Question

Break-even and other CVP analysis Please provide the answers in the format of the screen shot excel spreadsheet. I have to be able to place

Break-even and other CVP analysis

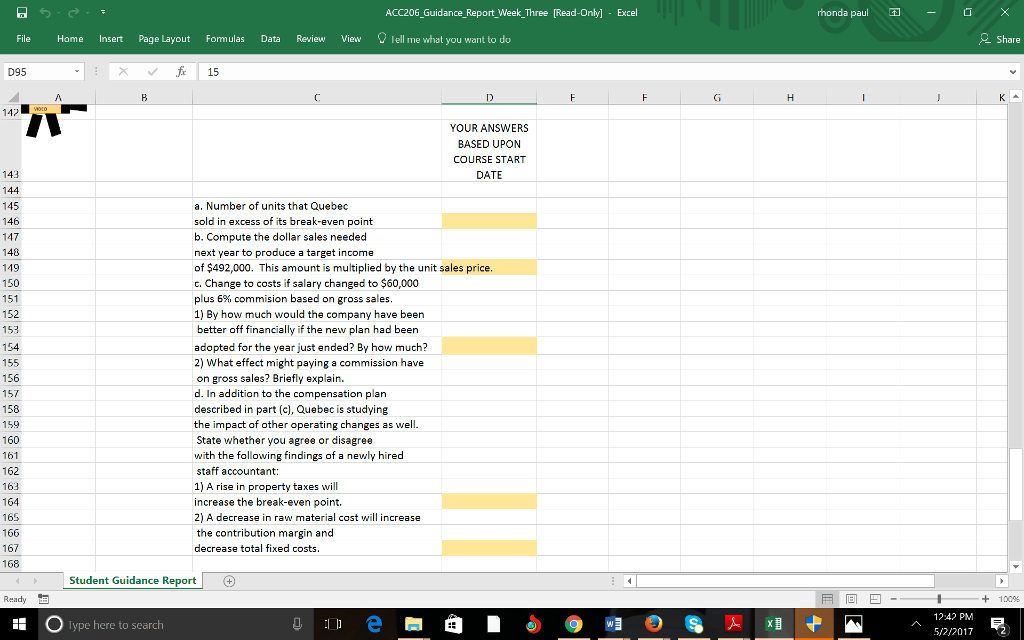

Please provide the answers in the format of the screen shot excel spreadsheet. I have to be able to place answers in this format.

This link will take you to a teachers instruction with different numbers used. http://ashford.mediaspace.kaltura.com/media/ACC206A+Chapter+5+Problem+4/0_6q4jspa1

Quebec Inc. manufactures and sells a single product. The information that follows relates to the year just ended, when 230,000 units were sold:

| Sales price per unit | $ | 10 |

|

|

|

| Variable cost per unit |

| 4.50 |

|

|

|

| Fixed costs |

| 930,000 |

|

|

|

Instructions

Determine the number of units that Quebec sold in excess of its break-even point.

If current revenue and cost patterns continue, compute the dollar sales needed next year to produce a target income of $492,000.

Assume that a different compensation plan was in effect during the current year. Rather than pay six salespeople an average salary of $36,000 each, management has proposed that the salespeople receive a $10,000 base salary and a 8% commission based on gross sales.

1) Would the company have been better off financially if the new plan had been adopted for the year just ended? By how much?

2) What effect might paying a commission have on gross sales? Briefly explain.

In addition to the compensation plan described in part (c), Quebec is studying the impact of other operating changes as well. State whether you agree or disagree with the following findings of a newly hired staff accountant: 1) A rise in property taxes will increase the break-even point. 2) A decrease in raw material cost will increase the contribution margin and decrease total fixed costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started