Question

YESUCAN COMPANY in the Philippines. (the Company) was registered with the Department of Trade and Industry (DTI) on January 1, 2021 and is primarily engaged

YESUCAN COMPANY in the Philippines. (the Company) was registered with the Department of Trade and Industry (DTI) on January 1, 2021 and is primarily engaged in the business of buying and selling of specialized machineries and equipment. On the same date, the Company was registered with the Bureau of Internal Revenue (BIR) as a VAT taxpayer.

need: STATEMENT OF FINANCIAL POSITION as of December 31, 2021

STATEMENT OF CASH FLOWS for the year ending December 31, 2021 (With supporting reconciliation of direct and indirect method in computing cash flows from operating activities)

You were engaged to compile the Company's financial statements and its bookkeeper sent to you the summary of the book of accounts with the following information:

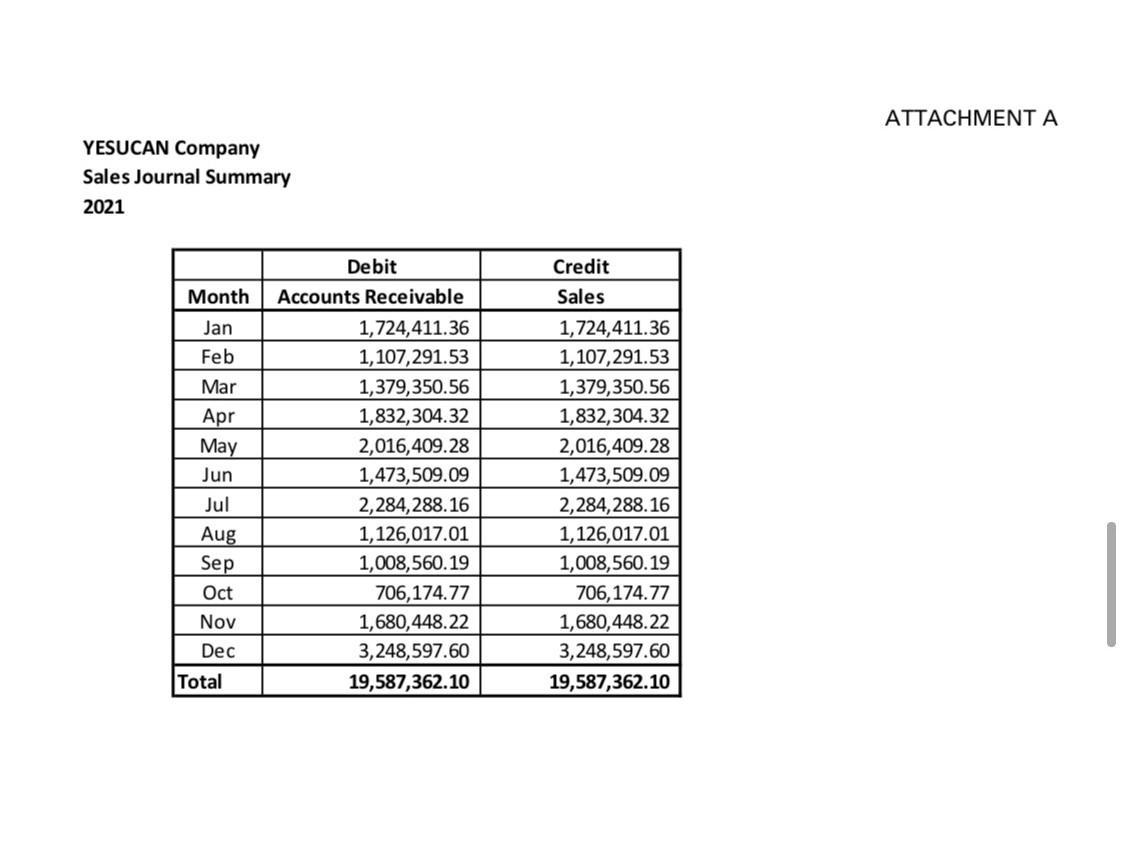

SALES JOURNAL

The bookkeeper is using this book to record sales on account. (See Attachment A)

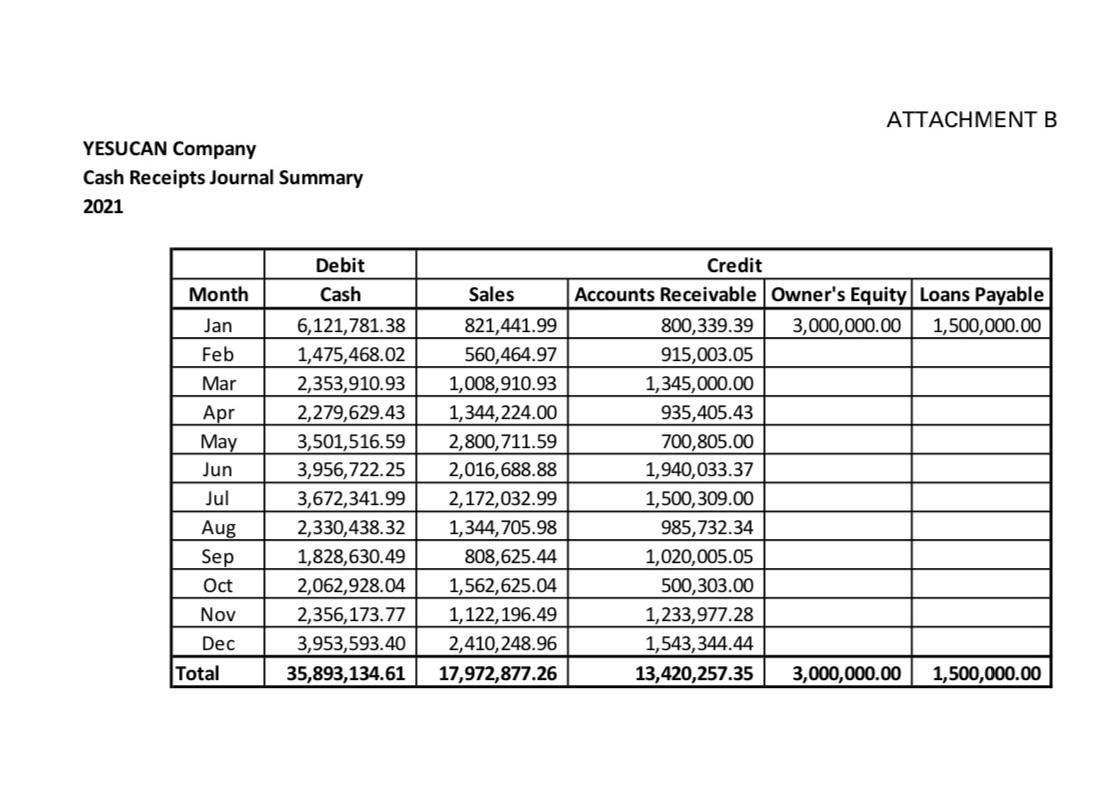

CASH RECEIPTS JOURNAL

This book is being used by the bookkeeper to record every cash collection by the Company. (See Attachment B)

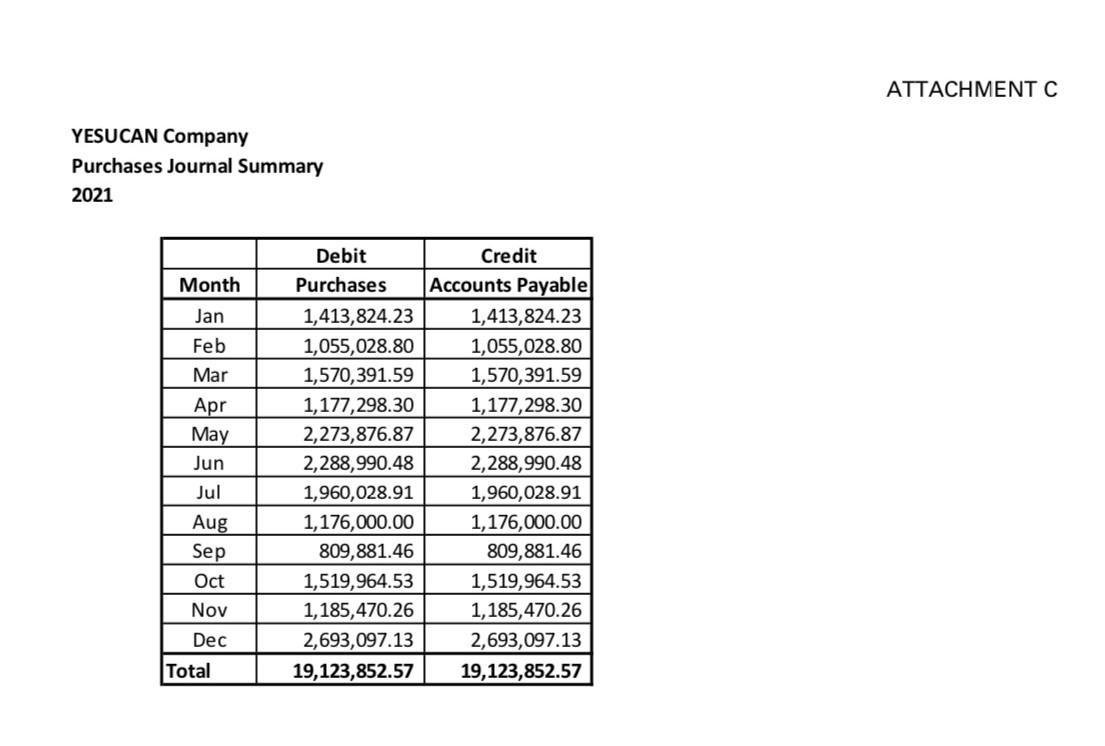

PURCHASES JOURNAL

The bookkeeper is using this book to record purchases on account. (See Attachment C)

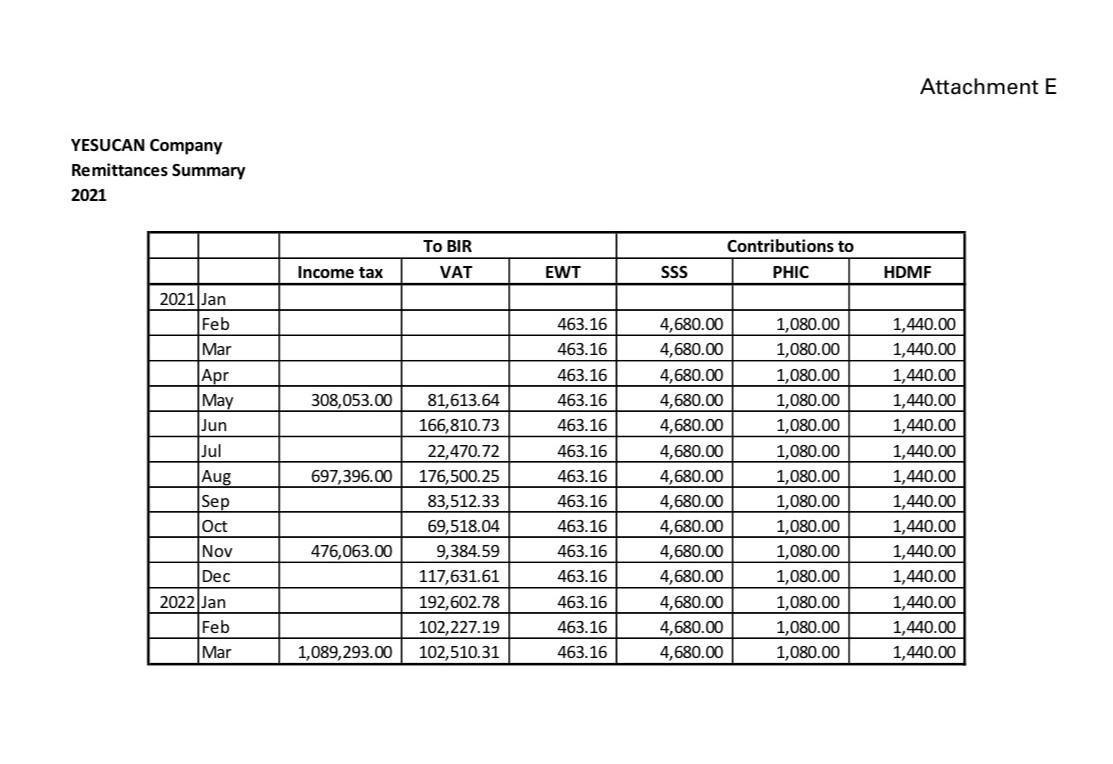

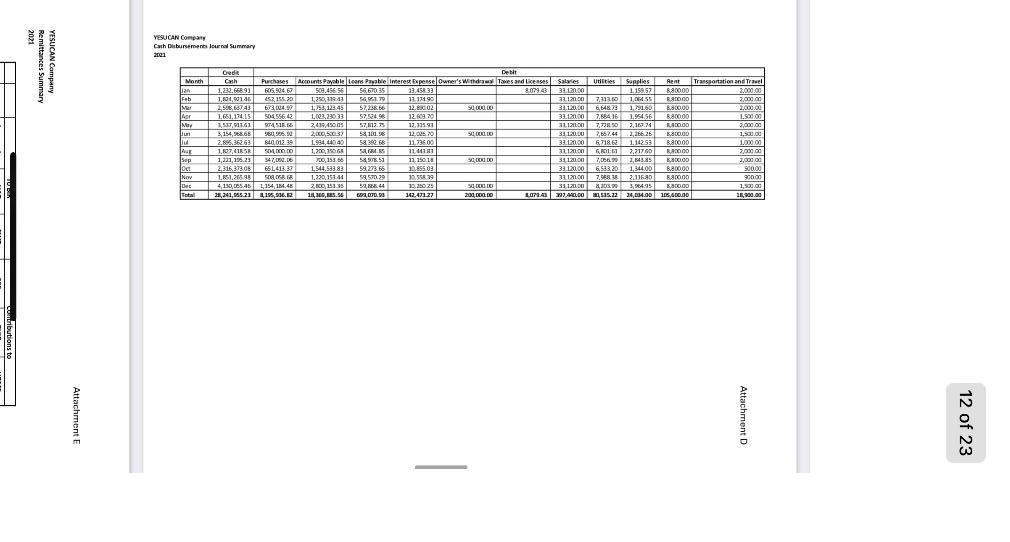

CASH DISBURSEMENTS JOURNAL This book is being used by the bookkeeper to record cash disbursements of the Company except those remittances to the BIR, to SSS, to PHIC, and to Pag IBIG as provided in the summary list. (See Attachment D and E)

The following are the related important details about every account in the Company's books.

CASH

This account pertains to any tender of payment the firm could use to pay its obligations and support its business operations. The company has the imprest system in place as its policy to safeguard its cash. As of December 31, 2021, the components of this account and their respective balances are as follows:

Cash on hand 1,490,952.34

Cash in bank 3,595,555.46

Petty cash fund 50,000.00

Total 5,136,507.80

ACCOUNTS RECEIVABLE

This account came from the Company's sales on account, all outstanding at period-end. Since this is the first year of operations of the Company, the management is still in process of determining the appropriate accounting policy to establish an allowance for doubtful account. There is no any indication of impairment of the Company's receivables so there will be no provision for doubtful accounts to be set up.

INVENTORIES

This account pertains to the specialized machineries and equipment still on-hand at year-end. The Company is using the periodic system of accounting for its inventories. From the physical count conducted as at December 31, there are unsold machineries and equipment inventories amounting to 438,434.81 (Net of VAT)

SUPPLIES

For practicality, the bookkeeper is recording every supply purchased as an expense. As of December 31, 2021, there are office supplies that are still unused and in good shape with the estimated value of 5,000 (Gross of VAT).

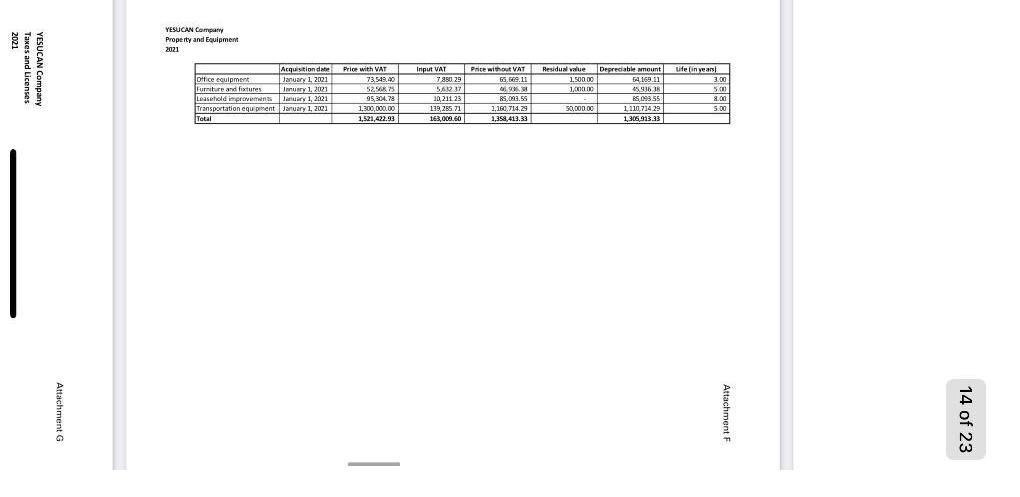

PROPERTY AND EQUIPMENT (FS LEVEL)

This FS line item includes the following accounts.

OFFICE EQUIPMENT

This account includes desktop computer, laptops, and multi-function printer initially acquired for use in the operations of the firm. The estimated residual value for this class of equipment is 1,500 after its useful life of three (3) years.

FURNITURE AND FIXTURES

This account includes office tables and chairs, cabinets, and all other furniture and fixtures initially acquired for use in the operations of the firm. The estimated residual value for this class of property is 1,000 after its useful life of five (5) years.

LEASEHOLD IMPROVEMENTS

There is no expected residual value for the said improvements, and these will be depreciated over its estimated useful life of eight (8) years which is shorter than the 10-year term of the lease contract.

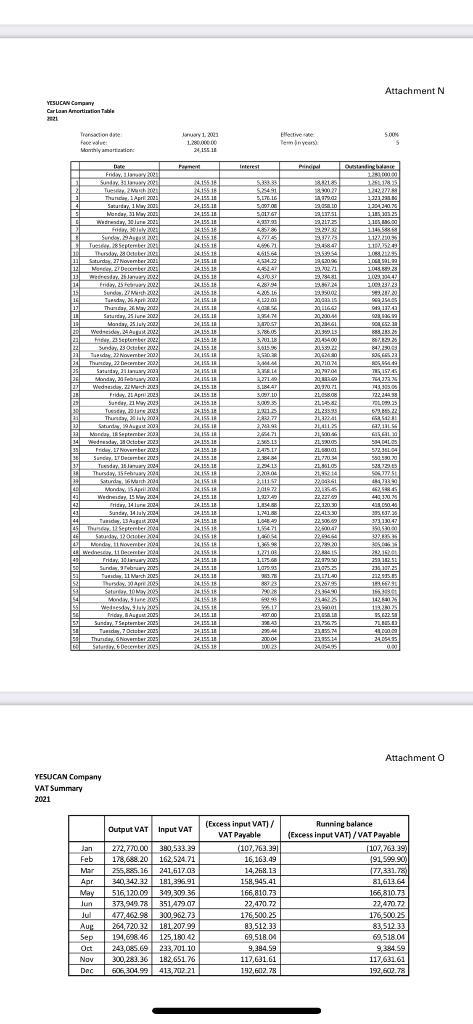

TRANSPORTATION EQUIPMENT

Acquisition date: January 1, 2021

Cash price: 1,300,000.00 (Gross of 12% VAT)

Down payment: 20,000.00 (From the personal pocket of the owner)

Day 1 outstanding balance: 1,280,000.00

Effective interest rate: 5.00%

Monthly amortization: 24,155.18 Refer to the amortization table provided. (Attachment N)

The estimated residual value of the vehicle is 50,000 after its expected useful life of five (5) years.

ACCUMULATED DEPRECIATION

This contra-asset account pertains to the depreciation on all property and equipment accrued by the firm in using such depreciable assets in its business operations. Depreciation will commence by the time the asset is available for its intended use by the management. Refer to the summary of property and equipment provided. (Attachment F)

ACCOUNTS PAYABLE

This account is being used by the Company solely for recording credit purchases of merchandise inventories. The balance of this account that will be shown in the financial statement is the payable due and outstanding as at period-end.

ACCRUED EXPENSES AND OTHER PAYABLES (FS LEVEL)

This account is composed of the following items and any other accrued items that may arise from period-end adjustments.

EXPANDED WITHHOLDING TAX (EWT) PAYABLE

This account pertains to the 5% expanded withholding tax (based on the gross rental) being withheld by the Company, as a business lessee in a rent agreement. This EWT is due to be paid to the BIR as follows.

Filing and payment for: Due date

Monthly, for the first two months of every quarter. On or before the 10th day of the following month

Quarterly, consolidated 3 months for the last month of the quarter. On or before the last day of the month following the quarter

VALUE-ADDED TAX (VAT) PAYABLE

This account pertains to the value-added tax to be remitted by the Company as VAT registered business. Computed as output VAT minus input VAT, VAT is due to be paid to the BIR as follows.

Filing and payment for: Due date:

Monthly, for the first two months of every quarter On or before the 20th day of the following month

Quarterly, consolidated 3 months for the last month of the quarter On or before the 25th day of the month following the quarter

Any excess input VAT over the output VAT is a tax credit and is claimable in the following period/s.

INCOME TAX PAYABLE

Filing and payment for: Due date

1st Quarter ITR May 15 of the applicable year

2nd Quarter ITR August 15 of the applicable year

3rd Quarter ITR Nov 15 of the applicable year

Annual ITR April 15 of the following year

SSS, PHIC, HDMF, AND OTHER CONTRIBUTIONS PAYABLE

Remittance of contributions for: Due date

SSS Last day of the month following the applicable month

PHI Every 11th - 15th day of the month following the applicable period

HDMF 25th to end of the month

The Company, as a matter of sound cash management, is following the practice of remitting the taxes and contributions above on the last day possible that it will not incur any penalty. (See attachment E)

UTILITIES PAYABLE

This account includes the amount to be paid by the Company for the consumption of electricity, water, and internet for the business operations. Every utility bill for a particular month is being paid during the first half of the following month. The Company is recording accrual for utilities in every month-end for purposes of including the input VAT on the utilities for that particular month. The accrued utility for December 2021 amounts to 8,474.05 (Gross of VAT)

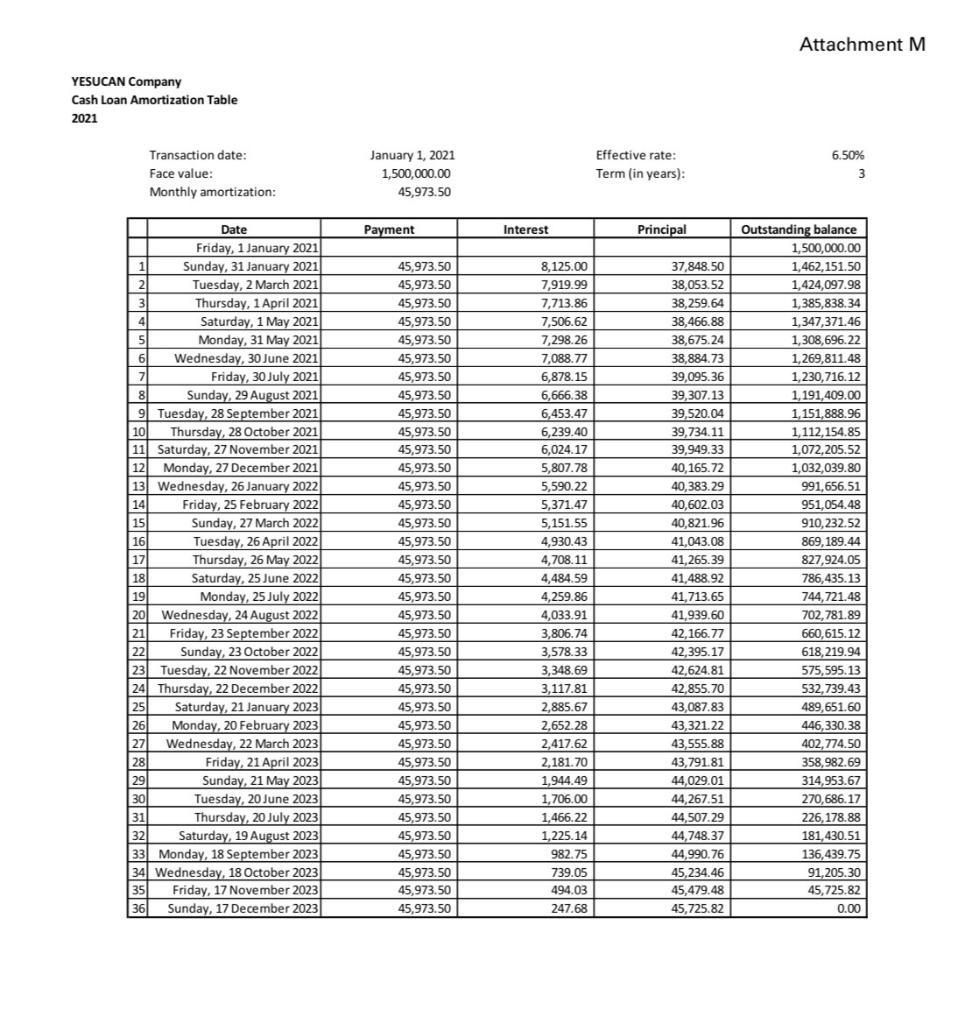

LOANS PAYABLE

This account pertains to the car loan (refer to details above about the transportation equipment) and cash loan entered into by the Company. The term for the said cash loan is as follows.

Principal amount and cash proceeds: 1,500,000.00

Prevailing interest rate: 6.50%

Payment frequency: Every 30 days starting January 31, 2021

Periodic payment: 45,973.50

Term: 3 years Refer to the cash loan amortization table provided. (Attachment M)

OWNER'S EQUITY

This account pertains to the ownership interest of the sole owner, Ms. Kaye Yamoyan, over the firm's net assets. At the time of the Company's formation, Ms. Kaye invested cash amounting to 3,000,000.00. SALES This account pertains to the revenues from the main business operating of buying and selling specialized machineries and equipment. The income of the Company is recognized in the period when the goods are delivered to the client. The amounts reflected in the books of accounts under this account are inclusive of VAT.

TAXES AND LICENSES

This account includes the Company's registration to the DTI, business permits from local government units, and the registration to the BIR. Initial registration, licenses and permits paid in forming the company amounted to 8,079.43. (See Attachment G)

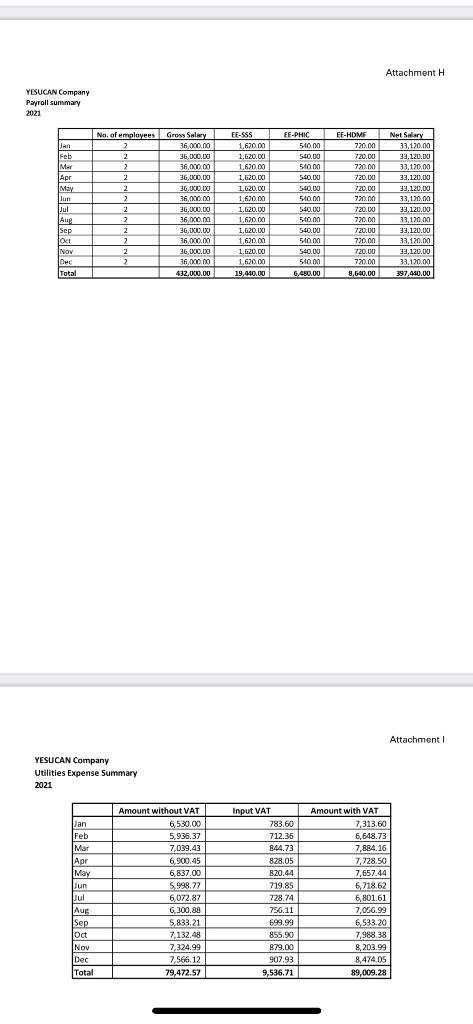

SALARIES EXPENSE This account pertains to the compensation of the two office personnel hired by the owner. The gross amount shown in the provided payroll summary (Attachment H) is the employees' earned monthly salaries (18,000 each), gross of employee mandatory contributions to SSS, PHIC, and Pag-IBIG.

SSS, PHIC, HDMF, AND OTHER CONTRIBUTIONS EXPENSE: This account pertains to the employer contributions as mandated by the local laws. This is an additional employee benefit expense being incurred by an employer aside from salaries. (See Attachment E and H)

UTILITIES EXPENSE: This account includes amount incurred by the Company for the consumption of electricity, water, and internet for the business operations. Refer to the details above for the utilities payable account. (See Attachment I)

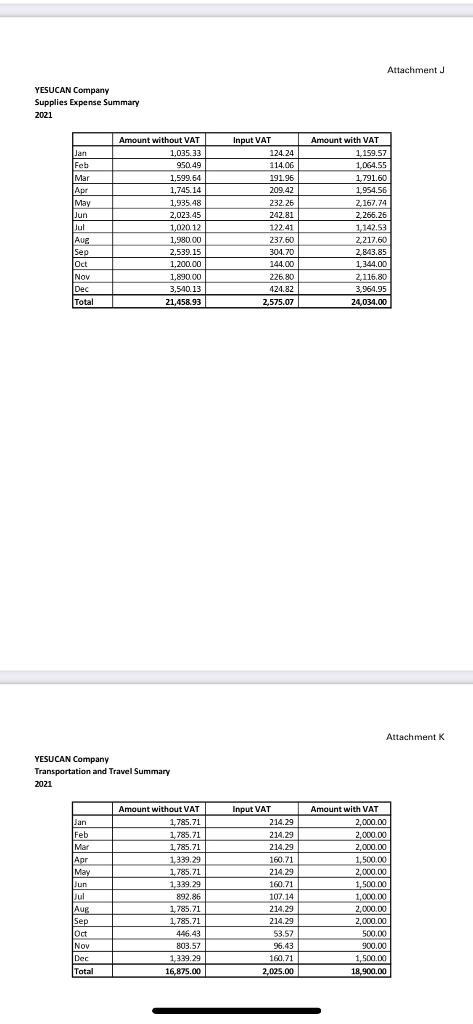

SUPPLIES EXPENSE

This account pertains to the office supplies consumed by the Company in operating its business. Refer to the details above for the supplies account. (See Attachment J)

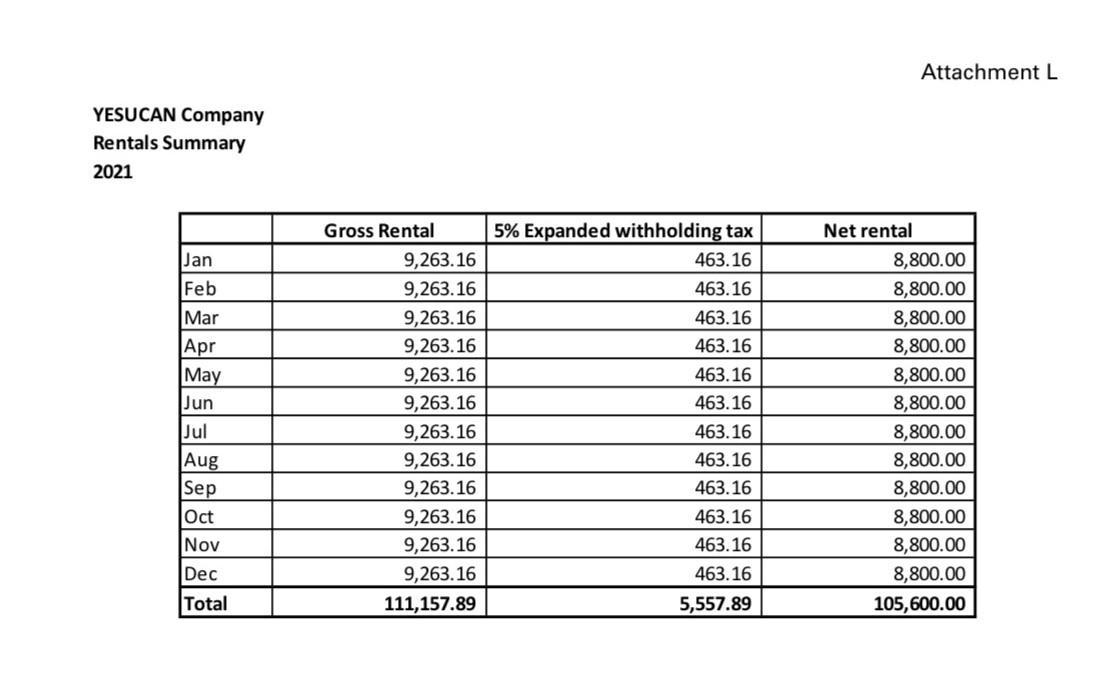

RENT EXPENSE

The Company is a lessee in a lease agreement for its office space. The term of the lease is as follows. The lessor is a Non-VAT entity.

Monthly rental: 8,800.00 (Net of 5% EWT)

Payment term: Last day of the applicable month

Lease duration: 10 years, renewable for another 10 years Rentals are recognized as expense when incurred.

Refer to the provided summary of rentals. (See Attachment L)

DEPRECIATION EXPENSE: This account pertains to the systematic allocation of cost of the depreciable assets for the period covered in the financial statements. The Company is using the straight-line method in computing the depreciation of property and equipment items. Refer to accumulated depreciation account and the provided summary of property and equipment. (See Attachment F)

TRANSPORTATION AND TRAVEL EXPENSE: This account includes gas and oil consumed on the company vehicle, as well as the related toll fees being charged to the Company's official business travels. (See Attachment K)

INTEREST EXPENSE: This account pertains to the interest incurred, during the period covered in the financial statements, by the Company from the cash loan and car loan it contracted. Refer to the attached interest-amortization tables. (See Attachments M and N)

INCOME TAX EXPENSE: This account pertains to the tax incurred by the Company based on the reported net taxable income for a particular period. Refer to the details in the income tax payable account. (See Attachment E)

ATTACHMENT A YESUCAN Company Sales Journal Summary 2021 Debit Credit Month Accounts Receivable Sales 1,724,411.36 1,107,291.53 1,379,350.56 1,832,304.32 2,016,409.28 1,473,509.09 2,284,288.16 1,126,017.01 1,008,560.19 706,174.77 1,680,448.22 3,248,597.60 19,587,362.10 1,724,411.36 1,107,291.53 1,379,350.56 1,832,304.32 2,016,409.28 1,473,509.09 2,284,288.16 1,126,017.01 1,008,560.19 706,174.77 1,680,448.22 3,248,597.60 19,587,362.10 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 QALYs are Quality Adjusted Life Years These were developed to pl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started