Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When you make your adjusting entry for depreciation expense, how is cash affected? Assume your physical inventory is $6,000 less than the LIFO inventory

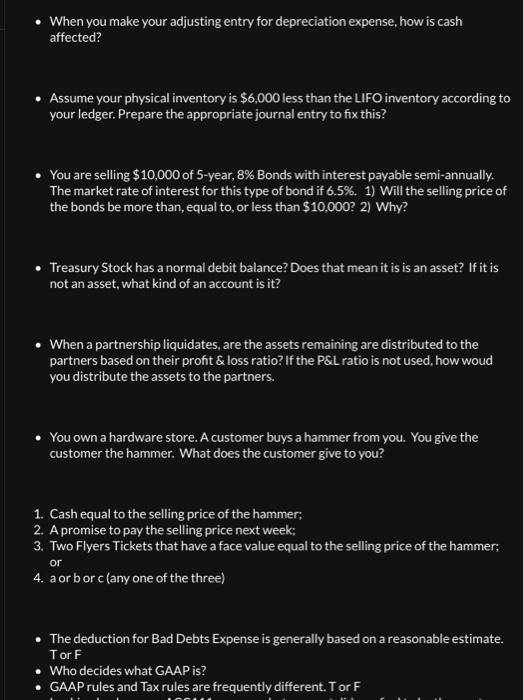

When you make your adjusting entry for depreciation expense, how is cash affected? Assume your physical inventory is $6,000 less than the LIFO inventory according to your ledger. Prepare the appropriate journal entry to fix this? You are selling $10,000 of 5-year, 8% Bonds with interest payable semi-annually. The market rate of interest for this type of bond if 6.5%. 1) Will the selling price of the bonds be more than, equal to, or less than $10,000? 2) Why? Treasury Stock has a normal debit balance? Does that mean it is is an asset? If it is not an asset, what kind of an account is it? When a partnership liquidates, are the assets remaining are distributed to the partners based on their profit & loss ratio? If the P&L ratio is not used, how woud you distribute the assets to the partners. You own a hardware store. A customer buys a hammer from you. You give the customer the hammer. What does the customer give to you? 1. Cash equal to the selling price of the hammer; 2. A promise to pay the selling price next week; 3. Two Flyers Tickets that have a face value equal to the selling price of the hammer; or 4. a or borc (any one of the three) The deduction for Bad Debts Expense is generally based on a reasonable estimate. Tor F Who decides what GAAP is? GAAP rules and Tax rules are frequently different. T or F

Step by Step Solution

★★★★★

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

When you make your adjusting entry for depreciation expense how is cash affected When you make your adjusting entry for depreciation expense cash is not affected Adjusting entries are made at the end ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started