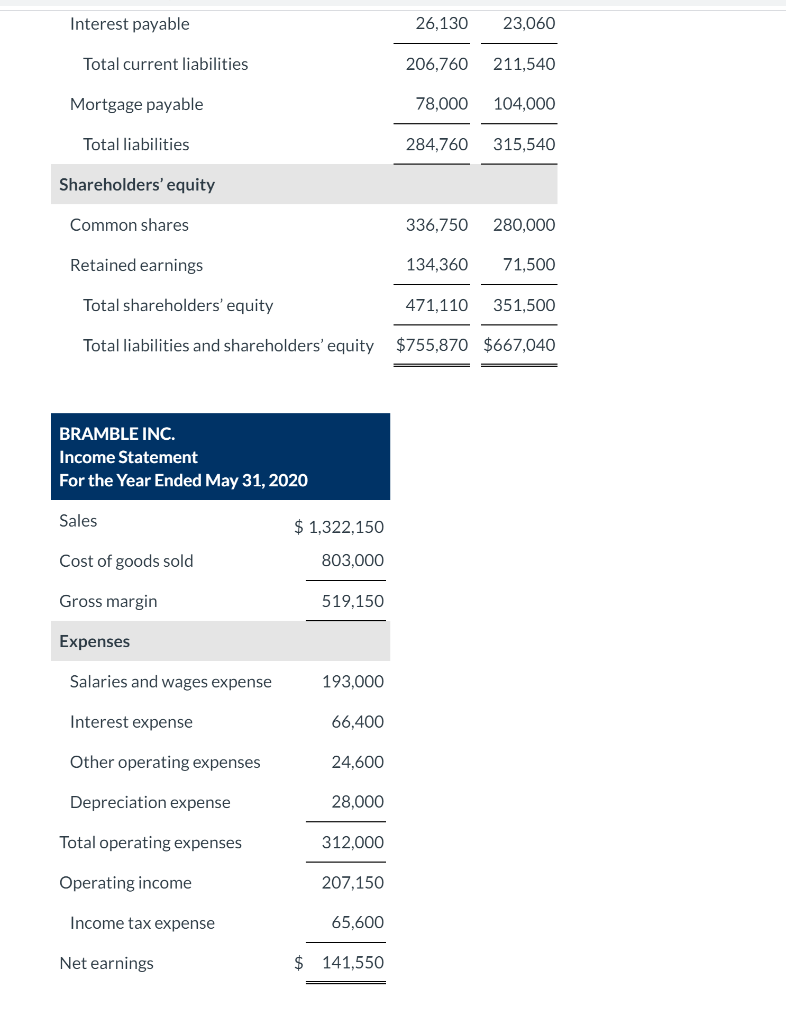

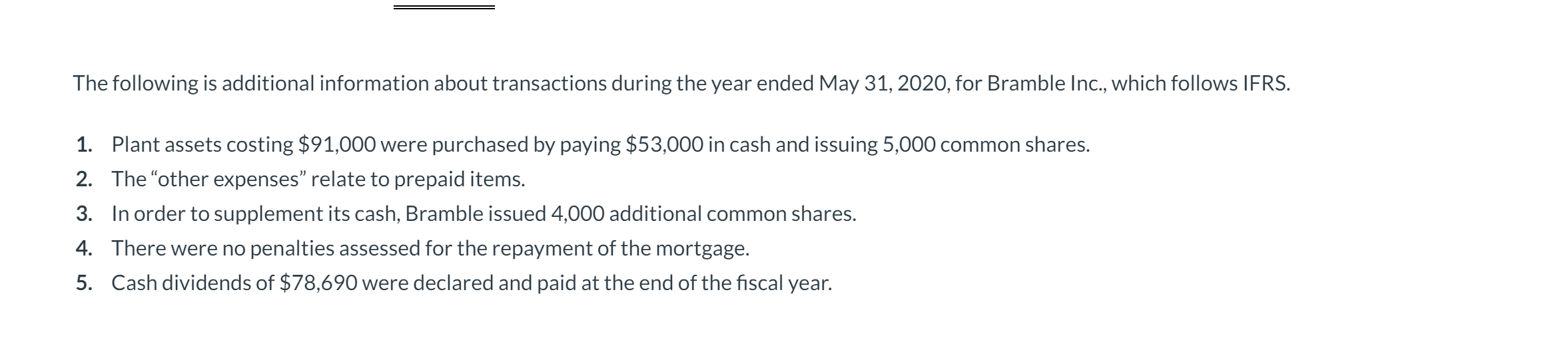

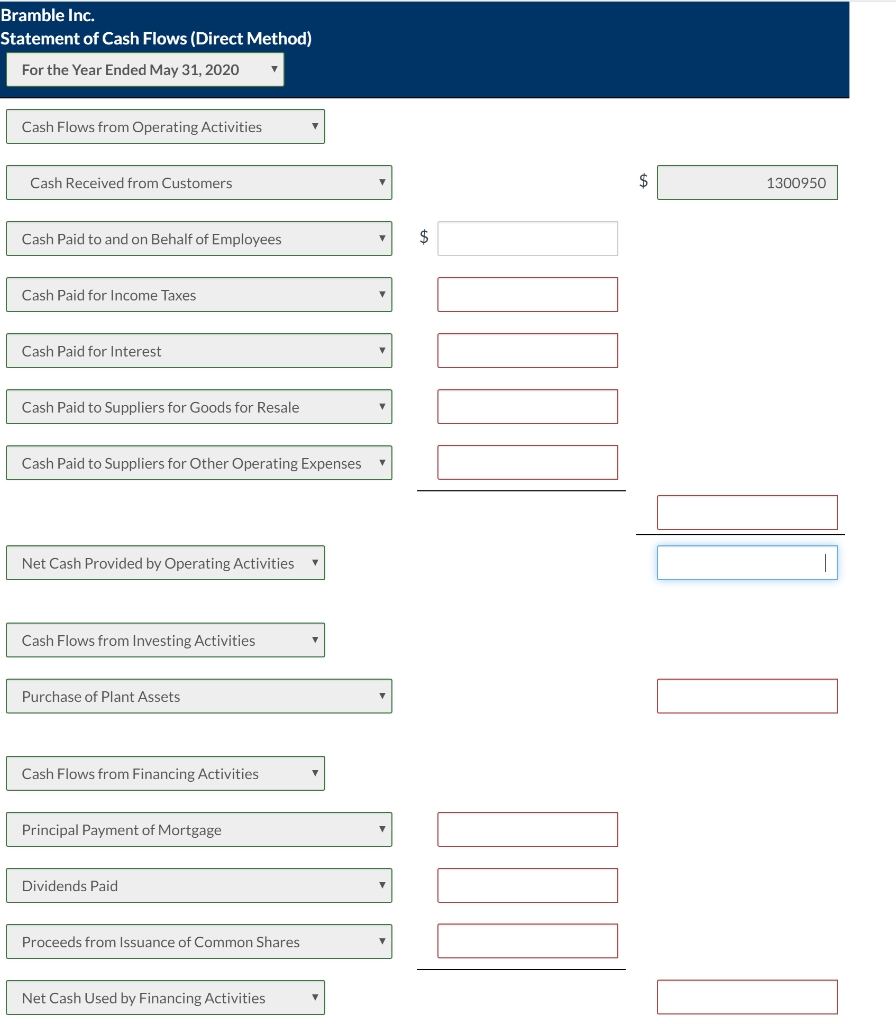

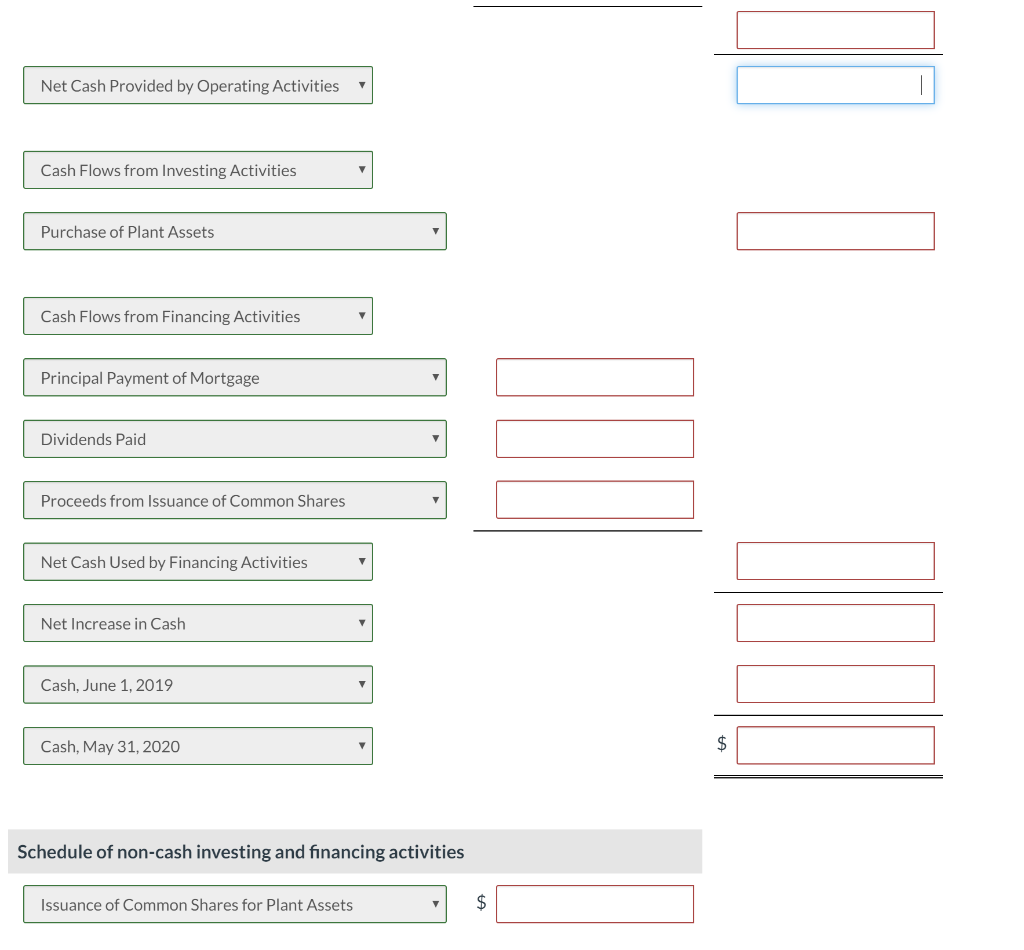

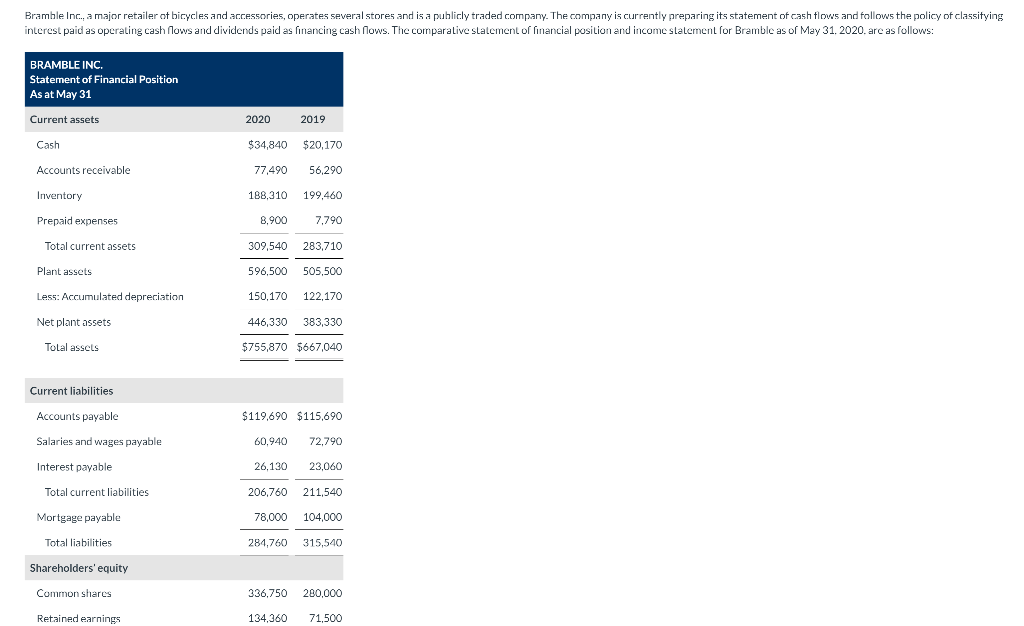

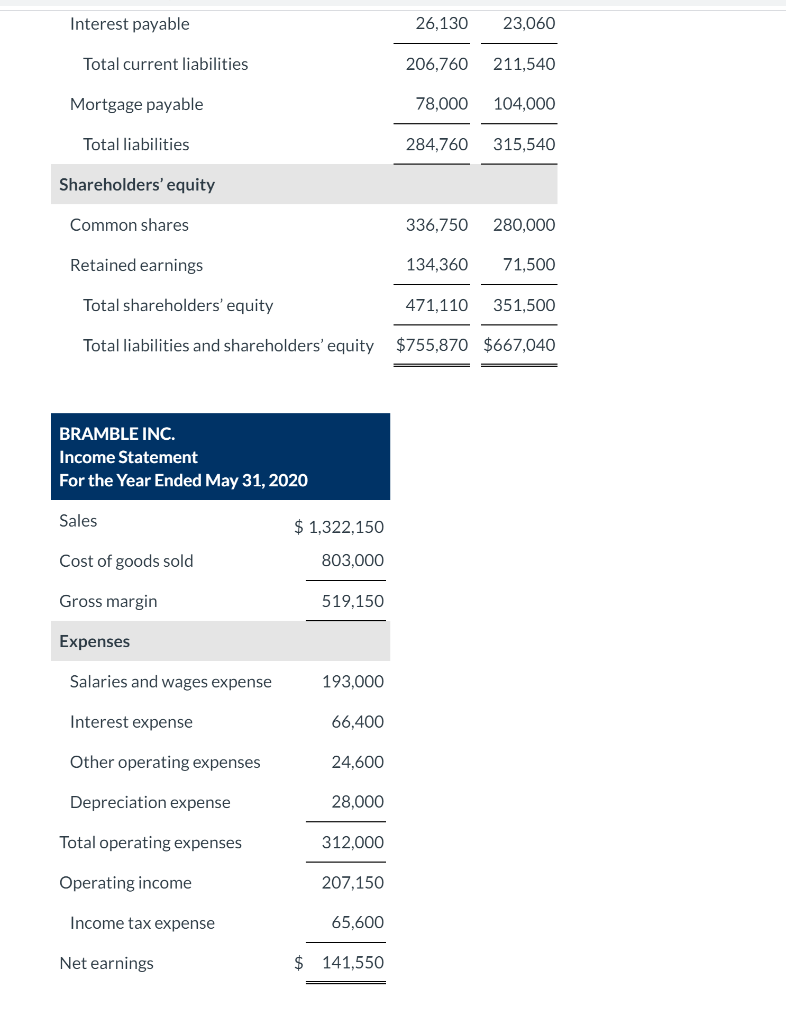

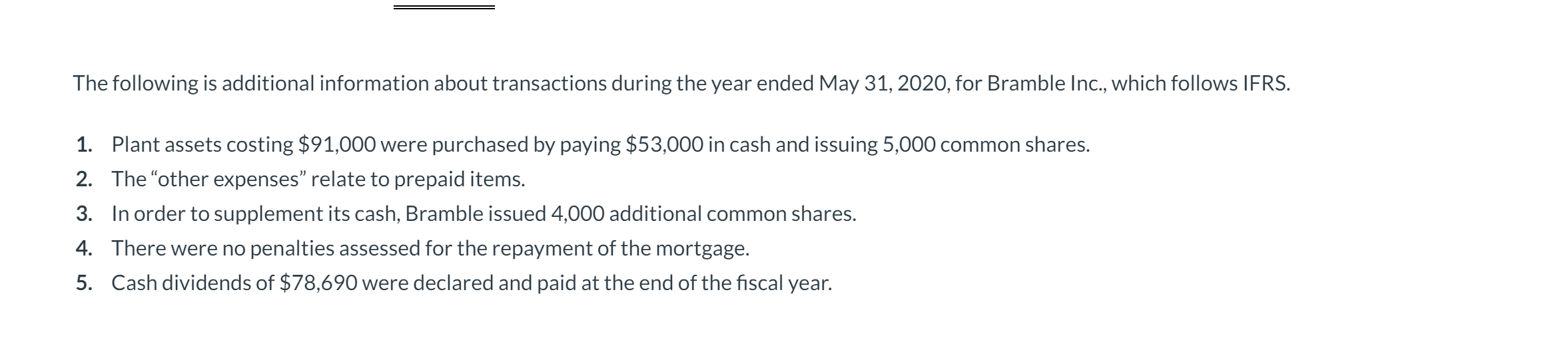

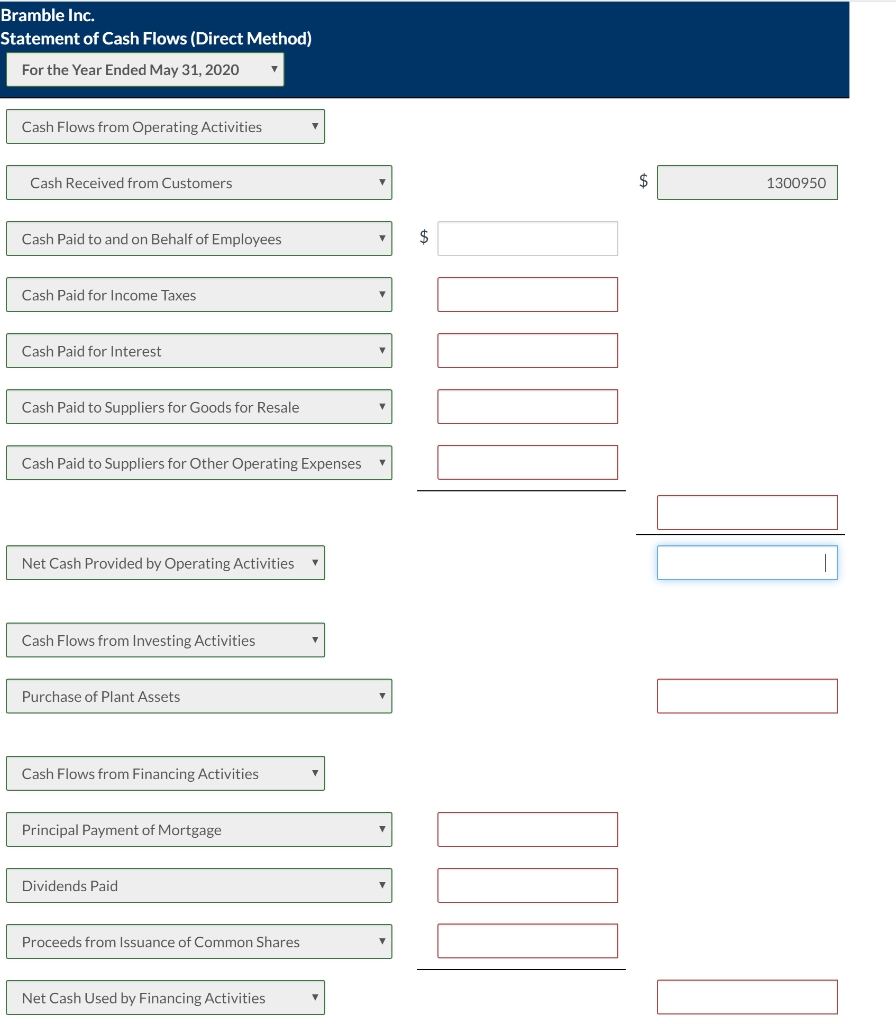

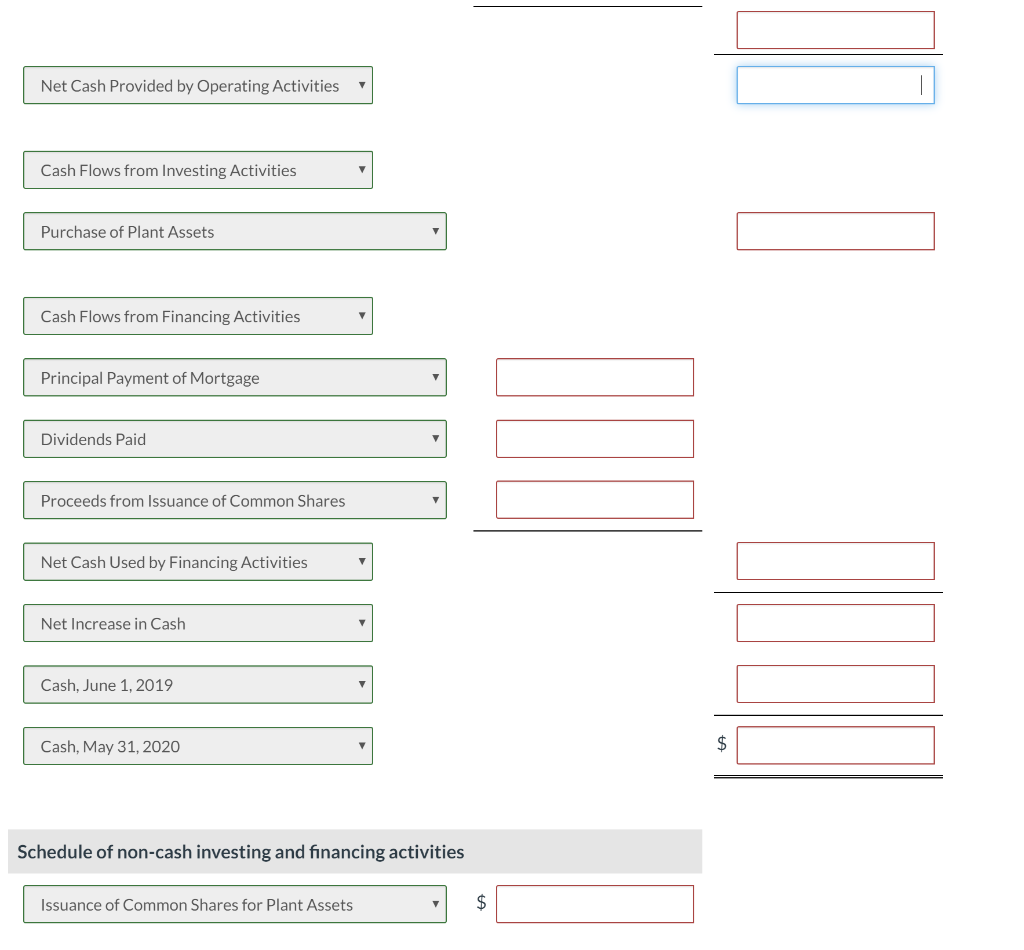

Bramhle Inc., a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows and follows the policy of classifying interest paid as operating cash rows and dividends paid as financing cash Mows. The comparative statement of financial position and income statement for Bramble as of May 31, 2020. are as follows: BRAMBLE INC. Statement of Financial Position As at May 31 Current assets 2020 2019 Cash Accounts receivable Inventory Prepaid expenses $34,840 77,490 188,310 8,900 309,540 596,500 150,170 $20,170 56,290 199,460 7,790 283,710 505,500 122,170 Total current assets Plant assets Less: Accumulated depreciation Net plant assets 446,330 383,330 $755,870 $667,040 Total assets Current liabilities Accounts payable $119,690 $115,690 60,940 72,790 Salaries and wages payable Interest payable 26,130 23,060 Total current liabilities Mortgage payable 206,760 78,000 284,760 211,540 104,000 315,540 Total liabilities Shareholders' equity Common shares 336,750 134,360 280,000 71,500 Retained earnings Interest payable 26,130 23,060 Total current liabilities 206,760 211,540 Mortgage payable 78,000 104,000 Total liabilities 284,760 315,540 Shareholders' equity Common shares 336,750 280,000 Retained earnings 134,360 71,500 Total shareholders' equity 471,110 351,500 Total liabilities and shareholders' equity $755,870 $667,040 BRAMBLE INC. Income Statement For the Year Ended May 31, 2020 Sales $ 1,322,150 803,000 Cost of goods sold Gross margin 519,150 Expenses Salaries and wages expense 193,000 Interest expense 66,400 Other operating expenses 24,600 Depreciation expense 28,000 Total operating expenses 312,000 Operating income 207,150 Income tax expense 65,600 Net earnings $ 141,550 The following is additional information about transactions during the year ended May 31, 2020, for Bramble Inc., which follows IFRS. 1. Plant assets costing $91,000 were purchased by paying $53,000 in cash and issuing 5,000 common shares. 2. The "other expenses relate to prepaid items. 3. In order to supplement its cash, Bramble issued 4,000 additional common shares. 4. There were no penalties assessed for the repayment of the mortgage. 5. Cash dividends of $78,690 were declared and paid at the end of the fiscal year. Bramble Inc. Statement of Cash Flows (Direct Method) For the Year Ended May 31, 2020 Cash Flows from Operating Activities Cash Received from Customers 1300950 Cash Paid to and on Behalf of Employees Cash Paid for Income Taxes Cash Paid for Interest Cash Paid to Suppliers for Goods for Resale Cash Paid to Suppliers for Other Operating Expenses Net Cash Provided by Operating Activities Cash Flows from Investing Activities Purchase of Plant Assets Cash Flows from Financing Activities Principal Payment of Mortgage Dividends Paid Proceeds from Issuance of Common Shares Net Cash Used by Financing Activities Net Cash Provided by Operating Activities Cash Flows from Investing Activities Purchase of Plant Assets Cash Flows from Financing Activities Principal Payment of Mortgage Dividends Paid Proceeds from Issuance of Common Shares Net Cash Used by Financing Activities Net Increase in Cash Cash, June 1, 2019 Cash, May 31, 2020 Schedule of non-cash investing and financing activities Issuance of Common Shares for Plant Assets