Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Inc. entered into a non-cancellable lease agreement with XYX Company for the lease of a new semi-tractor on March 1, 2021. Lease payments

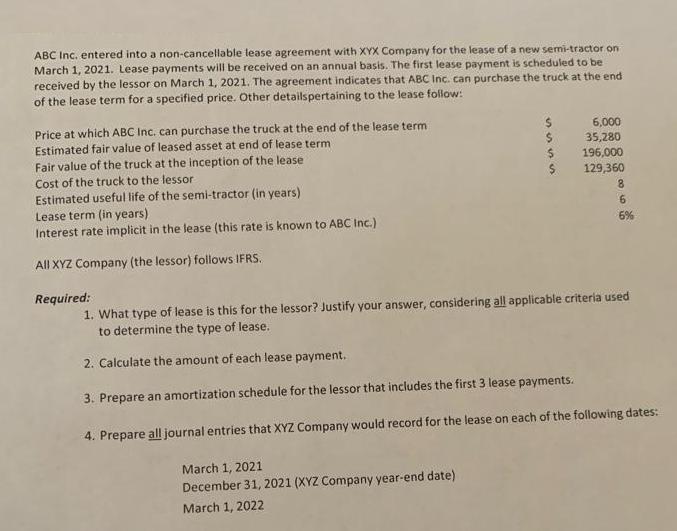

ABC Inc. entered into a non-cancellable lease agreement with XYX Company for the lease of a new semi-tractor on March 1, 2021. Lease payments will be received on an annual basis. The first lease payment is scheduled to be received by the lessor on March 1, 2021. The agreement indicates that ABC Inc. can purchase the truck at the end of the lease term for a specified price. Other detailspertaining to the lease follow: Price at which ABC Inc. can purchase the truck at the end of the lease term Estimated fair value of leased asset at end of lease term Fair value of the truck at the inception of the lease Cost of the truck to the lessor Estimated useful life of the semi-tractor (in years) Lease term (in years) Interest rate implicit in the lease (this rate is known to ABC Inc.) All XYZ Company (the lessor) follows IFRS. SSSS March 1, 2021 December 31, 2021 (XYZ Company year-end date). March 1, 2022 $ $ $ 6,000 35,280 196,000 129,360 8 6 6% Required: 1. What type of lease is this for the lessor? Justify your answer, considering all applicable criteria used to determine the type of lease. 2. Calculate the amount of each lease payment. 3. Prepare an amortization schedule for the lessor that includes the first 3 lease payments. 4. Prepare all journal entries that XYZ Company would record for the lease on each of the following dates:

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Requirement a Since lease term covers 75 of the economic life and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started