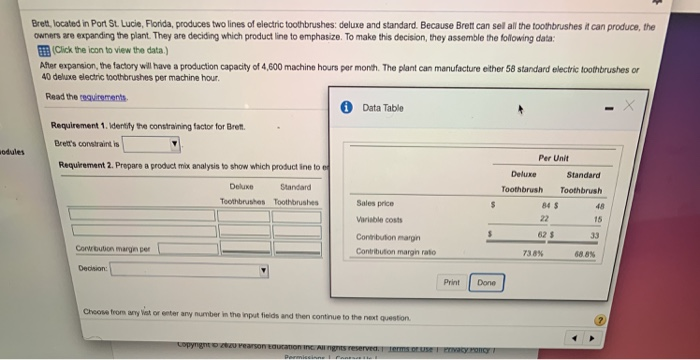

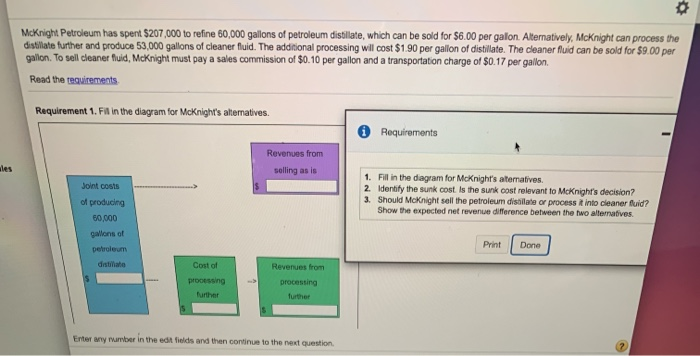

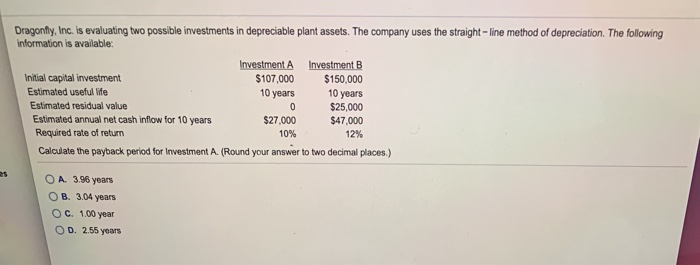

Brett, located in Port St. Lucie, Florida, produces two lines of electric toothbrushes: deluxe and standard. Because Brett can sel all the toothbrushes it can produce, the owners are expanding the plant. They are deciding which product line to emphasize. To make this decision, they assemble the following data: Click the icon to view the data.) After expansion, the factory will have a production capacity of 4,600 machine hours per month. The plant can manufacture either 58 standard electric toothbrushes or 40 deluxe electric toothbrushes per machine hour. Read the requirements Data Table Requirement 1. Identify the constraining factor for Brem. Brett's contraint in Requirement 2. Prepare a product mix analysis to show which product ine toe Deluxe Sales price wodules Per Unit Standard Toothbrushes Toothbrushes Deluxe Standard Toothbrush Toothbrush 84 $ 48 22 $ Variable costs Contribution margin Contribution margin rato $ 62 $ 33 Cortion margin per 738% 68.8% Decision Print Done Choose from any list or enter any number in the input fields and then continue to the next question copyright Pearson Education in Angrits reserved. USE OF Damien Mcknight Petroleum has spent $207,000 to refine 60,000 gallons of petroleum distillate, which can be sold for $6.00 per galon. Alternatively, McKnight can process the distillate further and produce 53,000 gallons of cleaner fluid. The additional processing wil cost $1.90 per gallon of distillate. The cleaner fluid can be sold for $9.00 per gallon. To sell cleaner fluid, Mcknight must pay a sales commission of $0.10 per gallon and a transportation charge of $0.17 per gallon. Read the requirements Requirement 1. Fill in the diagram for McKnight's alternatives. Requirements Revenues from selling as is les 1. Fill in the diagram for McKnight's ateratives 2. Identify the sunk cost is the sunk cost relevant to Mcknight's decision? 3. Should McKnight sell the petroleum distilate or process into cleaner fluid? Show the expected net revenue difference between the two alternatives. Joint costs of producing 60,000 gallons of petroleum destinate Print Done Cost of S processing further Revenues from processing further Enter my number in the edit fields and then continue to the next question Capital budgeting is the O A preparation of the budget for operating expenses OB. process of making pricing decisions for products C. process of evaluating the profitability of a business OD. process of planning for investments in long-term assets Dragonfly, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available Investment A Investment B Initial capital investment $107.000 $150,000 Estimated useful life 10 years 10 years Estimated residual value 0 $25,000 Estimated annual net cash inflow for 10 years $27,000 $47,000 Required rate of return 10% 12% Calculate the payback period for investment A. (Round your answer to two decimal places.) OA 3.96 years OB 3.04 years OC. 1.00 year OD. 2.55 years