Question

Brian Jones is an analyst at London Equity Research. Brian is analyzing securities for a portfolio with Environmental, Social, and Governance (ESG) constraints. During Brians

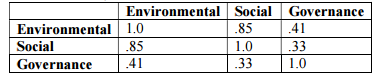

Brian Jones is an analyst at London Equity Research. Brian is analyzing securities for a portfolio with Environmental, Social, and Governance (ESG) constraints. During Brians analysis, he runs a regression to determine which variables have the greatest influence on a firms performance. Brian concludes the following regression and correlation coefficients.

StockReturn = Rf + b1E + b2S +b3G

The portfolio manager at London voices concern to Brian that his model may exhibit multicollinearity. What is multicollinearity? Which variables in Londons model exhibit multicollinearity? How can multicollinearity be corrected?

Environmental Social Govern .85 .41 Environmental 1 Social .85 1.0 .33 .33 10 Governance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started