Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brandon Concepcion, a merchant, kept very limited records. Purchases of merchandise were paid for by check, but most other items of expenses were paid

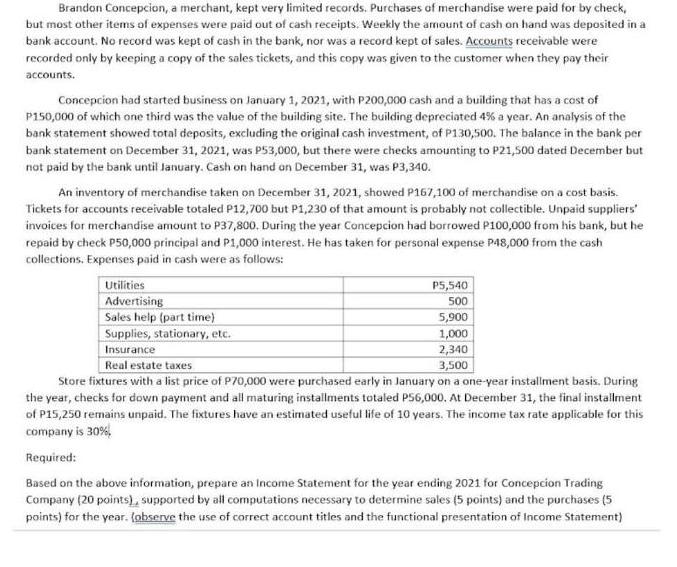

Brandon Concepcion, a merchant, kept very limited records. Purchases of merchandise were paid for by check, but most other items of expenses were paid out of cash receipts. Weekly the amount of cash on hand was deposited in a bank account. No record was kept of cash in the bank, nor was a record kept of sales. Accounts receivable were recorded only by keeping a copy of the sales tickets, and this copy was given to the customer when they pay their accounts. Concepcion had started business on January 1, 2021, with P200,000 cash and a building that has a cost of P150,000 of which one third was the value of the building site. The building depreciated 4% a year. An analysis of the bank statement showed total deposits, excluding the original cash investment, of P130,500. The balance in the bank per bank statement on December 31, 2021, was P53,000, but there were checks amounting to P21,500 dated December but not paid by the bank until January. Cash on hand on December 31, was P3,340. An inventory of merchandise taken on December 31, 2021, showed P167,100 of merchandise on a cost basis. Tickets for accounts receivable totaled P12,700 but P1,230 of that amount is probably not collectible. Unpaid suppliers' invoices for merchandise amount to P37,800. During the year Concepcion had borrowed P100,000 from his bank, but he repaid by check P50,000 principal and P1,000 interest. He has taken for personal expense P48,000 from the cash collections. Expenses paid in cash were as follows: Utilities Advertising Sales help (part time) Supplies, stationary, etc. Insurance P5,540 500 5,900 1,000 2,340 Real estate taxes 3,500 Store fixtures with a list price of P70,000 were purchased early in January on a one-year installment basis. During the year, checks for down payment and all maturing installments totaled P56,000. At December 31, the final installment of P15,250 remains unpaid. The fixtures have an estimated useful life of 10 years. The income tax rate applicable for this company is 30%, Required: Based on the above information, prepare an Income Statement for the year ending 2021 for Concepcion Trading Company (20 points), supported by all computations necessary to determine sales (5 points) and the purchases (5 points) for the year. (observe the use of correct account titles and the functional presentation of Income Statement)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Concepcion Trading Company Income Statement For the year ended December 31 2021 Revenue Sales P Less Uncollectible Accounts Net Sales P Cost of Goods ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started