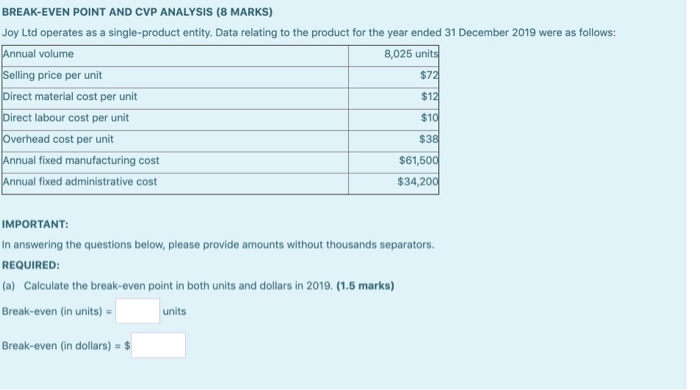

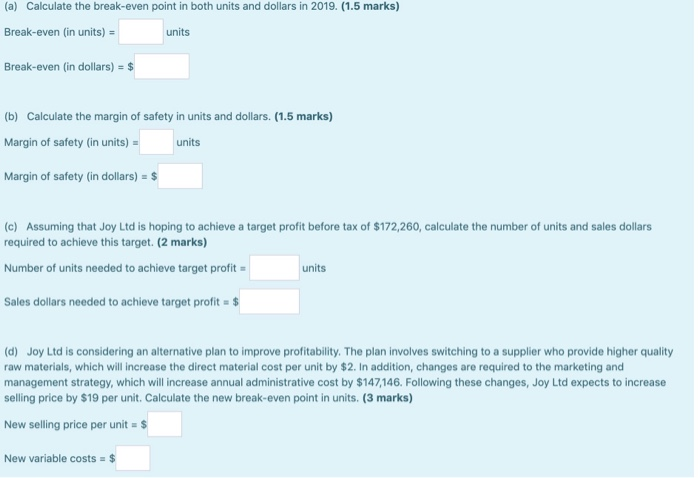

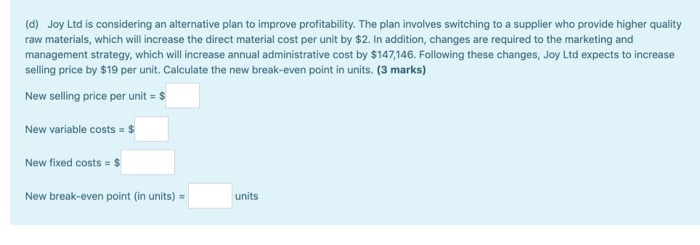

BREAK-EVEN POINT AND CVP ANALYSIS (8 MARKS) Joy Ltd operates as a single-product entity. Data relating to the product for the year ended 31 December 2019 were as follows: Annual volume 8,025 units Selling price per unit $72 Direct material cost per unit $12 Direct labour cost per unit Overhead cost per unit $38 Annual fixed manufacturing cost $61,500 Annual fixed administrative cost $34,200 $10 IMPORTANT: In answering the questions below, please provide amounts without thousands separators. REQUIRED: (a) Calculate the break-even point in both units and dollars in 2019. (1.5 marks) Break-even (in units) = units Break-even (in dollars) = $ (a) Calculate the break-even point in both units and dollars in 2019. (1.5 marks) Break-even (in units) = units Break-even (in dollars) = $ (b) Calculate the margin of safety in units and dollars. (1.5 marks) Margin of safety (in units) = units Margin of safety (in dollars) = $ (c) Assuming that Joy Ltd is hoping to achieve a target profit before tax of $172,260, calculate the number of units and sales dollars required to achieve this target. (2 marks) Number of units needed to achieve target profit = units Sales dollars needed to achieve target profit = $ (d) Joy Ltd is considering an alternative plan to improve profitability. The plan involves switching to a supplier who provide higher quality raw materials, which will increase the direct material cost per unit by $2. In addition, changes are required to the marketing and management strategy, which will increase annual administrative cost by $147,146. Following these changes, Joy Ltd expects to increase selling price by $19 per unit. Calculate the new break-even point in units. (3 marks) New selling price per unit = $ New variable costs = $ (d) Joy Ltd is considering an alternative plan to improve profitability. The plan involves switching to a supplier who provide higher quality raw materials, which will increase the direct material cost per unit by $2. In addition, changes are required to the marketing and management strategy, which will increase annual administrative cost by $147,146. Following these changes, Joy Ltd expects to increase selling price by $19 per unit. Calculate the new break-even point in units. (3 marks) New selling price per unit = $ New variable costs = $ New fixed costs = $ New break-even point (in units) = units