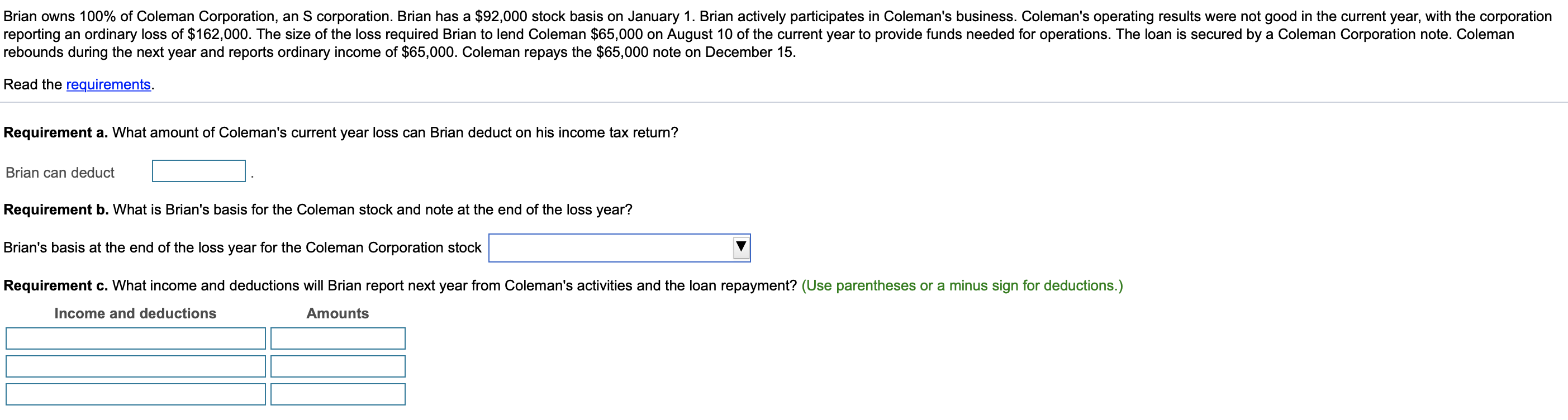

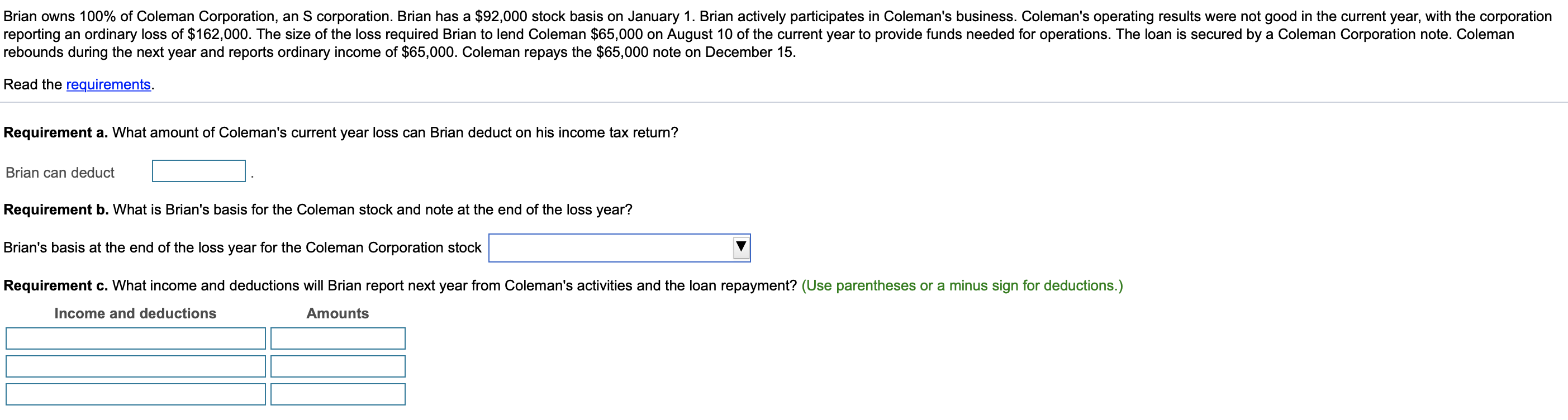

Brian owns 100% of Coleman Corporation, an s corporation. Brian has a $92,000 stock basis on January 1. Brian actively participates in Coleman's business. Coleman's operating results were not good in the current year, with the corporation reporting an ordinary loss of $162,000. The size of the loss required Brian to lend Coleman $65,000 on August 10 of the current year to provide funds needed for operations. The loan is secured by a Coleman Corporation note. Coleman rebounds during the next year and reports ordinary income of $65,000. Coleman repays the $65,000 note on December 15. Read the requirements. Requirement a. What amount of Coleman's current year loss can Brian deduct on his income tax return? Brian can deduct Requirement b. What is Brian's basis for the Coleman stock and note at the end of the loss year? Brian's basis at the end of the loss year for the Coleman Corporation stock Requirement c. What income and deductions will Brian report next year from Coleman's activities and the loan repayment? (Use parentheses or a minus sign for deductions.) Income and deductions Amounts Brian owns 100% of Coleman Corporation, an s corporation. Brian has a $92,000 stock basis on January 1. Brian actively participates in Coleman's business. Coleman's operating results were not good in the current year, with the corporation reporting an ordinary loss of $162,000. The size of the loss required Brian to lend Coleman $65,000 on August 10 of the current year to provide funds needed for operations. The loan is secured by a Coleman Corporation note. Coleman rebounds during the next year and reports ordinary income of $65,000. Coleman repays the $65,000 note on December 15. Read the requirements. Requirement a. What amount of Coleman's current year loss can Brian deduct on his income tax return? Brian can deduct Requirement b. What is Brian's basis for the Coleman stock and note at the end of the loss year? Brian's basis at the end of the loss year for the Coleman Corporation stock Requirement c. What income and deductions will Brian report next year from Coleman's activities and the loan repayment? (Use parentheses or a minus sign for deductions.) Income and deductions Amounts