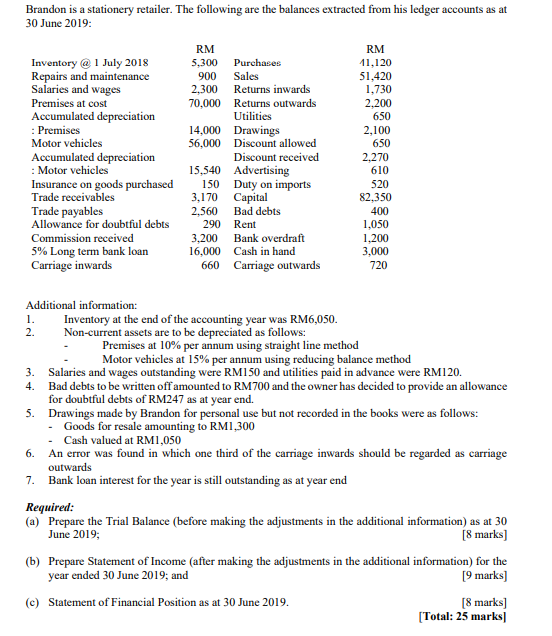

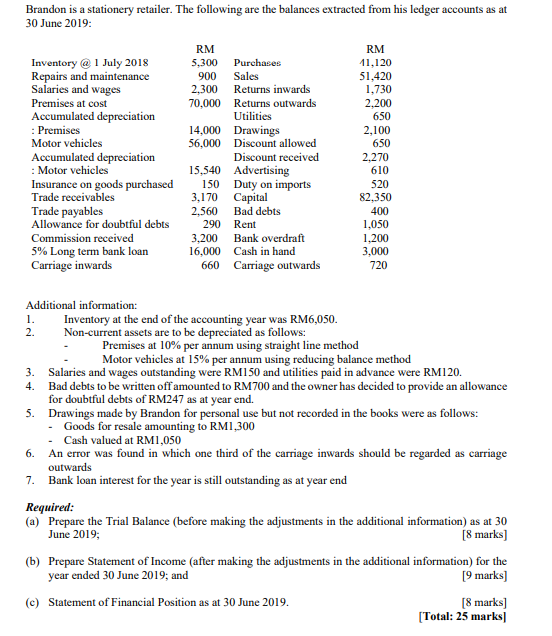

Brandon is a stationery retailer. The following are the balances extracted from his ledger accounts as at 30 June 2019: Additional information: 1. Inventory at the end of the accounting year was RM6,050. 2. Non-current assets are to be depreciated as follows: - Premises at 10% per annum using straight line method Motor vehicles at 15% per annum using reducing balance method 3. Salaries and wages outstanding were RM150 and utilities paid in advance were RM120. 4. Bad debts to be written off amounted to RM700 and the owner has decided to provide an allowance for doubtful debts of RM247 as at year end. 5. Drawings made by Brandon for personal use but not recorded in the books were as follows: - Goods for resale amounting to RM1,300 - Cash valued at RM1,050 6. An error was found in which one third of the carriage inwards should be regarded as carriage outwards 7. Bank loan interest for the year is still outstanding as at year end Required: (a) Prepare the Trial Balance (before making the adjustments in the additional information) as at 30 June 2019; [8 marks] (b) Prepare Statement of Income (after making the adjustments in the additional information) for the year ended 30 June 2019 ; and [9 marks] (c) Statement of Financial Position as at 30 June 2019. [8 marks] [Total: 25 marks] Brandon is a stationery retailer. The following are the balances extracted from his ledger accounts as at 30 June 2019: Additional information: 1. Inventory at the end of the accounting year was RM6,050. 2. Non-current assets are to be depreciated as follows: - Premises at 10% per annum using straight line method Motor vehicles at 15% per annum using reducing balance method 3. Salaries and wages outstanding were RM150 and utilities paid in advance were RM120. 4. Bad debts to be written off amounted to RM700 and the owner has decided to provide an allowance for doubtful debts of RM247 as at year end. 5. Drawings made by Brandon for personal use but not recorded in the books were as follows: - Goods for resale amounting to RM1,300 - Cash valued at RM1,050 6. An error was found in which one third of the carriage inwards should be regarded as carriage outwards 7. Bank loan interest for the year is still outstanding as at year end Required: (a) Prepare the Trial Balance (before making the adjustments in the additional information) as at 30 June 2019; [8 marks] (b) Prepare Statement of Income (after making the adjustments in the additional information) for the year ended 30 June 2019 ; and [9 marks] (c) Statement of Financial Position as at 30 June 2019. [8 marks] [Total: 25 marks]