Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Breeze Bank is offering investors the opportunity to place a minimum of $100,000 in the bank at 6% per annum. What will be the

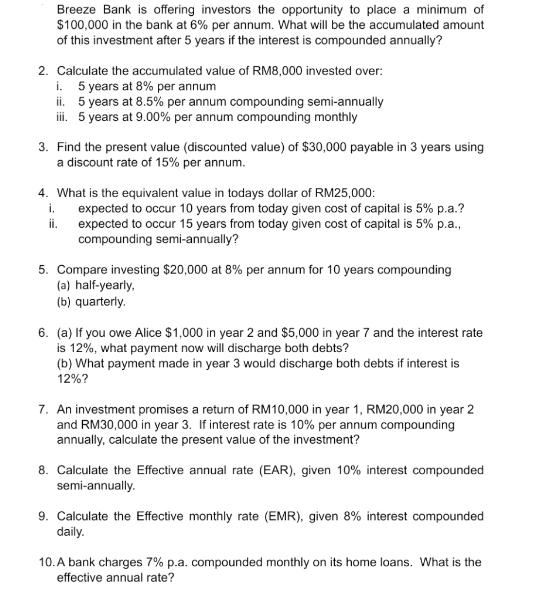

Breeze Bank is offering investors the opportunity to place a minimum of $100,000 in the bank at 6% per annum. What will be the accumulated amount of this investment after 5 years if the interest is compounded annually? 2. Calculate the accumulated value of RM8,000 invested over: i. 5 years at 8% per annum ii. 5 years at 8.5% per annum compounding semi-annually iii. 5 years at 9.00% per annum compounding monthly 3. Find the present value (discounted value) of $30,000 payable in 3 years using a discount rate of 15% per annum. 4. What is the equivalent value in todays dollar of RM25,000: i. ii. expected to occur 10 years from today given cost of capital is 5% p.a.? expected to occur 15 years from today given cost of capital is 5% p.a., compounding semi-annually? 5. Compare investing $20,000 at 8% per annum for 10 years compounding (a) half-yearly, (b) quarterly. 6. (a) If you owe Alice $1,000 in year 2 and $5,000 in year 7 and the interest rate is 12%, what payment now will discharge both debts? (b) What payment made in year 3 would discharge both debts if interest is 12%? 7. An investment promises a return of RM10,000 in year 1, RM20,000 in year 2 and RM30,000 in year 3. If interest rate is 10% per annum compounding annually, calculate the present value of the investment? 8. Calculate the Effective annual rate (EAR), given 10% interest compounded semi-annually. 9. Calculate the Effective monthly rate (EMR), given 8% interest compounded daily. 10. A bank charges 7% p.a. compounded monthly on its home loans. What is the effective annual rate?

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 The formula for compound interest is A P1 rnnt where A is the accumulated amount P is the principal amount r is the annual interest rate n is the number of times the interest is compounded per year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started