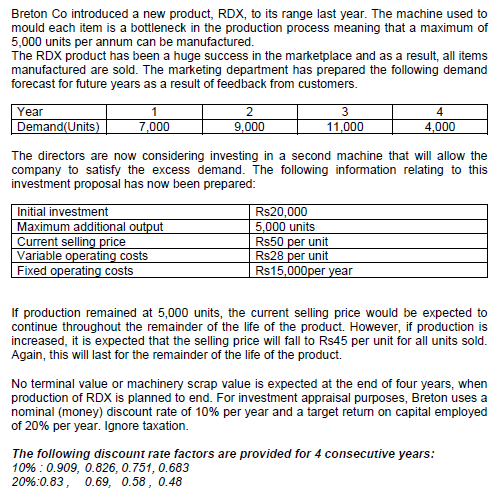

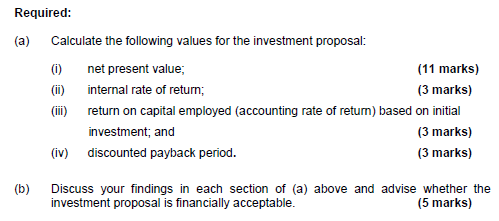

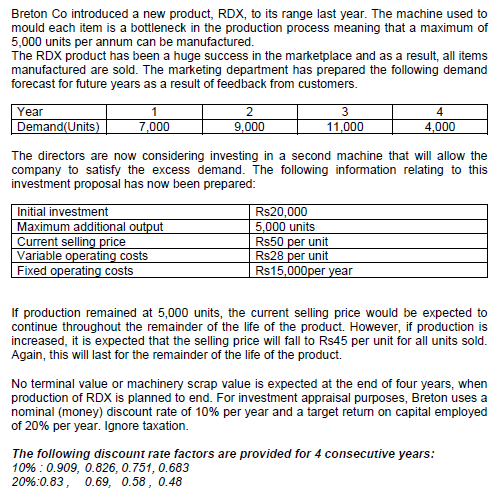

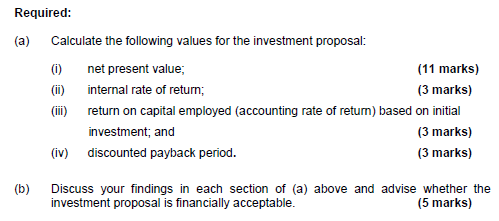

Breton Co introduced a new product, RDX, to its range last year. The machine used to mould each item is a bottleneck in the production process meaning that a maximum of 5,000 units per annum can be manufactured. The RDX product has been a huge success in the marketplace and as a result, all items manufactured are sold. The marketing department has prepared the following demand forecast for future years as a result of feedback from customers. Year 2 3 Demand(Units) 7,000 9,000 11,000 4,000 4 The directors are now considering investing in a second machine that will allow the company to satisfy the excess demand. The following information relating to this investment proposal has now been prepared: Initial investment Rs20,000 Maximum additional output 5,000 units Current selling price Rs50 per unit Variable operating costs Rs28 per unit Fixed operating costs R$15,000 per year If production remained at 5,000 units, the current selling price would be expected to continue throughout the remainder of the life of the product. However, if production is increased, it is expected that the selling price will fall to Rs45 per unit for all units sold. Again, this will last for the remainder of the life of the product. No terminal value or machinery scrap value is expected at the end of four years, when production of RDX is planned to end. For investment appraisal purposes, Breton uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 20% per year. Ignore taxation. The following discount rate factors are provided for 4 consecutive years: 10% : 0.909, 0.826, 0.751, 0.683 20%:0.83, 0.69, 0.58, 0.48 Required: (a) Calculate the following values for the investment proposal: (0) net present value; (11 marks) () internal rate of return; (3 marks) () return on capital employed accounting rate of return) based on initial investment, and (3 marks) (iv) discounted payback period. (3 marks) (b) Discuss your findings in each section of (a) above and advise whether the investment proposal is financially acceptable