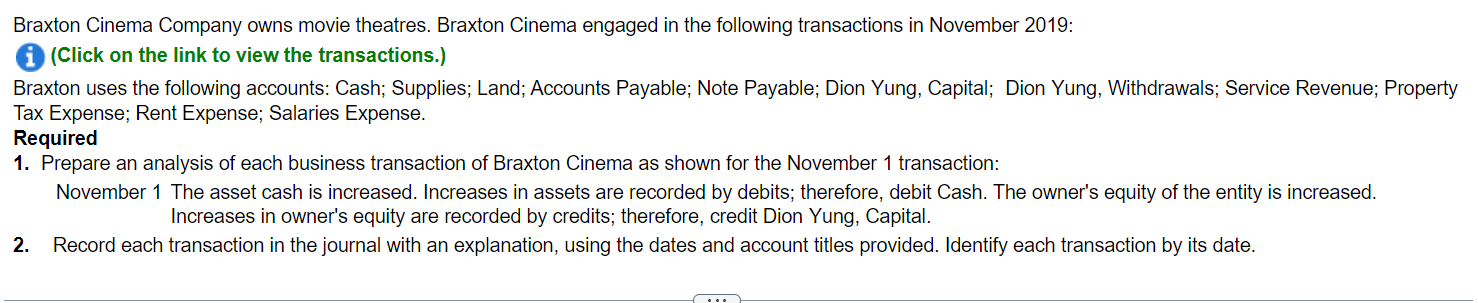

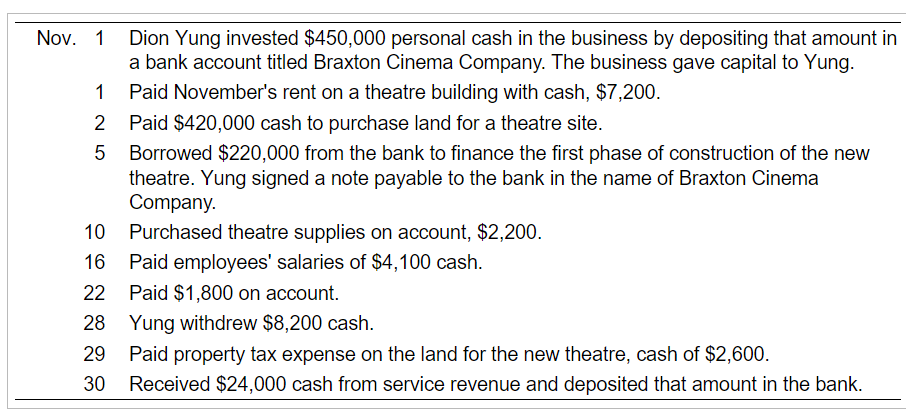

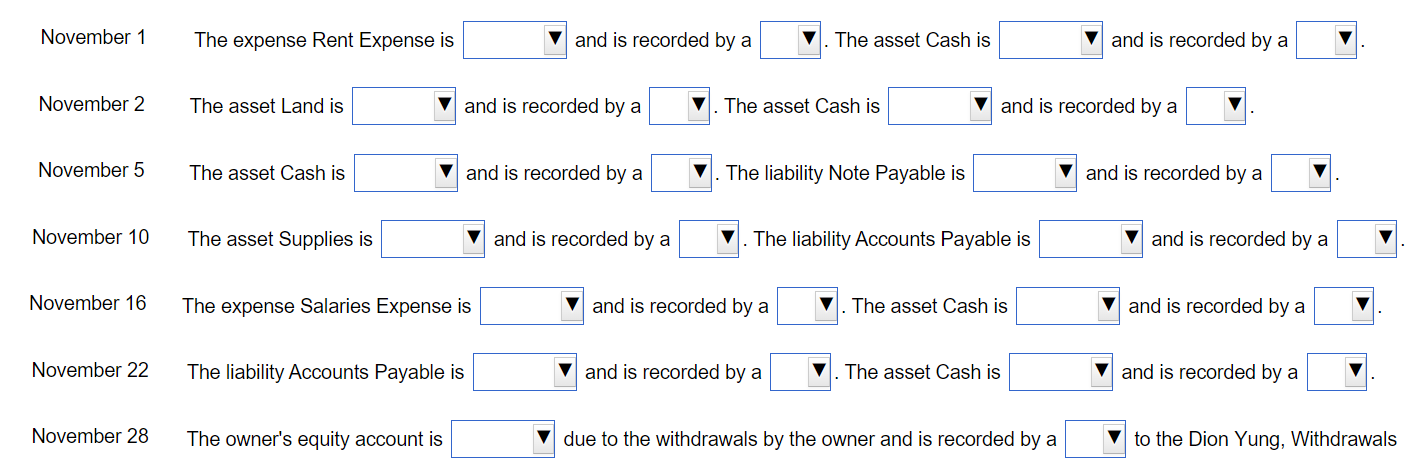

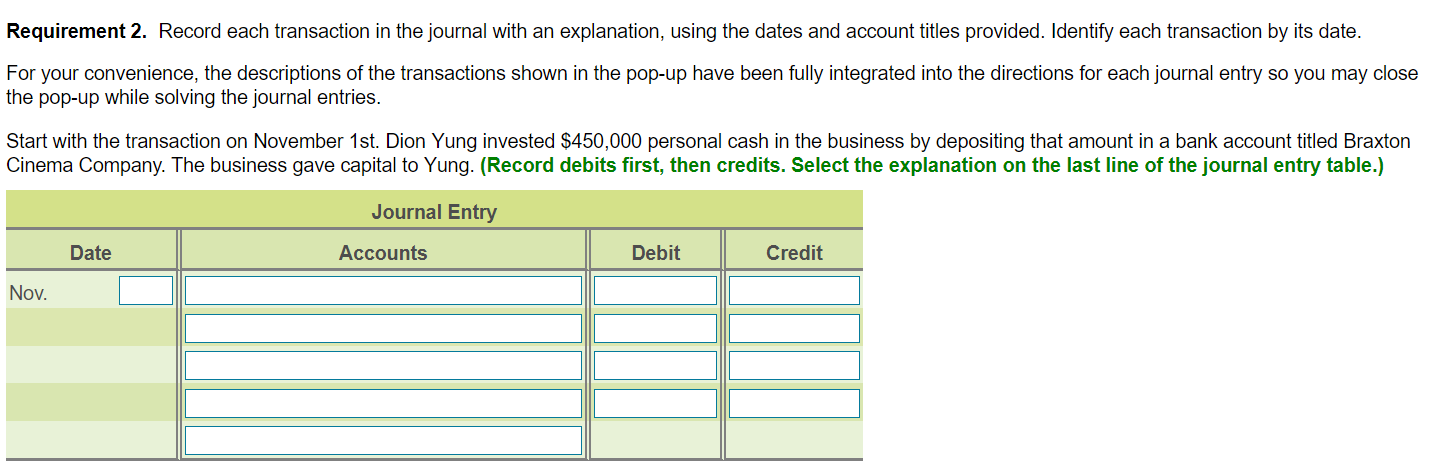

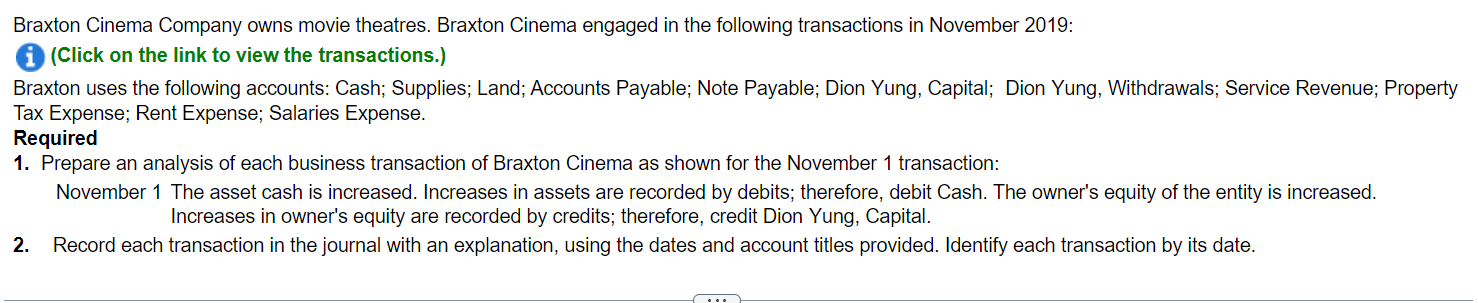

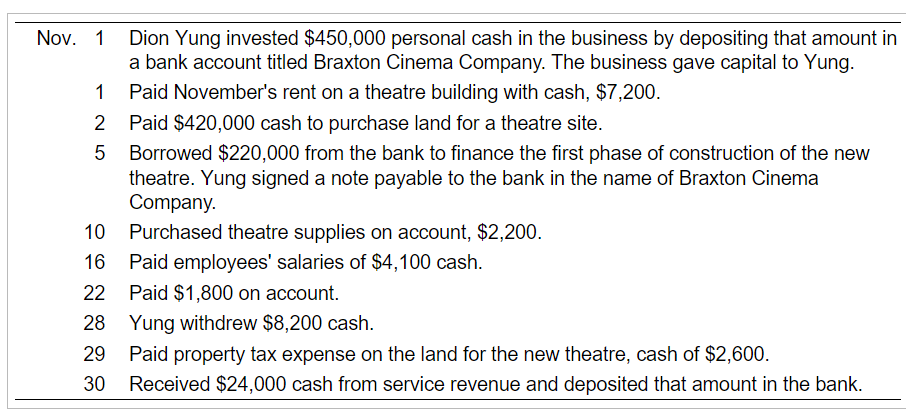

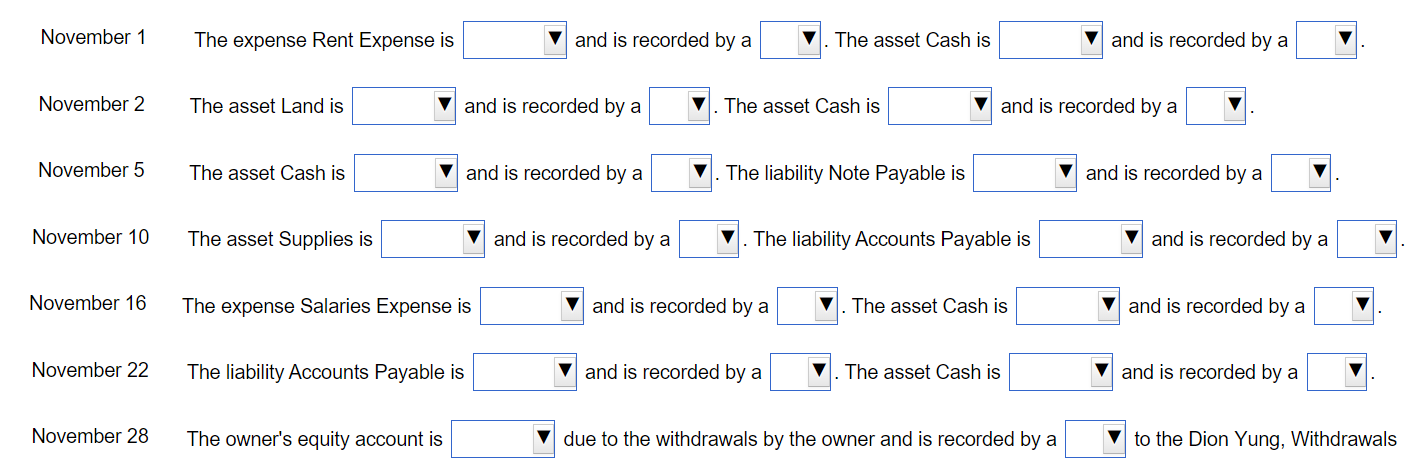

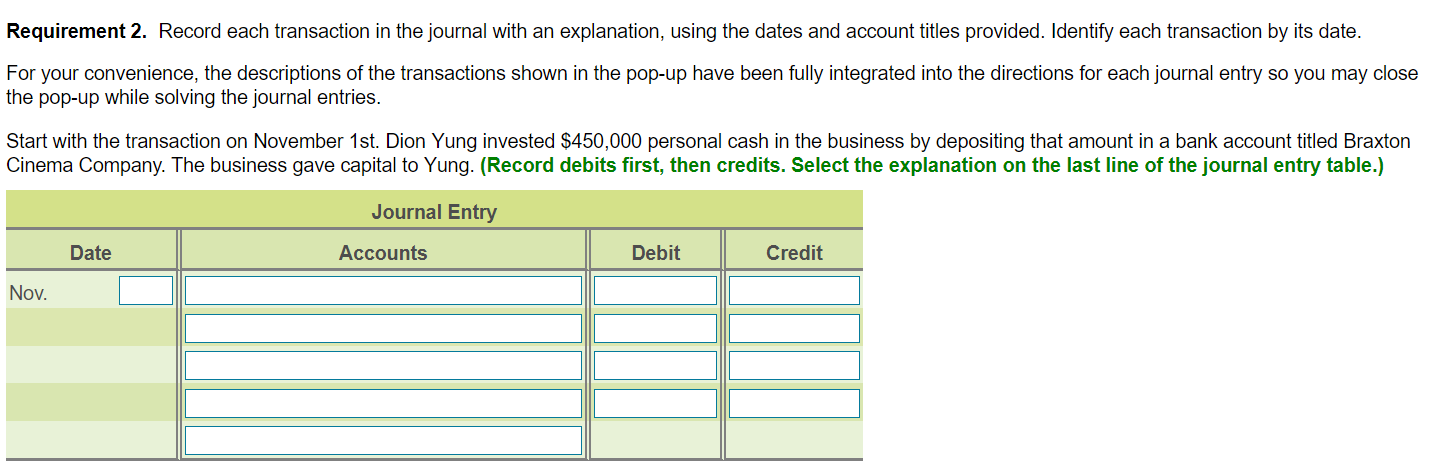

Braxton Cinema Company owns movie theatres. Braxton Cinema engaged in the following transactions in November 2019 : (Click on the link to view the transactions.) Braxton uses the following accounts: Cash; Supplies; Land; Accounts Payable; Note Payable; Dion Yung, Capital; Dion Yung, Withdrawals; Service Revenue; Property Tax Expense; Rent Expense; Salaries Expense. Required 1. Prepare an analysis of each business transaction of Braxton Cinema as shown for the November 1 transaction: November 1 The asset cash is increased. Increases in assets are recorded by debits; therefore, debit Cash. The owner's equity of the entity is increased. Increases in owner's equity are recorded by credits; therefore, credit Dion Yung, Capital. 2. Record each transaction in the journal with an explanation, using the dates and account titles provided. Identify each transaction by its date. Nov. 1 Dion Yung invested $450,000 personal cash in the business by depositing that amount in a bank account titled Braxton Cinema Company. The business gave capital to Yung. 1 Paid November's rent on a theatre building with cash, $7,200. 2 Paid $420,000 cash to purchase land for a theatre site. 5 Borrowed $220,000 from the bank to finance the first phase of construction of the new theatre. Yung signed a note payable to the bank in the name of Braxton Cinema Company. 10 Purchased theatre supplies on account, $2,200. 16 Paid employees' salaries of $4,100 cash. 22 Paid $1,800 on account. 28 Yung withdrew $8,200 cash. 29 Paid property tax expense on the land for the new theatre, cash of $2,600. 30 Received $24,000 cash from service revenue and deposited that amount in the bank. November 1 The expense Rent Expense is and is recorded by a The asset Cash is and is recorded by a November 2 The asset Land is and is recorded by a . The asset Cash is and is recorded by a November 5 The asset Cash is and is recorded by a The liability Note Payable is and is recorded by a November 10 The asset Supplies is and is recorded by a . The liability Accounts Payable is and is recorded by a November 16 The expense Salaries Expense is and is recorded by a . The asset Cash is and is recorded by a November 22 The liability Accounts Payable is and is recorded by a . The asset Cash is and is recorded by a November 28 The owner's equity account is due to the withdrawals by the owner and is recorded by a to the Dion Yung, Withdrawals Requirement 2. Record each transaction in the journal with an explanation, using the dates and account titles provided. Identify each transaction by its date. For your convenience, the descriptions of the transactions shown in the pop-up have been fully integrated into the directions for each journal entry so you may close the pop-up while solving the journal entries. Start with the transaction on November 1st. Dion Yung invested $450,000 personal cash in the business by depositing that amount in a bank account titled Braxton Cinema Company. The business gave capital to Yung. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)