Answered step by step

Verified Expert Solution

Question

1 Approved Answer

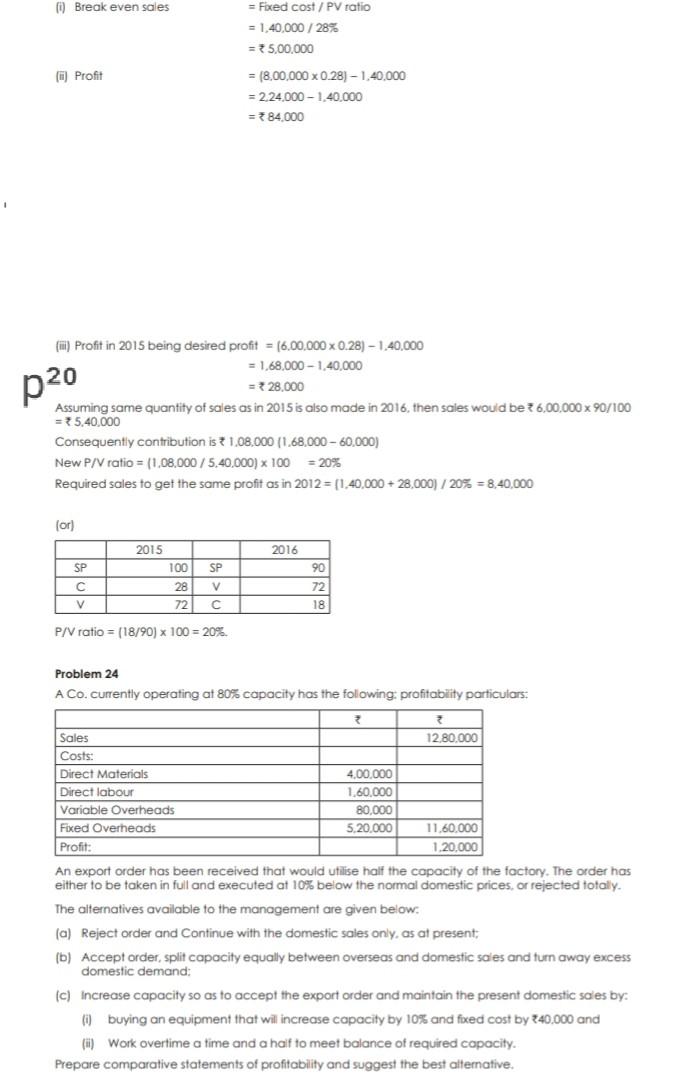

Break even sales = Fixed cost/PV ratio = 1,40,000/28% = 35,00.000 (6) Profit = (8,00,000 x 0.28) - 1.40,000 = 224,000 -1,40.000 = 84.000 .

Break even sales = Fixed cost/PV ratio = 1,40,000/28% = 35,00.000 (6) Profit = (8,00,000 x 0.28) - 1.40,000 = 224,000 -1,40.000 = 84.000 . p20 m) Profit in 2015 being desired profit = (6.00.000 x 0.28) - 1.40,000 = 1,68,000 - 1,40.000 = 28.000 Assuming same quantity of sales as in 2015 is also made in 2016, then sales would be 6,00.000 x 90/100 = 75,40,000 Consequently contribution is ? 1,08,000 (1.68.000 - 60.000) New P/V ratio = 11.08.000 / 5.40.000) x 100 = 20 Required sales to get the same profit as in 2012 = (1,40,000 + 28,000) / 20% = 8,40,000 (or) 2015 2016 100 90 SP v 28 72 SP V 72 18 P/V ratio = (18/90) > 100 = 20% Problem 24 A Co. currently operating at 80% capacity has the following profitability particulars: . 12.80.000 Sales Costs: Direct Materials Direct labour Variable Overheads Fixed Overheads Profit: 4,00.000 1.60.000 80.000 5.20.000 11.60,000 1.20.000 An export order has been received that would utilise half the capacity of the factory. The order has either to be taken in full and executed at 10% below the normal domestic prices, or rejected totally. The alternatives available to the management are given below: (a) Reject order and Continue with the domestic sales only, as at present (b) Accept order, split capacity equally between overseas and domestic sales and turn away excess domestic demand: (c) Increase capacity so as to accept the export order and maintain the present domestic sales by: () buying an equipment that will increase capacity by 10% and fixed cost by 340,000 and (ii) Work overtime a time and a half to meet balance of required capacity. Prepare comparative statements of profitability and suggest the best alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started