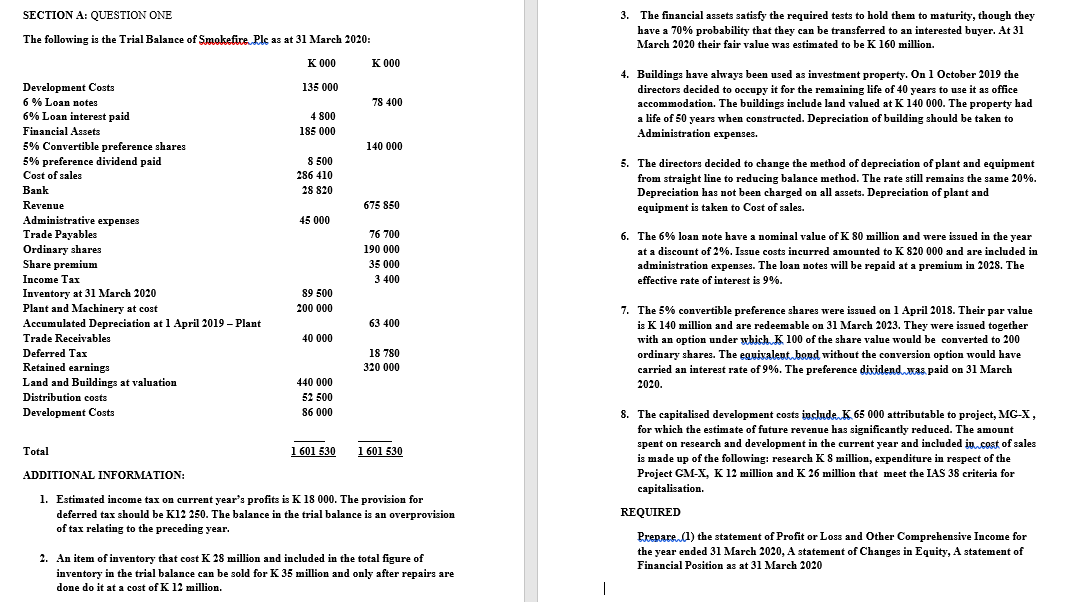

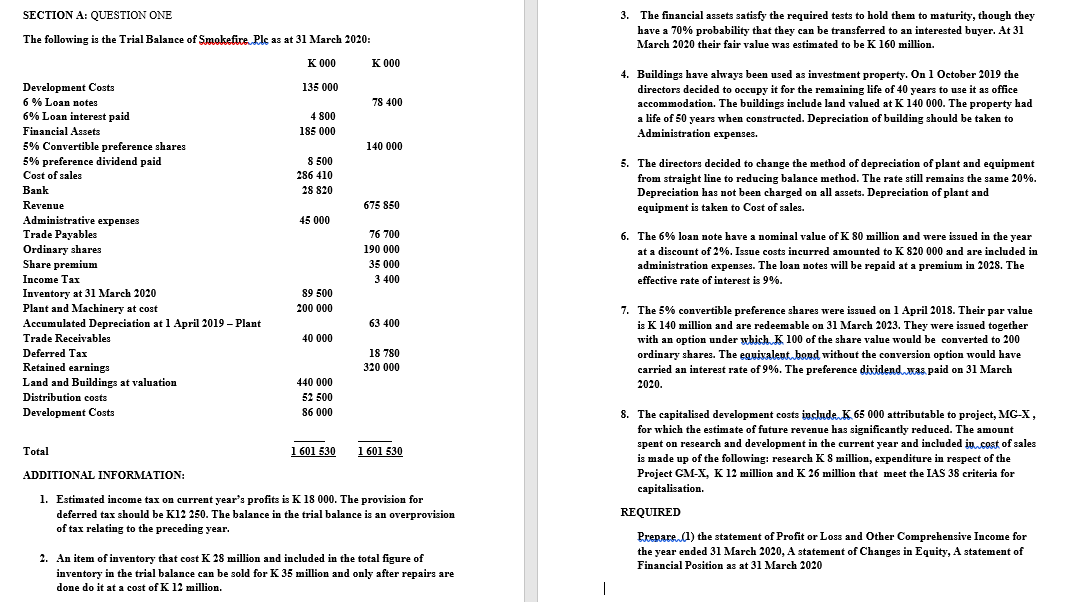

SECTION A: QUESTION ONE The following is the Trial Balance of Smokefice. Plc as at 31 March 2020: K 000 K 000 3. The financial assets satisfy the required tests to hold them to maturity, though they have a 70% probability that they can be transferred to an interested buyer. At 31 March 2020 their fair value was estimated to be K 160 million. 135 000 78 400 4. Buildings have always been used as investment property. On 1 October 2019 the directors decided to occupy it for the remaining life of 40 years to use it as office accommodation. The buildings include land valued at K 140 000. The property had a life of 50 years when constructed. Depreciation of building should be taken to Administration expenses. 4 800 185 000 140 000 8 500 286 410 28 820 5. The directors decided to change the method of depreciation of plant and equipment from straight line to reducing balance method. The rate still remains the same 20%. Depreciation has not been charged on all assets. Depreciation of plant and equipment is taken to Cost of sales. 675 850 45 000 Development Costs 6% Loan notes 6% Loan interest paid Financial Assets 5% Convertible preference shares 5% preference dividend paid Cost of sales Bank Revenue Administrative expenses Trade Payables Ordinary shares Share premium Income Tax Inventory at 31 March 2020 Plant and Machinery at cost Accumulated Depreciation at 1 April 2019 - Plant Trade Receivables Deferred Tax Retained earnings Land and Buildings at valuation Distribution costs Development Costs 76 700 190 000 35 000 3 400 6. The 6% loan note have a nominal value of K 80 million and were issued in the year at a discount of 2%. Issue costs incurred amounted to K 820 000 and are included in administration expenses. The loan notes will be repaid at a premium in 2028. The effective rate of interest is 9%. 89 500 200 000 63 400 40 000 18 780 320 000 7. The 5% convertible preference shares were issued on 1 April 2018. Their par value is K 140 million and are redeemable on 31 March 2023. They were issued together with an option under which K 100 of the share value would be converted to 200 ordinary shares. The equivalent bond without the conversion option would have carried an interest rate of 9%. The preference dividend was paid on 31 March 2020. 440 000 52 500 86 000 Total 1 601 530 1601 530 ADDITIONAL INFORMATION: 1. Estimated income tax on current year's profits is K 18 000. The provision for deferred tax should be K12 250. The balance in the trial balance is an overprovision of tax relating to the preceding year. 8. The capitalised development costs include K 65 000 attributable to project, MG-X, for which the estimate of future revenue has significantly reduced. The amount spent on research and development in the current year and included in..cost of sales is made up of the following research K 8 million, expenditure in respect of the Project CM-X, K 12 million and K 26 million that meet the IAS 38 criteria for capitalisation REQUIRED Prepare. (a) the statement of Profit or Loss and Other Comprehensive Income for the year ended 31 March 2020, A statement of Changes in Equity, A statement of Financial Position as at 31 March 2020 2. An item of inventory that cost K 28 million and included in the total figure of inventory in the trial balance can be sold for K 35 million and only after repairs are done do it at a cost of K 12 million. SECTION A: QUESTION ONE The following is the Trial Balance of Smokefice. Plc as at 31 March 2020: K 000 K 000 3. The financial assets satisfy the required tests to hold them to maturity, though they have a 70% probability that they can be transferred to an interested buyer. At 31 March 2020 their fair value was estimated to be K 160 million. 135 000 78 400 4. Buildings have always been used as investment property. On 1 October 2019 the directors decided to occupy it for the remaining life of 40 years to use it as office accommodation. The buildings include land valued at K 140 000. The property had a life of 50 years when constructed. Depreciation of building should be taken to Administration expenses. 4 800 185 000 140 000 8 500 286 410 28 820 5. The directors decided to change the method of depreciation of plant and equipment from straight line to reducing balance method. The rate still remains the same 20%. Depreciation has not been charged on all assets. Depreciation of plant and equipment is taken to Cost of sales. 675 850 45 000 Development Costs 6% Loan notes 6% Loan interest paid Financial Assets 5% Convertible preference shares 5% preference dividend paid Cost of sales Bank Revenue Administrative expenses Trade Payables Ordinary shares Share premium Income Tax Inventory at 31 March 2020 Plant and Machinery at cost Accumulated Depreciation at 1 April 2019 - Plant Trade Receivables Deferred Tax Retained earnings Land and Buildings at valuation Distribution costs Development Costs 76 700 190 000 35 000 3 400 6. The 6% loan note have a nominal value of K 80 million and were issued in the year at a discount of 2%. Issue costs incurred amounted to K 820 000 and are included in administration expenses. The loan notes will be repaid at a premium in 2028. The effective rate of interest is 9%. 89 500 200 000 63 400 40 000 18 780 320 000 7. The 5% convertible preference shares were issued on 1 April 2018. Their par value is K 140 million and are redeemable on 31 March 2023. They were issued together with an option under which K 100 of the share value would be converted to 200 ordinary shares. The equivalent bond without the conversion option would have carried an interest rate of 9%. The preference dividend was paid on 31 March 2020. 440 000 52 500 86 000 Total 1 601 530 1601 530 ADDITIONAL INFORMATION: 1. Estimated income tax on current year's profits is K 18 000. The provision for deferred tax should be K12 250. The balance in the trial balance is an overprovision of tax relating to the preceding year. 8. The capitalised development costs include K 65 000 attributable to project, MG-X, for which the estimate of future revenue has significantly reduced. The amount spent on research and development in the current year and included in..cost of sales is made up of the following research K 8 million, expenditure in respect of the Project CM-X, K 12 million and K 26 million that meet the IAS 38 criteria for capitalisation REQUIRED Prepare. (a) the statement of Profit or Loss and Other Comprehensive Income for the year ended 31 March 2020, A statement of Changes in Equity, A statement of Financial Position as at 31 March 2020 2. An item of inventory that cost K 28 million and included in the total figure of inventory in the trial balance can be sold for K 35 million and only after repairs are done do it at a cost of K 12 million