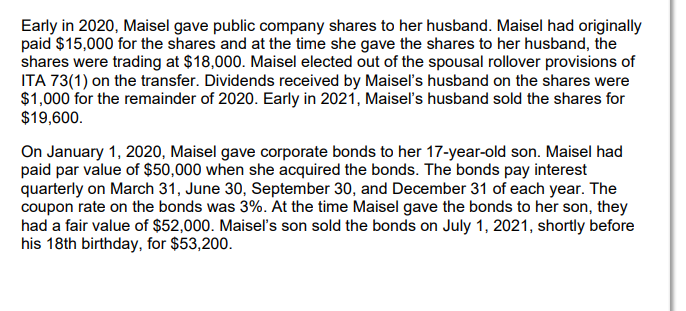

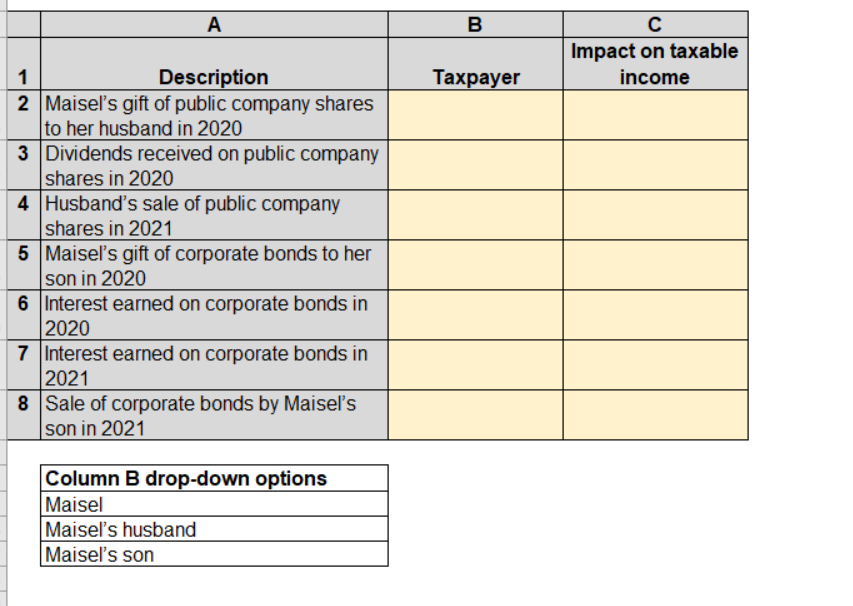

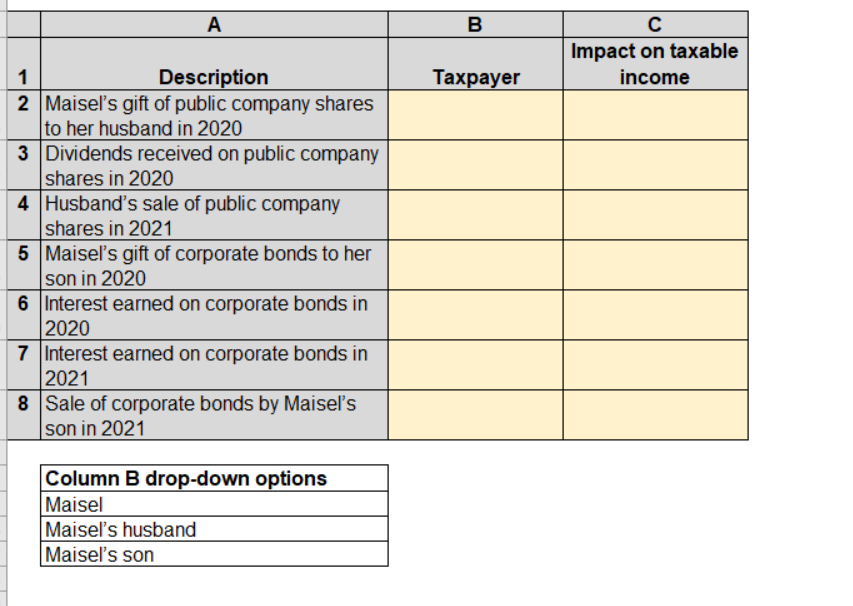

Brendan Palate recently started working for Paulson Slater LLP (PSL) in the tax department. The tax partner, Randall Slater, has asked Brendan to assist one of the clients that he recently met with. The following documents are attached: Appendix 1: Information from meeting with Maisel Complete the tasks in the Excel Task file. Early in 2020, Maisel gave public company shares to her husband. Maisel had originally paid $15,000 for the shares and at the time she gave the shares to her husband, the shares were trading at $18,000. Maisel elected out of the spousal rollover provisions of ITA 73(1) on the transfer. Dividends received by Maisel's husband on the shares were $1,000 for the remainder of 2020. Early in 2021, Maisel's husband sold the shares for $19,600. On January 1, 2020, Maisel gave corporate bonds to her 17-year-old son. Maisel had paid par value of $50,000 when she acquired the bonds. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31 of each year. The coupon rate on the bonds was 3%. At the time Maisel gave the bonds to her son, they had a fair value of $52,000. Maisel's son sold the bonds on July 1, 2021, shortly before his 18th birthday, for $53,200. A 1 Description 2 Maisel's gift of public company shares to her husband in 2020 3 Dividends received on public company shares in 2020 4 Husband's sale of public company shares in 2021 5 Maisel's gift of corporate bonds to her son in 2020 6 Interest earned on corporate bonds in 2020 7 Interest earned on corporate bonds in 2021 8 Sale of corporate bonds by Maisel's son in 2021 Column B drop-down options Maisel Maisel's husband Maisel's son B Taxpayer Impact on taxable income Brendan Palate recently started working for Paulson Slater LLP (PSL) in the tax department. The tax partner, Randall Slater, has asked Brendan to assist one of the clients that he recently met with. The following documents are attached: Appendix 1: Information from meeting with Maisel Complete the tasks in the Excel Task file. Early in 2020, Maisel gave public company shares to her husband. Maisel had originally paid $15,000 for the shares and at the time she gave the shares to her husband, the shares were trading at $18,000. Maisel elected out of the spousal rollover provisions of ITA 73(1) on the transfer. Dividends received by Maisel's husband on the shares were $1,000 for the remainder of 2020. Early in 2021, Maisel's husband sold the shares for $19,600. On January 1, 2020, Maisel gave corporate bonds to her 17-year-old son. Maisel had paid par value of $50,000 when she acquired the bonds. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31 of each year. The coupon rate on the bonds was 3%. At the time Maisel gave the bonds to her son, they had a fair value of $52,000. Maisel's son sold the bonds on July 1, 2021, shortly before his 18th birthday, for $53,200. A 1 Description 2 Maisel's gift of public company shares to her husband in 2020 3 Dividends received on public company shares in 2020 4 Husband's sale of public company shares in 2021 5 Maisel's gift of corporate bonds to her son in 2020 6 Interest earned on corporate bonds in 2020 7 Interest earned on corporate bonds in 2021 8 Sale of corporate bonds by Maisel's son in 2021 Column B drop-down options Maisel Maisel's husband Maisel's son B Taxpayer Impact on taxable income