Question

Lucy and Patrick, aged in their early 30s, own their own home worth $1,000,000 and each have a car worth approximately $30,000 each. They have

Lucy and Patrick, aged in their early 30’s, own their own home worth $1,000,000 and each have a car worth approximately $30,000 each.

They have the following investment assets: Item Amount Ownership Investment Property $900,000 Tenants-In-Common Cash at bank $200,000 Joint Term deposit – 2 year fixed $15,000 Patrick Shares – Australian, blue-chip shares acquired in 2016 for $20,000 $80,000 Lucy Managed fund – Aust. Shares acquired in 2015 for $15,000 $25,000 Lucy Superannuation (both have binding death nomination clauses) $300,000 $125,000

Lucy Patrick The couple’s superannuation accounts are invested in a growth fund with the following allocations: Cash 5%; Fixed interest 25%; Aust shares 35%, Property 10%; International shares 25%.

Lucy earns $105,000 p.a. and Patrick earns $50,000 p.a. working part-time.

The couple have 2 children aged 16 and 18 years old. The couple’s risk profile has been determined as conservative.

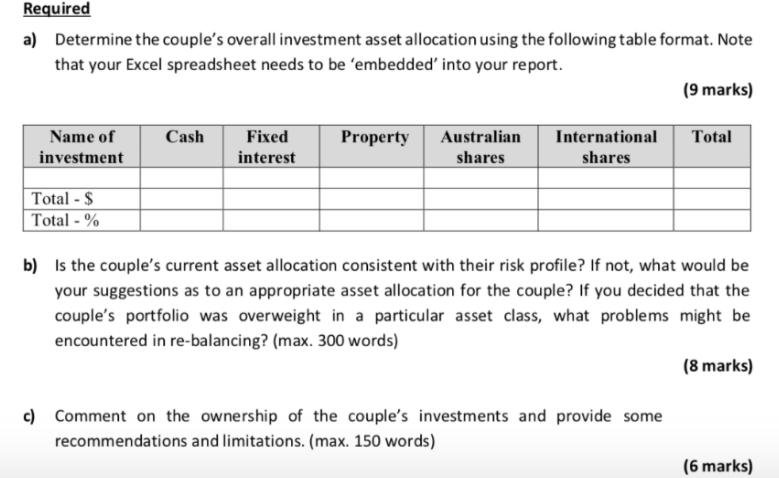

Required a) Determine the couple's overall investment asset allocation using the following table format. Note that your Excel spreadsheet needs to be 'embedded' into your report. Name of investment Total $ Total - % Cash Fixed interest Property Australian shares International shares (9 marks) c) Comment on the ownership of the couple's investments and provide some recommendations and limitations. (max. 150 words) Total b) Is the couple's current asset allocation consistent with their risk profile? If not, what would be your suggestions as to an appropriate asset allocation for the couple? If you decided that the couple's portfolio was overweight in a particular asset class, what problems might be encountered in re-balancing? (max. 300 words) (8 marks) (6 marks)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Name of investment Cash Fixed interest Property Australian shares International shares Total Origi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started