Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brendan Martin is a retired 68 year old pensioner. In November he moved from Calgary to Edmonton to be closer to family. He sold

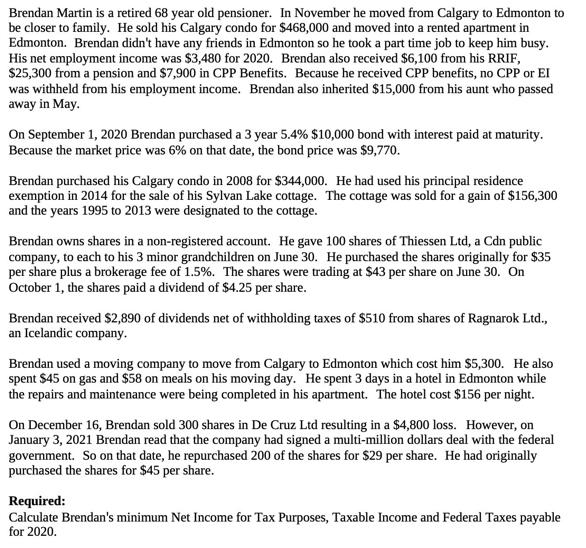

Brendan Martin is a retired 68 year old pensioner. In November he moved from Calgary to Edmonton to be closer to family. He sold his Calgary condo for $468,000 and moved into a rented apartment in Edmonton. Brendan didn't have any friends in Edmonton so he took a part time job to keep him busy. His net employment income was $3,480 for 2020. Brendan also received $6,100 from his RRIF, $25,300 from a pension and $7,900 in CPP Benefits. Because he received CPP benefits, no CPP or EI was withheld from his employment income. Brendan also inherited $15,000 from his aunt who passed away in May. On September 1, 2020 Brendan purchased a 3 year 5.4% $10,000 bond with interest paid at maturity. Because the market price was 6% on that date, the bond price was $9,770. Brendan purchased his Calgary condo in 2008 for $344,000. He had used his principal residence exemption in 2014 for the sale of his Sylvan Lake cottage. The cottage was sold for a gain of $156,300 and the years 1995 to 2013 were designated to the cottage. Brendan owns shares in a non-registered account. He gave 100 shares of Thiessen Ltd, a Cdn public company, to each to his 3 minor grandchildren on June 30. He purchased the shares originally for $35 per share plus a brokerage fee of 1.5%. The shares were trading at $43 per share on June 30. On October 1, the shares paid a dividend of $4.25 per share. Brendan received $2,890 of dividends net of withholding taxes of $510 from shares of Ragnarok Ltd., an Icelandic company. Brendan used a moving company to move from Calgary to Edmonton which cost him $5,300. He also spent $45 on gas and $58 on meals on his moving day. He spent 3 days in a hotel in Edmonton while the repairs and maintenance were being completed in his apartment. The hotel cost $156 per night. On December 16, Brendan sold 300 shares in De Cruz Ltd resulting in a $4,800 loss. However, on January 3, 2021 Brendan read that the company had signed a multi-million dollars deal with the federal government. So on that date, he repurchased 200 of the shares for $29 per share. He had originally purchased the shares for $45 per share. Required: Calculate Brendan's minimum Net Income for Tax Purposes, Taxable Income and Federal Taxes payable for 2020.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Brendans net income for tax purposes we need to add up all his income and subtract any ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started