Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Brian and Landry are partners who share income and losses in the ratio of 3:2, respectivelyOn August 31, their capital balances were Brian, $134000 and

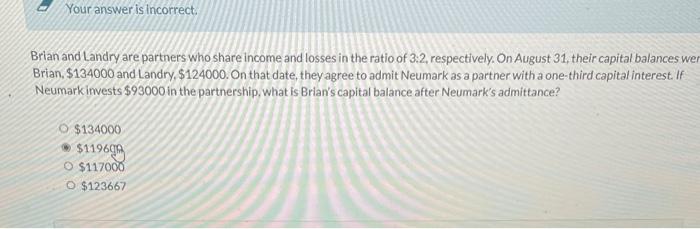

Brian and Landry are partners who share income and losses in the ratio of 3:2, respectivelyOn August 31, their capital balances were Brian, \$134000 and Landry$ 124000. On that date, they agree to admit Neumark as a partner with a one-third capital interest. If Neumark invests $93000 in the partnership, what is Brian's capital balance after Neumark's admittance?

did you look at the other pictures i sent

H1tro9e 412bir Brian and Landry are partners who share Brian, $134000 and Landry, $124000. On Neumark invests $93000 in the partnershi $134000 $119600 $117000 $123667 Brian and Landry are partners who share income and losses in the ratio of 3:2, respectively. On August 31 , their capital balances we Brian, $134000 and Landry, $124000. On that date, they agree to admit Neumark as a partner with a one-third capital interest. If Neumark invests $93000 in the partnership, what is Brian's capital balance after Neumark's admittance? $134000$119600$117000$123667 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started